Monthly Market Summary: December 2023

Investment Communications Team, Investment Strategy Team, Wealth Management

Investment Communications Team, Investment Strategy Team, Wealth Management

Summary: Year-end festive cheer for stocks and bonds

Global equities rose again in December (+4.8% in USD terms), alongside government bonds (+2.9% in USD, hedged terms). Key themes included:

-

- Disinflation continued, amid ongoing economic resilience;

- The Fed struck a more dovish tone than its European counterparts;

- Uneasy geopolitics persisted, but markets remained composed.

The policy pivot narrative moved into focus in December, with money markets discounting more aggressive rate cuts in 2024. Global stocks rose to a fresh year-to-date high and market participation broadened into the year-end, while benchmark 10-year government bond yields declined further – concluding 2023 at or below where they started it. In the geopolitical sphere, a financial aid package for Ukraine was vetoed by Hungary at the EU Summit, while the conflict in the Middle East caused interruptions to maritime trade in the Red Sea. Gold rose by 1.3% (USD terms), though Brent Crude oil prices fell by 7.0% and European wholesale natural gas prices decreased by 23% (EUR terms). Finally, the COP 28 Summit ended with an agreement to “transition away” from fossil fuels.

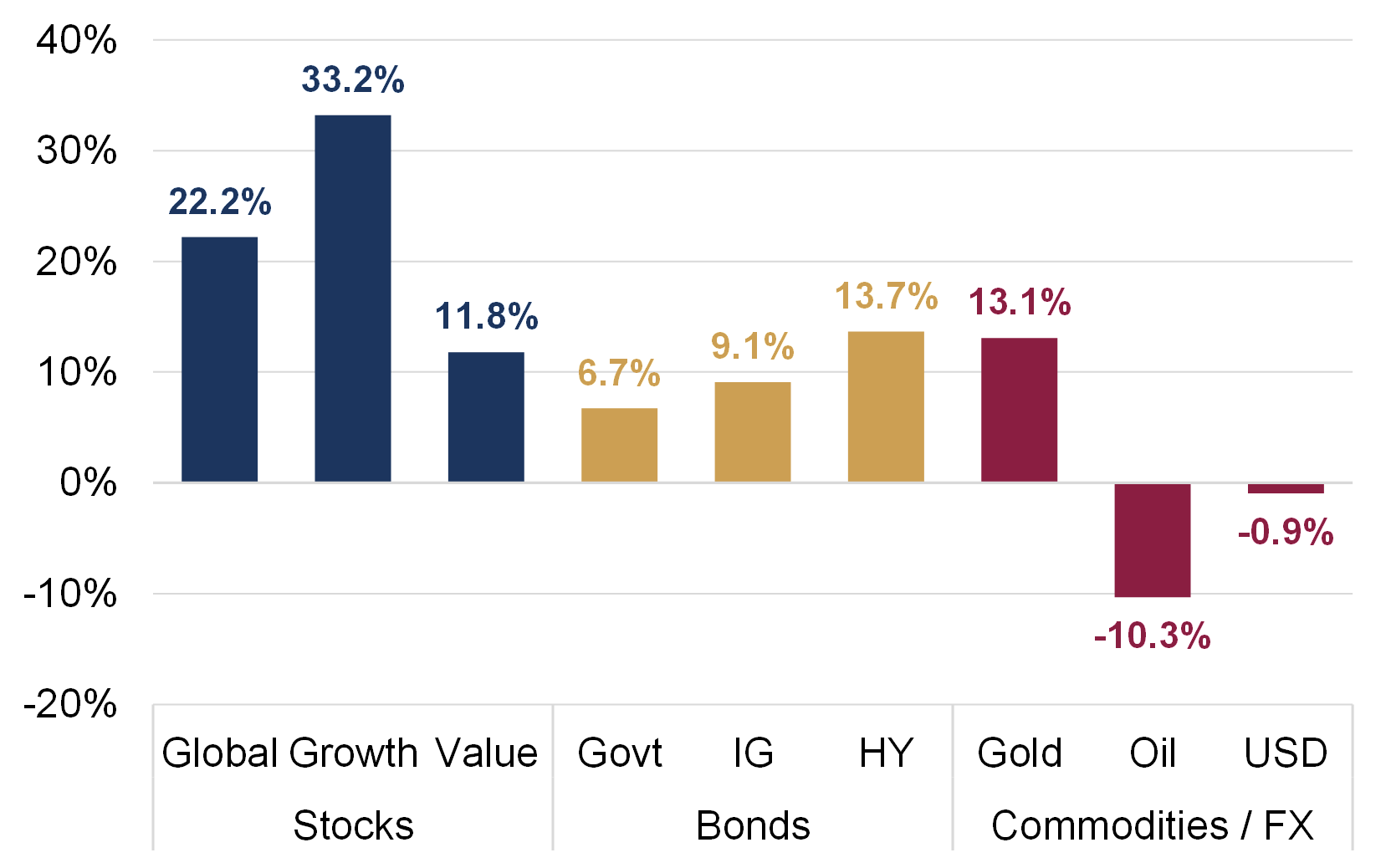

2023 cross asset class returns

USD terms (%)

Source: Bloomberg, Rothschild & Co., 31/12/2022 – 29/12/2023

Note: Stocks are MSCI indices. Bonds are Bloomberg indices in USD, hedged terms. USD is the JP Morgan US nominal broad effective exchange rate series.

US: Robust economy; Dovish Fed; Political woes

US economic momentum accelerated in November: consumer activity was robust – ‘core’ retail sales grew by 0.4% (m/m) – and industrial production rose by 0.2%. The labour market also remained tight: the unemployment rate unexpectedly fell to 3.7% and initial jobless claims remained subdued. Real-time estimates of GDP were tracking at a trend-like 0.6% (q/q) in the fourth quarter. Headline inflation edged lower to 3.1% (y/y) and core inflation was unchanged at 4% in November. The Fed left its target rate range at 5.25-5.50% for the third consecutive meeting, but Powell signalled the prospects of rate cuts next year. In politics, the Colorado Supreme Court disqualified former President Trump from the state’s primary ballots next year – as did Maine – and the House backed an impeachment inquiry into President Biden.

Europe: Mixed activity; Inflation fades; Central banks on hold

Eurozone activity softened in October as industrial production fell by 0.7% (m/m) and retail sales stagnated (+0.1%). Meanwhile, UK GDP declined by 0.3% in October – Q3 GDP was revised down to -0.1% (q/q) – though core retail sales rose by 1.3% (m/m) in November. The Composite PMIs also diverged in December: the eurozone contracted further (47.0), while the UK conversely expanded at a faster pace (51.7). UK inflation fell by more than anticipated in November: headline inflation declined to 3.9% (y/y), as did core inflation to 5.1%. The ECB left its policy rate unchanged (at 4%), along with the BoE (5.25%) and SNB (1.75%) – but Lagarde and Bailey struck a hawkish tone at their respective meetings.

ROW: China’s economic resilience; Deflation (again); BoJ unaltered

China’s activity backdrop improved further in November: industrial production rose to 6.6% (y/y) and retail sales increased to 10.1%. The timely NBS PMIs were mixed in December, as manufacturing remained ‘contractionary’ (49.0), while services activity expanded (50.4). Deflation persisted in November – the headline rate fell to -0.5% (y/y) – but, again, this was largely driven by food price declines, with core inflation unchanged at 0.6%. Beijing announced that industrial policy would overtake boosting domestic demand as the top economic priority for next year. In Japan, the Tankan Business Conditions survey signalled a stronger fourth quarter for both the manufacturing and services sectors. Headline and core inflation both moved lower in November, to 2.8% and 3.8%, respectively. The Bank of Japan remained on hold, despite speculation that negative rates may end soon.

Performance figures (as of 29/12/2023 in local currency)

| Fixed Income | Yield | 1M % | YTD % |

|---|---|---|---|

| US 10 Yr | 3.88% | 4.0% | 3.6% |

| UK 10 Yr | 3.53% | 5.1% | 5.6% |

| Swiss 10 Yr | 0.70% | 1.3% | 8.0% |

| German 10 Yr | 2.02% | 3.5% | 7.0% |

| Global Govt (hdg $) | 2.92% | 2.9% | 6.7% |

| Global IG (hdg $) | 4.68% | 3.8% | 9.1% |

| Global HY (hdg $) | 8.20% | 3.8% | 13.7% |

| Equity Index | Level | 1M % | YTD % |

|---|---|---|---|

| MSCI ACWI ($) | 388 | 4.8% | 22.2% |

| S&P 500 | 4,770 | 4.5% | 26.3% |

| MSCI UK | 14,877 | 3.8% | 7.7% |

| SMI | 11,138 | 2.6% | 7.1% |

| Euro Stoxx 50 | 4,522 | 3.2% | 23.2% |

| DAX | 16,752 | 3.3% | 20.3% |

| CAC | 7,543 | 3.3% | 20.1% |

| Hang Seng | 17,047 | 0.2% | -10.5% |

| MSCI EM ($) | 534 | 3.9% | 9.8% |

| Currencies (trade-weighted) | 1M % | YTD % |

|---|---|---|

| US Dollar | -1.4% | -0.9% |

| Euro | 0.4% | 4.3% |

| Yen | 3.8% | -6.1% |

| Pound Sterling | -0.4% | 5.2% |

| Swiss Franc | 3.2% | 8.2% |

| Chinese Yuan | -0.7% | -2.3% |

| Commodities | Level | 1M % | YDT % |

|---|---|---|---|

| Gold ($/oz) | 2,063 | 1.3% | 13.1% |

| Brent ($/bl) | 77.04 | -7.0% | -10.3% |

| Copper ($/t) | 8,464 | 0.9% | 1.2% |

Source: Bloomberg, Rothschild & Co.