Monthly Market Summary: July 2023

Investment Communications Team, Investment Strategist Team, Wealth Management

Investment Communications Team, Investment Strategist Team, Wealth Management

Summary: Global equities hit fresh 2023 highs

Global equities rose by a further 3.7% in July (USD terms), while global government bonds edged lower again by 0.3% (USD, hedged terms). Key themes included:

- Economic activity remained robust in the US, but appeared softer in Europe;

- Major central banks approached the end of their tightening cycles;

- China’s recovery remained patchy, but policymakers signalled support ahead.

Stock market participation continued to broaden as a wider cyclical rally pushed global equities to fresh year-to-date highs. Geopolitical risks ebbed last month after US-China dialogue resumed, with Treasury Secretary Yellen visiting Beijing. At the NATO Summit, Ukraine’s bid for membership remained idle, while Turkey dropped its objections against Sweden joining. Meanwhile, commodity prices moved higher in July partly driven by the improved growth outlook (oil +14.2% and copper +5.7%); while higher wheat prices (+4.6%) reflected Russia’s failure to extend the Black Sea grain deal. Finally, the second-quarter US earnings season has roughly been in line with expectations, tracking at -7.3%.

US: Resilient economy; Cooling inflation; Fed’s final hike?

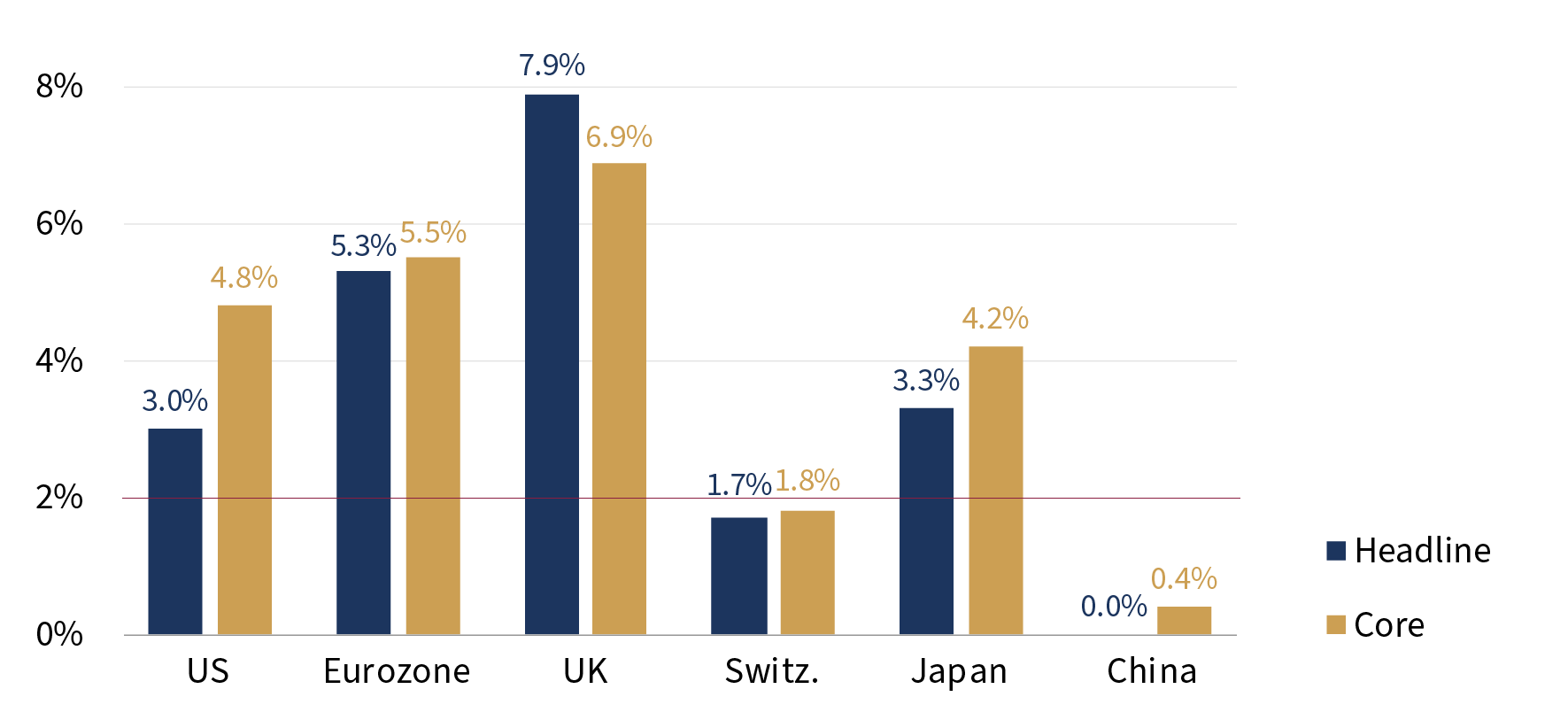

US GDP grew by 0.6% in the second quarter (q/q), a stronger-than-expected reading. The ISM manufacturing PMI moved higher to 46.4 in July, as did the closely-watched New Orders sub-index, to 47.3 (both figures remained in “contraction” territory). Remarkably, labour market tightness persisted: the unemployment rate edged lower again to 3.6% in June, while weekly initial jobless claims moved lower through July. The US headline inflation rate fell sharply again in June, to 3%, and core inflation also declined to 4.8%. The Fed raised its target rate range by another 25bps, to 5.25-5.50%, and Powell stated they would follow a “data-dependent” approach going forward.

Europe: Mixed activity; Patchy disinflation; ECB hikes again

The euro area economy expanded in the second quarter, by 0.3% (q/q). The monthly UK GDP data signalled a modest contraction in May, although core retail sales grew by 0.8% in June. The euro area and UK Composite PMIs continued to drift lower in July: the former is no longer in “expansion” territory, following another weak manufacturing reading (42.7). A patchy inflation story saw euro area headline inflation ease in July, to 5.3%, but the core rate was unchanged at 5.5%. UK inflation remained uncomfortably high in June, with headline and core inflation at 7.9% and 6.9%, respectively. The ECB raised its deposit rate by another 25bps, to 3.75%, with Lagarde stating they would keep an “open mind” on future rate decisions. In politics, the Spanish General Election ended in deadlock, after the right-wing PP failed to win a majority vote. Elsewhere, Dutch PM Rutte resigned, with an early election scheduled for November.

ROW: China GDP disappoints; Politburo meeting; BoJ surprise

China’s economy expanded by a weaker-than-expected 6.3% (y/y) in the second quarter. Retail sales growth decelerated, property sector activity remained subdued, and headline inflation fell to 0% in June. The timelier NBS PMIs signalled ongoing contraction in the manufacturing sector (49.3) and a slower pace of expansion in the non-manufacturing sector (51.5) in July. The Politburo signalled further support for the property sector at its July meeting but fell short of announcing widespread stimulus. Promisingly, Beijing also urged local governments to provide more support to Internet firms, a tentative sign that regulatory scrutiny may finally be easing. In Japan, core inflation edged lower to 4.2% in June. The BoJ surprisingly adjusted its Yield Curve Control policy: the band was widened to 100bps (from 50bps) around its 0% yield target on 10-year government bonds.

Performance figures (as of 31/07/2023 in local currency)

| Fixed Income | Yield | 1M % | YTD % |

|---|---|---|---|

| US 10 Yr | 3.96% | -0.6% | 1.0% |

| UK 10 Yr | 4.31% | 1.3% | -2.0% |

| Swiss 10 Yr | 1.01% | -0.1% | 5.3% |

| German 10 Yr | 2.49% | -0.1% | 2.2% |

| Global Govt (hdg $) | 3.20% | -0.3% | 2.9% |

| Global IG (hdg $) | 5.19% | 0.6% | 3.8% |

| Global HY (hdg $) | 8.93% | 1.8% | 6.8% |

| Equity Index | Level | 1M % | YTD % |

|---|---|---|---|

| MSCI ACWI ($) | 375 | 3.7% | 18.1% |

| S&P 500 | 4,589 | 3.2% | 20.6% |

| MSCI UK | 14,491 | 2.2% | 4.9% |

| SMI | 11,309 | 0.3% | 8.6% |

| Euro Stoxx 50 | 4,471 | 1.8% | 21.3% |

| DAX | 16,447 | 1.9% | 18.1% |

| CAC | 7,498 | 1.4% | 19.0% |

| Hang Seng | 20,079 | 7.2% | 4.2% |

| MSCI EM ($) | 542 | 6.2% | 11.4% |

| Currencies (trade-weighted) | 1M % | YTD % |

|---|---|---|

| US Dollar | -1.4% | -1.3% |

| Euro | 0.3% | 4.5% |

| Yen | 0.4% | -6.9% |

| Pound Sterling | 0.7% | 5.3% |

| Swiss Franc | 1.9% | 5.1% |

| Chinese Yuan | 0.4% | -3.7% |

| Commodities | Level | 1M % | YDT % |

|---|---|---|---|

| Gold ($/oz) | 1,965 | 2.4% | 7.7% |

| Brent ($/bl) | 85,56 | 14.2% | -0.4% |

| Copper ($/t) | 8,800 | 5.7% | 5.2% |

Source: Bloomberg, Rothschild & Co.

Latest headline and core inflation rates

(Year-over-year, %)

Footnote: All inflation rates are as of June; Eurozone is July estimate

Footnote: All inflation rates are as of June; Eurozone is July estimate

Source: Bloomberg, Rothschild & Co.