Monthly Market Summary: September 2023

Investment Communications Team, Investment Strategy Team, Wealth Management

Investment Communications Team, Investment Strategy Team, Wealth Management

Summary: Stocks retreat in the face of higher bond yields

Global equities declined further in September, by 4.1% (USD terms), and global government bonds also fell by 1.6% (USD, hedged terms). Key themes included:

- Global activity momentum remained resilient, despite a mixed regional picture;

- Core inflation rates declined across the US and Europe;

- Hawkish central banks signalled their “higher for longer” stance.

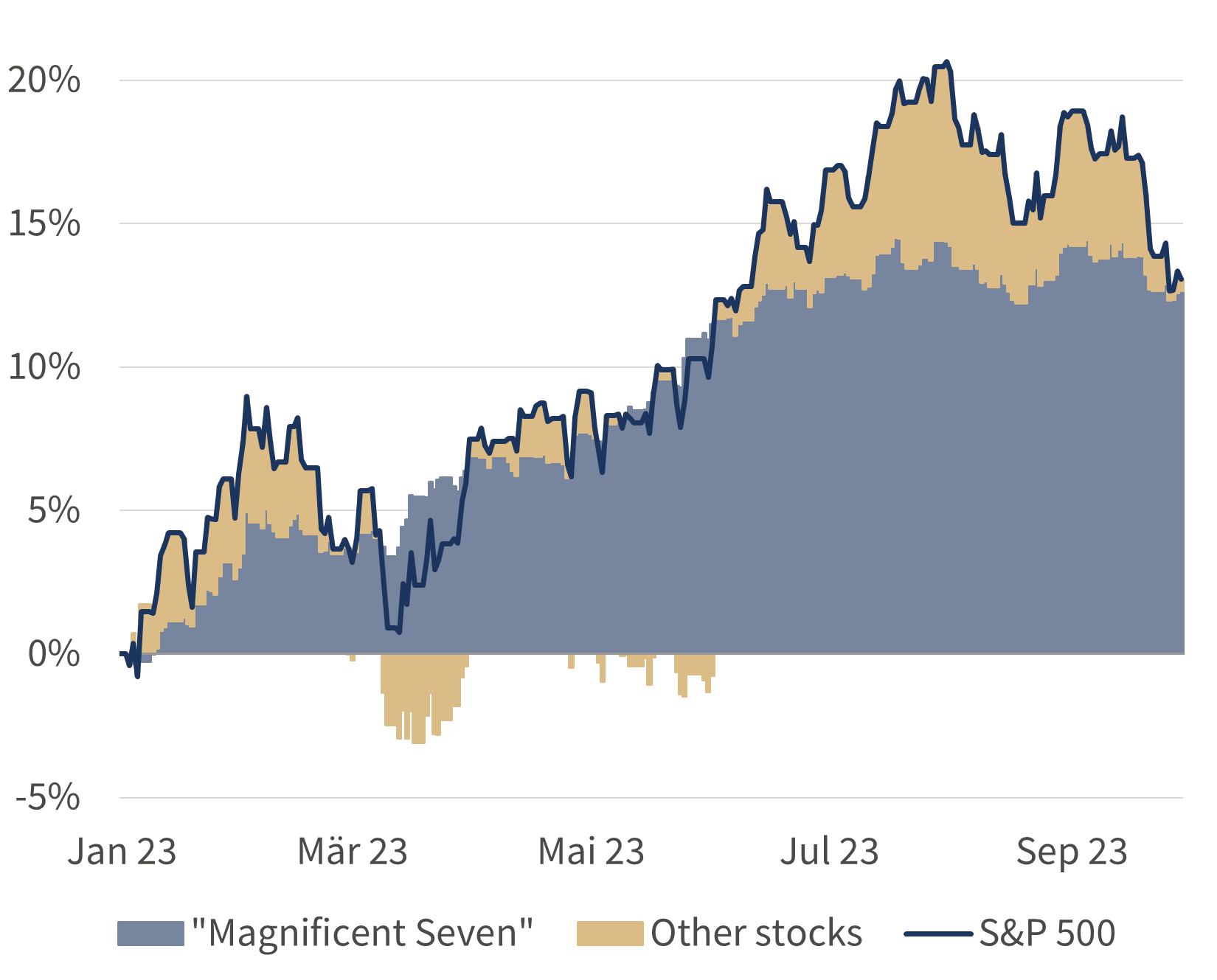

Broad equity market weakness persisted in September – with only the energy sector in positive territory – reversing the summer’s gains. Subsequently, the seven largest US “technology” stocks once again accounted for most of the S&P 500’s 13% year-to-date return. In fixed income, 10-year government bond yields continued to hit fresh cycle highs, including in the US (4.61%) and Germany (2.93%). Russia’s invasion of Ukraine showed few signs of a resolution, and the G20 joint declaration controversially avoided direct criticism of the aggressor. In commodity markets, energy remained in focus: Brent crude oil rose by 10% to $95 p/b, following the extension of production cuts by Saudi Arabia. Gold declined by 5% to $1,849, amid rising real bond yields and a stronger US dollar.

US: Resilient activity; Hawkish Fed pause; Shutdown averted

The US economy retained its lead over the past month – core retail sales, industrial production and core durable goods orders all expanded in August – and third-quarter GDP estimates tracked at a healthy 1.2% (q/q). The timely ISM Manufacturing PMI was stronger than expected, rising to 49 in September, with the closely-watched New Orders sub-index also turning higher (49.2). Inflation data were mixed: the headline rate rose again in August, to 3.7% (y/y) – amid the surge in oil prices – but core inflation declined to 4.3%. The Fed left its target rate range unchanged at 5.25-5.50%, though the latest projections showed one further rate hike this year, along with a tighter policy stance through next year. A US government shutdown was avoided following a last-minute deal, but it only ensured funding until mid-November.

Europe: UK GDP revised; Inflation cools; ECB hikes

Business surveys remained subdued in September, with the Composite PMIs still in “contraction” territory in the euro area (47.1) and UK (46.8). Moreover, eurozone hard data releases were weak in July, while the UK economy also contracted by 0.5%. On a more positive note, the UK’s post-pandemic recovery was revised higher: the economy was c.2% larger than previously estimated as of 2Q23. Eurozone inflation slowed by more than anticipated in September: the headline rate fell to 4.3%, while core inflation eased to 4.5% (almost a full percentage point decline in both series). The UK headline inflation rate edged lower to 6.7% in August, though core inflation decreased more sharply to 6.2%. Finally, the ECB raised its deposit rate by 25bps, to 4%, but both the BoE and SNB unexpectedly kept rates on hold at 5.25% and 1.75%, respectively.

ROW: China’s mixed backdrop; BoJ Yield Curve Control persists

China’s economic backdrop improved in August: both retail sales and industrial production growth reaccelerated – and were better than expected – while “deflation” proved to be short-lived (the headline inflation rate rose to 0.1% y/y). Moreover, the forward-looking manufacturing NBS PMI returned to “expansion” territory in September (50.2), while non-manufacturing activity also grew at a faster pace (51.7). Real estate distress remained in focus – notably, Evergrande remains a recurring concern – but Beijing has been eager to signal support, this time by easing banks’ reserve requirement ratios. In Japan, the BoJ kept its policy stance unaltered, maintaining its widened Yield Curve Control.

Performance figures (as of 29/09/2023 in local currency)

| Fixed Income | Yield | 1M % | YTD % |

|---|---|---|---|

| US 10 Yr | 4.57% | -3.1% | -2.9% |

| UK 10 Yr | 4.44% | 0.1% | -2.0% |

| Swiss 10 Yr | 1.10% | -1.2% | 4.7% |

| German 10 Yr | 2.84% | -2.5% | 0.0% |

| Global Govt (hdg $) | 3.51% | -1.6% | 1.2% |

| Global IG (hdg $) | 5.66% | -1.9% | 1.5% |

| Global HY (hdg $) | 9.46% | -1.1% | 5.5% |

| Equity Index | Level | 1M % | YTD % |

|---|---|---|---|

| MSCI ACWI ($) | 350 | -4.1% | 10.1% |

| S&P 500 | 4,288 | -4.8% | 13.1% |

| MSCI UK | 14,541 | 2.9% | 5.2% |

| SMI | 10,964 | -1.3% | 5.4% |

| Euro Stoxx 50 | 4,175 | -2.8% | 13.4% |

| DAX | 15,387 | -3.5% | 10.5% |

| CAC | 7,135 | -2.4% | 13.4% |

| Hang Seng | 17,810 | -2.6% | -6.8% |

| MSCI EM ($) | 495 | -2.6% | 1.8% |

| Currencies (trade-weighted) | 1M % | YTD % |

|---|---|---|

| US Dollar | 1.7% | 2.1% |

| Euro | -0.6% | 3.2% |

| Yen | -0.9% | -8.3% |

| Pound Sterling | -1.8% | 4.7% |

| Swiss Franc | -1.5% | 2.7% |

| Chinese Yuan | 0.9% | -2.1% |

| Commodities | Level | 1M % | YDT % |

|---|---|---|---|

| Gold ($/oz) | 1,849 | -4.7% | 1.3% |

| Brent ($/bl) | 95.31 | 9.7% | 10.9% |

| Copper ($/t) | 8,213 | -2.3% | -1.8% |

Source: Bloomberg, Rothschild & Co.

A concentrated stock market

Contribution to S&P 500 year-to-date return (%)

Source: Bloomberg, Rothschild & Co., 01/01/2023 – 29/09/2023

Note: “Magnificent Seven” refers to Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla