Stock market optimism prevails in March

Investment Communications Team, Investment Strategy Team, Wealth Management

Investment Communications Team, Investment Strategy Team, Wealth Management

Summary

Global equities continued their upswing, rising by 3.1% in March (USD terms), while government bonds were also up by 0.7% (USD, hedged terms). Key themes included:

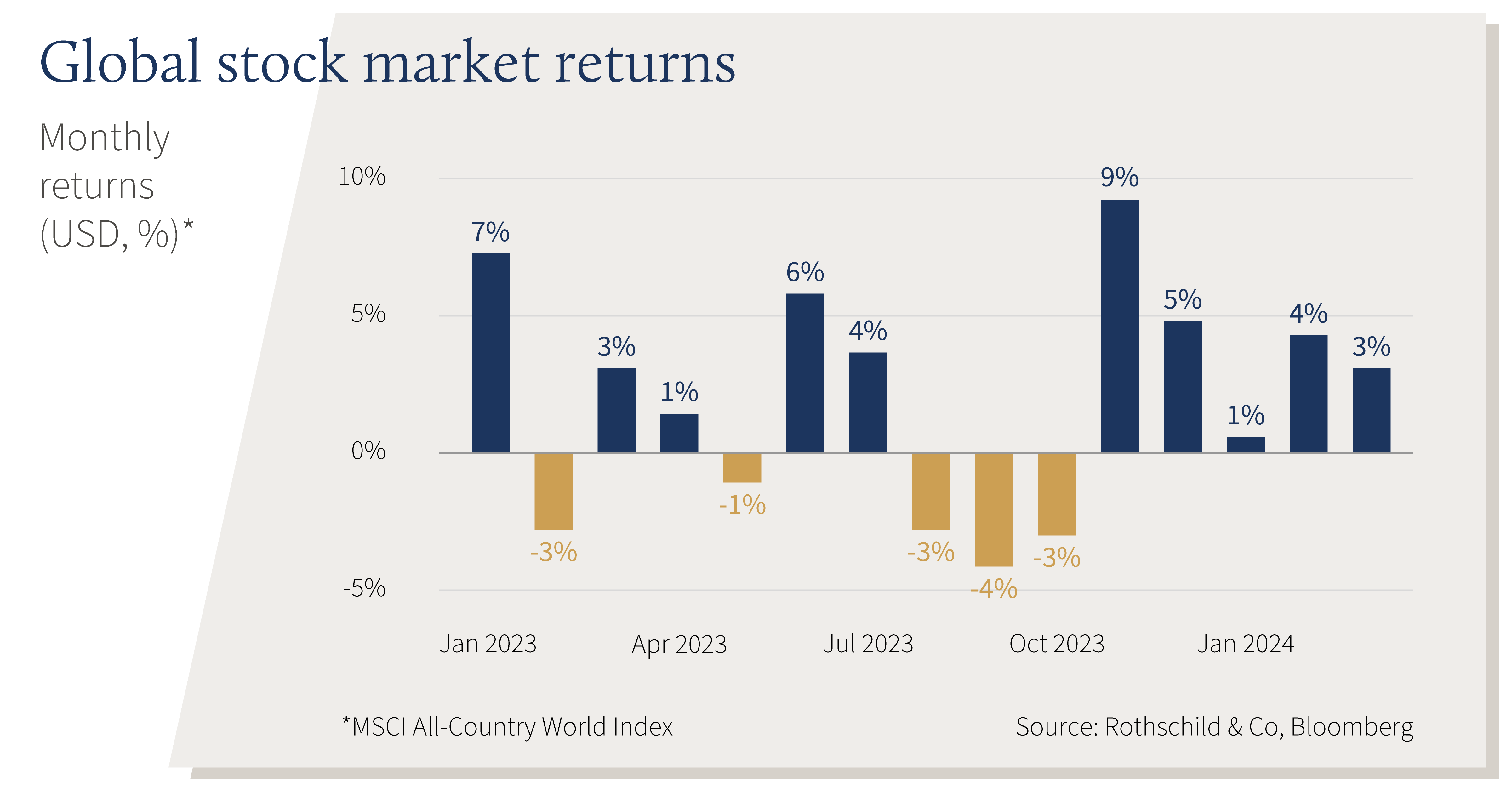

- Subdued volatility persisted as global stocks rose for a fifth consecutive month;

- Central banks signalled rate cuts were likely to occur later this year;

- A Biden-Trump rematch was confirmed for the US Presidential Election.

Markets: Stock participation broadens

Stock indices continued to rise, with global stocks recording their longest positive monthly streak since 2021. There were broad-based returns across regions and sectors: both US and non-US stocks rose by 3% in March (USD terms). Meanwhile, Energy and Materials were the best performing sectors amid higher commodity prices. Oil nearly rose by 5%, to $87 per barrel (Brent). In fixed income, longer-dated government bond yields retreated, but most sovereign bond returns remained underwater by the end of the quarter. Currency markets were generally quiescent aside from the Swiss Franc, which weakened further following easing from the Swiss National Bank. Gold rose to a record high in US dollar terms – exceeding the $2,200 threshold – as did bitcoin which briefly surpassed $70,000.

Economy: Ongoing economic resilience

In the US, both retail sales and industrial production rebounded modestly in February, following a weak January, while the timelier ISM manufacturing PMI signalled expansion for the first time since 2022. The unemployment rate nudged higher in February, though it remained low by historical standards. Overall, first-quarter US GDP estimates were tracking at an above-trend 3% (q/q, annualised). US CPI data were mixed: headline inflation edged up to 3.2% (y/y), solely driven by the services category, though core inflation continued to move lower to 3.8%. In Europe, economic activity remained subdued. The euro area manufacturing and services PMIs diverged further in March, with the former looking particularly weak. Conversely, UK data were more upbeat: GDP expanded modestly in January, while the Composite PMI was in ‘expansion’ territory throughout the first quarter. European inflation rates continued to move lower, despite ongoing labour market tightness. Elsewhere, Japan’s technical recession was revised away after fourth-quarter GDP was upgraded, while the Tankan survey hinted at a solid first quarter. Finally, China’s hard data were robust at the start of the year – in spite of its ongoing property sector weakness – and headline inflation turned positive amid strong demand during the Lunar New Year period.

Policy: The pending central bank pivot

The Federal Reserve left its target rate range unchanged at 5.25%-5.50% for the fifth consecutive meeting, while its updated interest rate projections reiterated three rate cuts in 2024. In Europe, the European Central Bank left the deposit rate at 4.00% – Lagarde hinted that the easing cycle could begin in June – and the Bank of England’s base rate remained at 5.25%. Unexpectedly, the Swiss National Bank was the first developed-market central bank to cut interest rates, by 25bps to 1.50%. The Bank of Japan also bucked the trend: it ended eight years of negative interest rates amid growing evidence of solid wage growth. In the political sphere, with the US primaries largely concluded, a Biden-Trump rematch was confirmed for the 5th November. At his State of Union address, Biden signalled further corporate tax increases and a ‘billionaire’ tax if he were to win. Elsewhere, the UK Spring Budget revealed modest net stimulus, mostly through tax cuts (a reduction in employee National Insurance contributions and an extended reduction in fuel duty). China revealed a GDP growth target of 5% for 2024 at the annual National People's Congress.

Performance figures (as of 29/03/2024 in local currency)

| Equity (MSCI indices $) | 1M % | YTD % |

|---|---|---|

| Global | 3.1% | 8.2% |

| US | 3.1% | 10.3% |

| Eurozone | 4.2% | 7.8% |

| UK | 4.5% | 3.1% |

| Switzerland | 1.3% | -1.3% |

| Japan | 3.0% | 11.0% |

| Pacific ex Japan | 1.3% | -1.7% |

| EM Asia | 3.0% | 3.4% |

| EM ex Asia | 0.5% | -1.1% |

| Fixed income | Yield | 1 M % | YTD % |

|---|---|---|---|

| Global Govt (hdg $) | 3.16% | 0.7% | 0.0% |

| Global IG (hdg $) | 4.88% | 1.3% | 0.1% |

| Global HY (hdg $) | 8.09% | 1.6% | 2.6% |

| US 10Y | 4.20% | 0.8% | -1.4% |

| German 10Y | 2.30% | 1.1% | -1.6% |

| UK 10Y | 3.93% | 1.8% | -1.7% |

| Switzerland 10Y | 0.69% | 1.2% | 0.5% |

| Currencies (NEERs) | 1M % | YTD % |

|---|---|---|

| US Dollar | 0.2% | 2.2% |

| Euro | 0.4% | 0.4% |

| Pound Sterling | 0.2% | 1.8% |

| Swiss Franc | -1.9% | -4.6% |

Table note: NEERs under ‘currencies’ are the JP Morgan trade-weighted nominal effective exchange rates

| Commodities ($) | Level | 1M % | YTD % |

|---|---|---|---|

| Gold | 2,230 | 9.1% | 8.1% |

| Brent Crude oil | 87 | 4.6% | 13.6% |

| Natural gas (€) | 27 | 10.0% | -15.5% |

Source: Bloomberg, Rothschild & Co.