Monthly Market Summary: August 2023

Investment Communications Team, Investment Strategist Team, Wealth Management

Investment Communications Team, Investment Strategist Team, Wealth Management

Summary: A month of two halves

Global equities fell by 2.8% in August (USD terms), alongside global government bonds which edged lower by 0.1% (USD, hedged terms). Key themes included:

- Economic activity stays resilient in the US, but softens further in Europe;

- Inflation continues to abate, though core inflation rates remain elevated;

- China’s sluggish property sector prompts contagion fears.

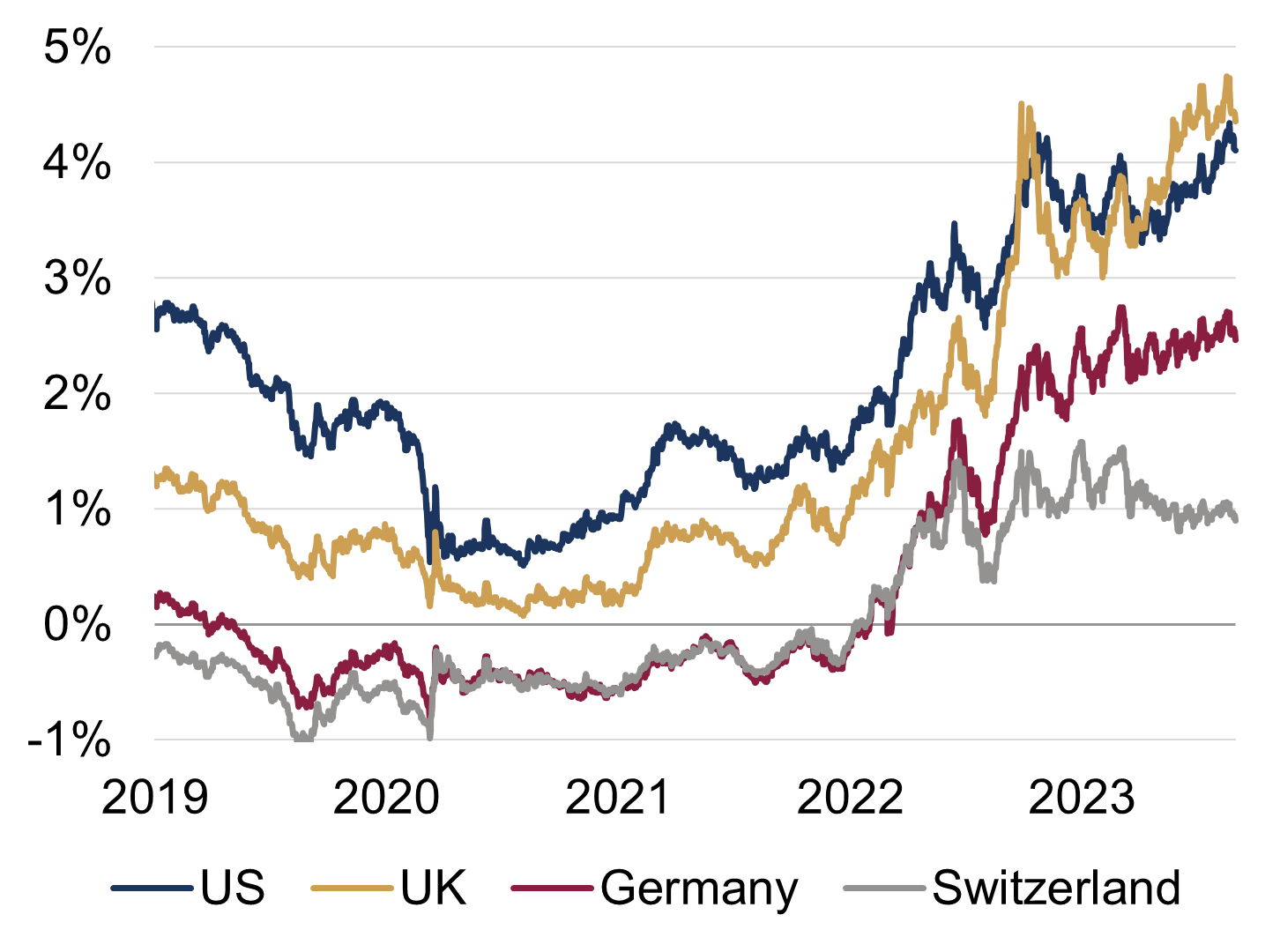

US-China tensions continued to ease last month: the US Commerce Secretary was the latest high-profile official to visit Beijing. In Russia, the Wagner Group Leader, Yevgeny Prigozhin, died in a plane crash, though the Kremlin denied any involvement. In fixed income, benchmark 10-year government bond yields briefly rose to fresh cyclical highs in the US and UK, before retracing most of their moves. Commodity prices were mixed in August: oil rose by 1.5%; copper and gold fell by 4.5% and 1.3%, respectively. Finally, European natural gas prices rose by 23%, amid potential industrial action in Australia.

US: Robust activity; Core inflation fading; Fitch downgrade

Economic activity remained robust last month: core retail sales and industrial production both grew by 1% (m/m) in July – real-time third-quarter GDP estimates are tracking at a lofty 1.4% (q/q). Survey data remained softer – the ISM Manufacturing PMI only rose to 47.6 in August (the closely-watched new orders sub-index moved lower to 46.8) – and the unemployment rate unexpectedly rose to 3.8% in August. Headline inflation moved higher in July, to 3.2% (y/y), but core inflation edged lower to 4.7%. Fitch downgraded the US’ long-term credit rating, to AA+, citing a deterioration in fiscal conditions and the standard of governance. Meanwhile, at the annual Jackson Hole Summit, Powell emphasised the ‘higher for longer’ rhetoric, and did not rule out further rate hikes.

Europe: Business surveys soften; Inflation abating; BoE hikes

The UK economy expanded by a modest 0.2% in the second quarter, slightly stronger than anticipated. That said, the Composite PMI fell into “contraction” territory in August (47.9), while the euro area PMI contracted at a faster pace (47.0). Inflation mostly continued to ease in the euro area: both headline and core inflation were at 5.3% in August (the former unchanged, but the latter falling). The UK headline inflation rate decreased sharply to 6.8% in July – echoing the reduction in the Energy Price Cap – while core inflation remained at 6.9%. As expected, the Bank of England increased its base rate by 25bps, to 5.25%, with further hikes likely ahead – nominal pay growth has yet to peak, despite the unemployment rate creeping higher.

ROW: China’s property woes; Modest deflation; Japan GDP

China’s economic slowdown continued in July: both retail sales and industrial production unexpectedly decelerated, to 2.5% and 3.7% (y/y), respectively. The NBS manufacturing PMI unexpectedly moved higher to 49.7 in August, but the non-manufacturing PMI fell to 51.0 (the latter is still expansionary). The property ‘crisis’ deepened, with Country Garden – one of China’s biggest private property developers – flirting with default. Contagion fears ensued, as Zhongzhi Group – a major player in the shadow banking industry – also missed payments on some of its investment products. The headline inflation rate slipped into deflation in July, falling to -0.3%, though core inflation accelerated to 0.8%. The PBoC cut its Medium-Term Lending Facility Rate by a modest 15bps, to 2.5% – its second cut in two months. In Japan, second-quarter GDP was stronger than anticipated, rising by 1.5% (q/q) – and entirely driven by strong exports – while core inflation edged up to 4.3% in July.

Performance figures (as of 31/08/2023 in local currency)

| Fixed Income | Yield | 1M % | YTD % |

|---|---|---|---|

| US 10 Yr | 4.11% | -0.7% | 0.2% |

| UK 10 Yr | 4.36% | -0.1% | -2.1% |

| Swiss 10 Yr | 0.93% | 0.6% | 5.9% |

| German 10 Yr | 2.46% | 0.4% | 2.6% |

| Global Govt (hdg $) | 3.24% | -0.1% | 2.8% |

| Global IG (hdg $) | 5.31% | -0.4% | 3.4% |

| Global HY (hdg $) | 9.09% | -0.2% | 6.6% |

| Equity Index | Level | 1M % | YTD % |

|---|---|---|---|

| MSCI ACWI ($) | 365 | -2.8% | 14.8% |

| S&P 500 | 4,508 | -1.6% | 18.7% |

| MSCI UK | 14,124 | -2.5% | 2.2% |

| SMI | 11,126 | -1.6% | 6.8% |

| Euro Stoxx 50 | 4,297 | -3.8% | 16.7% |

| DAX | 15,947 | -3.0% | 14.5% |

| CAC | 7,317 | -2.4% | 16.1% |

| Hang Seng | 18,382 | -8.2% | -4.4% |

| MSCI EM ($) | 508 | -6.2% | 4.6% |

| Currencies (trade-weighted) | 1M % | YTD % |

|---|---|---|

| US Dollar | 1.8% | 0.5% |

| Euro | -0.7% | 3.8% |

| Yen | -0.6% | -7.5% |

| Pound Sterling | 1.2% | 6.6% |

| Swiss Franc | -0.8% | 4.3% |

| Chinese Yuan | 0.7% | -3.0% |

| Commodities | Level | 1M % | YDT % |

|---|---|---|---|

| Gold ($/oz) | 1,940 | -1.3% | 6.4% |

| Brent ($/bl) | 88,86 | 1.5% | 1.1% |

| Copper ($/t) | 8,405 | -4.5% | 0.5% |

Source: Bloomberg, Rothschild & Co.

10-year government bond yields

US, UK, Germany, Switzerland (%)

Source: Bloomberg, Rothschild & Co.,01/01/2019 - 31/08/2023

Source: Bloomberg, Rothschild & Co.,01/01/2019 - 31/08/2023