Market sentiment sours in April

Investment Communications Team, Investment Strategy Team, Wealth Management

Investment Communications Team, Investment Strategy Team, Wealth Management

Summary

Global equities declined by 3.3% in April (USD terms), alongside government bonds which fell by 1.5% (USD, hedged terms). Key themes included:

- Stock markets’ longest winning streak since 2021 comes to an end;

- US interest rate cut expectations postponed, but not cancelled this year;

- Middle East conflict intensifies, but with modest market impact.

Markets: Stock market momentum falters

After five consecutive positive months, stock market sentiment reversed in April, with broad-based weakness across most regions and sectors. While geopolitical threats – the escalation of tensions between Iran and Israel – may have contributed to fragile sentiment, the revival in both stock and bond volatility suggests this was not a conventional ‘risk off’ move. The reappraisal of looming interest rate cuts was likely the bigger factor. However, volatility was short-lived: stocks retraced some of their losses during the latter half of April. In fixed income, 10-year government bond yields rose to fresh year-to-date highs in the US (4.7%), Germany (2.6%) and UK (4.4%). Commodity prices continued their ascent. Brent Crude oil rose as high as $91 per barrel, while gold exceeded $2,400 (intraday), though both retraced most of their gains by month-end. Industrial metals also had a strong month, surging by 13%. Finally, halfway through the first-quarter US earnings season, the blended earnings growth rate was tracking at 3.5% – broadly in line with consensus expectations.

Economy: Growth holds steady; Inflation remains sticky

US first-quarter GDP was slightly weaker than anticipated, expanding by 0.4% (q/q), though this followed an extremely strong end to 2023 (the US economy has expanded for seven consecutive quarters now). The closely-watched ISM Manufacturing PMI unexpectedly signalled modest contraction in manufacturing activity in April. Labour market strength also persisted, as the unemployment rate fell and jobs gains accelerated further in March. However, US CPI inflation surprised to the upside for the fourth consecutive month: headline inflation rose to 3.5%, while core inflation was unchanged at 3.8%, driven by sticky core services. Meanwhile, Europe exited its technical recession: euro area first-quarter output grew by a stronger-than-expected 0.3%, while monthly UK data signalled a swift rebound from the year-end contraction. The timelier PMIs showed ongoing service sector strength in April, though manufacturing remained subdued. Core inflation continued its gradual decline in the eurozone (2.7%) and UK (4.2%). Finally, China GDP grew by 5.3% (y/y), an above-consensus reading, while the PMIs showed ongoing expansion in both the manufacturing and services sectors in April. Property market woes prevailed, though authorities reaffirmed support to tackle the crisis at the Politburo meeting. Swiss inflation remained subdued in March: both the headline and core inflation rate unexpectedly declined to 1% (y/y).

Policy: Higher for even longer?

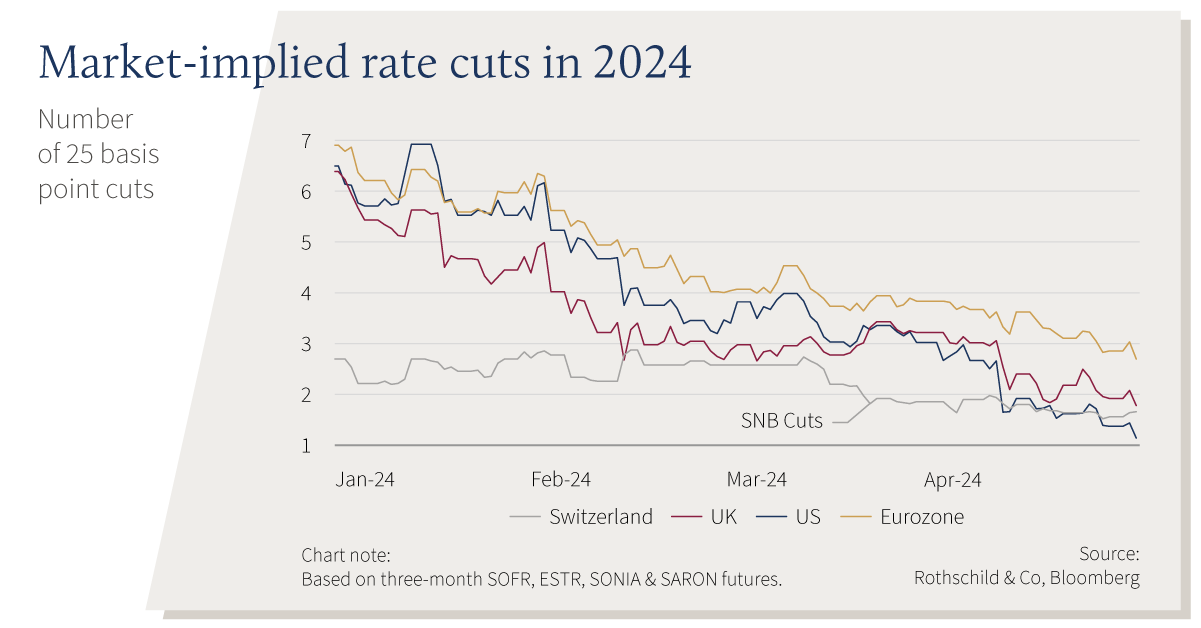

While there was no Fed meeting in April, Powell and other FOMC members generally struck a more hawkish tone. The Fed chair suggested that the resilient data – robust growth and stickier inflation – could delay the start of the easing cycle. Money markets further tempered their dovish expectations, with only one interest rate cut now in the final quarter of 2024. Conversely, the ECB signalled that the first cut could occur in June, after leaving its main interest rates unchanged at the April meeting. The Bank of Japan also kept its policy rate unaltered, following the prior month’s hike, though the yen subsequently weakened to its lowest level against the US dollar since 1990. On the geopolitical front, US-China communication continued. Biden and Xi held a call for the first time since November, while Treasury Secretary Yellen visited China. Congress also reached an agreement to provide military aid to Ukraine.

Performance figures (as of 30/04/2024 in local currency)

| Equity (MSCI indices $) | 1M % | YTD % |

|---|---|---|

| Global | -3.3% | 4.6% |

| US | -4.2% | 5.7% |

| Eurozone | -2.9% | 4.7% |

| UK | 1.9% | 5.1% |

| Switzerland | -4.7% | -5.9% |

| Japan | -4.9% | 5.6% |

| Pacific ex Japan | -1.2% | -2.9% |

| EM Asia | 0.9% | 4.3% |

| EM ex Asia | -1.3% | -2.4% |

| Fixed income | Yield | 1 M % | YTD % |

|---|---|---|---|

| Global Govt (hdg $) | 3.45% | -1.5% | -1.5% |

| Global IG (hdg $) | 5.25% | -1.9% | -1.8% |

| Global HY (hdg $) | 8.46% | -0.6% | 2.0% |

| US 10Y | 4.68% | -3.2% | -4.5% |

| German 10Y | 2.58% | -2.1% | -3.6% |

| UK 10Y | 4.35% | -2.8% | -4.5% |

| Switzerland 10Y | 0.77% | -0.5% | 0.0% |

| Currencies (NEERs) | 1M % | YTD % |

|---|---|---|

| US Dollar | 1.4% | 3.7% |

| Euro | 0.2% | 0.6% |

| Pound Sterling | 0.1% | 1.9% |

| Swiss Franc | -0.4% | -5.1% |

Table note: NEERs under ‘currencies’ are the JP Morgan trade-weighted nominal effective exchange rates

| Commodities ($) | Level | 1M % | YTD % |

|---|---|---|---|

| Gold | 2286 | 2.5% | 10.8% |

| Brent Crude oil | 88 | 0.4% | 14.0% |

| Natural gas (€) | 29 | 6.5% | -10.0% |

Source: Bloomberg, Rothschild & Co.