Stocks edge higher amid tense geopolitical backdrop

Investment Communications Team, Investment Strategy Team, Wealth Management

Summary

Global equities rose by 0.6% in January (USD terms), while government bonds were down by 0.3% (USD, hedged terms). Key themes included:

- US growth-inflation mix improves further; European activity remains softer;

- Major central banks leave policy rates unchanged, with rate cut timing in focus;

- Middle East conflict continues; no major China response after Taiwan elections.

Markets: ‘Growth’ stocks in front (again)

Markets: ‘Growth’ stocks in front (again)

The theme of US outperformance continued in January – the S&P 500 briefly rose to a record high. ‘Growth’ and ‘cyclicals’ led the market higher, with the ‘Magnificent Seven’ stocks outperforming. The fourth-quarter US earnings season was subdued: actual earnings growth was tracking at 0.8%, after c.40% of S&P 500 companies had reported. In fixed income, government bond prices weakened: the US 10-year yield briefly rose to 3.9%, briefly touching 4% intramonth. Commodity prices were broadly flat, though Brent Crude oil rose by 6% to $82p/b. Conversely, European wholesale natural gas prices declined by 6.5%, and gold fell by 1% - but remained above $2,000 (the US dollar strengthened in January).

Economy: A robust end to 2023

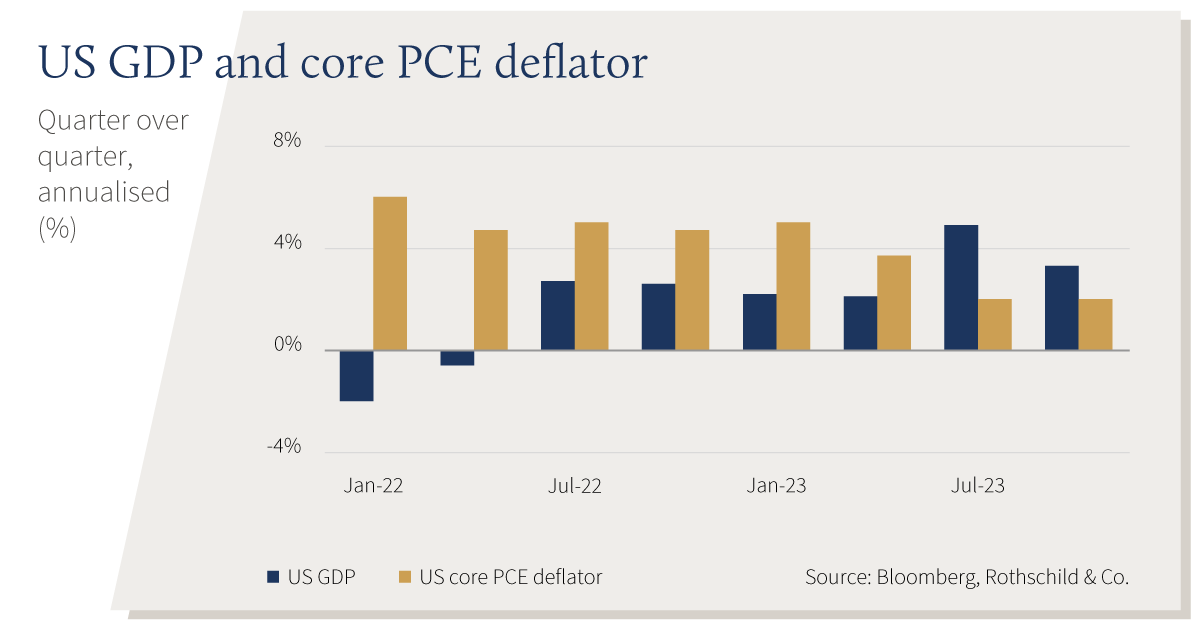

The US economy defied expectations in the final quarter of 2023, expanding by 3.3% (annualised). Full-year growth came in at 2.5%, with consumption remaining firm. Meanwhile, euro area activity remained soft, after fourth-quarter GDP stagnated, narrowly avoiding a technical recession. The timelier business surveys were more resilient, signalling expansion in both the US and UK in January – weak manufacturing showed signs of a revival. The ISM Manufacturing PMI New Orders sub-index also unexpectedly rose to its highest reading in a year and a half (52.5). Labour market tightness persisted on both sides of the Atlantic: the US unemployment rate was unchanged at 3.7%, while the eurozone rate remained at a record low in December. Remarkably, the Fed’s preferred inflation measure – the core PCE – returned to 2% in the fourth quarter on a quarterly annualised basis (it fell to 2.9% in year-on-year terms). In the eurozone, both headline and core inflation edged lower in January, but the UK CPI data were disappointing in December, with core inflation still elevated at 5.1%. Finally, China’s economy expanded by 5.2% in 2023, beating the annual growth target. Headline inflation remained in modest deflation territory at year-end, though this was mostly driven by falling food prices again. Swiss inflation remained muted: both headline and core inflation rose in December, though remained below 2%.

Policy: Central banks on hold; Uneasy geopolitics

The major central banks – the Fed, ECB and BoE – all left their policy rates unchanged during their inaugural meetings of the year. The timing of rate cuts remained in focus, as Powell signalled a March rate cut was not the base scenario. Money markets pencilled-in easing from the second quarter onwards. Elsewhere, the BoJ left its policy rate unaltered, while the People’s Bank of China cut the reserve requirement ratio for banks, amid persistent property sector problems. On fiscal policy, US Congress passed a temporary spending bill to avoid a government shutdown. Beijing was also rumoured to be preparing a stock market package, following its ongoing weakness. In the geopolitical sphere, conflict spread in the Middle East, after a US military base was attacked in Jordan. Red Sea disruptions also continued and caused global spot container rates to more than double in January (though they are roughly a third of their 2021 highs). In the Taiwan election, the incumbent DPP retained power with little reaction from China. In the US Republican primaries, Trump cemented his nomination after winning in Iowa and New Hampshire. UK PM Sunak announced a general election was likely in the second half of this year.

Performance figures (as of 31/01/2024 in local currency)

| Equity (MSCI indices $) | 2023 % | YTD % |

|---|---|---|

| Global | 22.2% | 0.6% |

| US | 26.5% | 1.5% |

| Eurozone | 22.9% | 0.5% |

| UK | 14.1% | -1.3% |

| Switzerland | 15.7% | -0.3% |

| Japan | 20.3% | 4.6% |

| Pacific ex Japan | 6.4% | -3.5% |

| EM Asia | 7.8% | -5.2% |

| EM ex Asia | 17.6% | -2.6% |

| Fixed income | Yield | 2023 % | YTD % |

|---|---|---|---|

| Global Govt (hdg $) | 3.00% | 6.7% | -0.3% |

| Global IG (hdg $) | 4.73% | 9.1% | 0.0% |

| Global HY (hdg $) | 8.30% | 13.7% | 0.1% |

| US 10Y | 3.91% | 3.6% | -0.2% |

| German 10Y | 2.17% | 7.0% | -0.6% |

| UK 10Y | 3.79% | 5.6% | -1.8% |

| Switzerland 10Y | 0.84% | 8.0% | -0.7% |

| Currencies (NEERs) | 2023% | YTD % |

|---|---|---|

| US Dollar | -0.9% | 1.5% |

| Euro | 4.3% | -0.4% |

| Pound Sterling | 5.2% | 1.6% |

| Swiss Franc | 8.2% | -0.6% |

| Commodities ($) | Level | 2023 % | YTD % |

|---|---|---|---|

| Gold | 2,040 | 13.1% | -1.1% |

| Brent Crude oil | 82 | -10.3% | 6.1% |

| Natural gas (€) | 30 | -57.6% | -6.5% |

Source: Bloomberg, Rothschild & Co.

Table note: NEERs under ‘currencies’ are the JP Morgan trade-weighted nominal effective exchange rates