Monthly Market Summary: June 2023

Investment Communications Team, Investment Strategist Team, Wealth Management

Investment Communications Team, Investment Strategist Team, Wealth Management

Summary: Geopolitics and central banks in focus

Global equities rebounded by 5.8% in June (USD terms), while global government bonds edged lower by 0.1% (USD, hedged terms). Key themes included:

- Economic activity generally appears to soften, though US data seem resilient;

- Major central banks commit to further tightening amid sticky core inflation;

- China cuts several key lending rates, as economic rebound loses momentum.

Following Ukraine’s long-awaited counteroffensive, Putin’s rule appeared to be challenged domestically. The Wagner Group – a Russian paramilitary organisation which had expressed discontent with its military leaders – marched towards Moscow, though the protest was short-lived. US-China tensions appeared to de-escalate after Antony Blinken, the US Secretary of State, unexpectedly held a meeting with Xi during his Beijing trip. Stock market participation broadened in June, with all sectors in positive territory following a very lopsided May. Elsewhere, Saudi Arabia announced further oil production cuts at the OPEC+ meeting, but Brent Crude only rose by 3.1% in June. European natural gas prices rose sharply last month (+38%) but remain around 90% below last year’s highs.

US: Robust growth; Inflation moderating; Fed’s hawkish pause

US hard data remained robust in May: core retail sales (+0.4%) and core durable goods orders (+0.7%) were both stronger than expected, while housing activity – home sales, building permits and housing starts – also rebounded. The ISM Manufacturing PMI declined to 46 in June, though the closely-watched New Orders sub-index rose to 45.6 (still contractionary). Tentative signs of a cooling labour market were evident: the unemployment rate increased to 3.7%, while timely initial jobless claims briefly rose to late-2021 levels. Headline inflation fell sharply to 4% (y/y), but core inflation only edged down to 5.3%. The Fed paused for the first time in 15 months – with the target rate range at 5-5.25% – although the updated dot plot indicated two further 25bps hikes later this year.

Europe: Slowing activity; Sticky UK CPI; Tightening continues

Business surveys continued to soften in June, though the Composite PMIs remained in “expansion” territory in both the UK and eurozone. Downwardly revised GDP figures showed that the euro area entered a technical recession in the first quarter, while the monthly UK GDP data revealed a modest expansion in April (+0.2%). Inflation was disappointingly sticky in the UK: the headline rate was unchanged at 8.7% (y/y) in May and core inflation accelerated to 7.1% – its highest reading since 1992. Headline inflation in the euro area fell to 5.5%, although core inflation edged up to 5.4% in June. Central banks continued to raise their respective policy rates, including the ECB (+25bps to 3.5%), BoE (+50bps to 5%), SNB (+25bps to 1.75%), and even the Central Bank of Turkey (+650bps to 15%). In the political sphere, Sunak and Biden signed the “Atlantic Declaration”, with a goal to increase UK-US trade and cooperation in critical minerals, defence and other areas.

ROW: PBoC eases; Japan’s inflation backdrop; BoJ still dovish

China’s economic rebound slowed in May: retail sales decelerated to 12.7% (y/y), as did industrial production to 3.5%. The timely NBS PMIs continued to signal expansion in the non-manufacturing sector (53.2) and a modest contraction in manufacturing (49.0) in June. Moreover, the PBoC announced marginal cuts to several key lending rates. In Japan, the Tankan Business Conditions surveys signalled a stronger second quarter in both the manufacturing and non-manufacturing sectors. Core inflation crept up to 4.3% – its highest reading since 1981 – yet the BoJ made no adjustments to its yield curve control policy.

Performance figures (as of 30/06/2023 in local currency)

| Fixed Income | Yield | 1M % | YTD % |

|---|---|---|---|

| US 10 Yr | 3.84% | -1.3% | 1.6% |

| UK 10 Yr | 4.38% | -1.7% | -3.3% |

| Swiss 10 Yr | 0.96% | -0.8% | 5.4% |

| German 10 Yr | 2.39% | -1.1% | 2.3% |

| Global Govt (hdg $) | 3.16% | -0.1% | 3.1% |

| Global IG (hdg $) | 5.28% | 0.1% | 3.1% |

| Global HY (hdg $) | 9.20% | 2.1% | 4.9% |

| Equity Index | Level | 1M % | YTD % |

|---|---|---|---|

| MSCI ACWI($) | 362 | 5.8% | 13.9% |

| S&P 500 | 4,450 | 6.6% | 16.9% |

| MSCI UK | 14,178 | 1.2% | 2.6% |

| SMI | 11,280 | 0.6% | 8.3% |

| Eurostoxx 50 | 4,399 | 4.4% | 19.2% |

| DAX | 16,148 | 3.1% | 16.0% |

| CAC | 7,400 | 4.5% | 17.4% |

| Hang Seng | 18,916 | 4.5% | -2.8% |

| MSCI EM ($) | 510 | 3.8% | 4.9% |

| Currencies (trade-weighted) | 1M % | YTD % |

|---|---|---|

| US Dollar | -0.3% | 0.0% |

| Euro | 2.4% | 4.2% |

| Yen | -3.0% | -7.3% |

| Pound Sterling | 1.7% | 4.6% |

| Swiss Franc | 0.9% | 3.1% |

| Chinese Yuan | -1.9% | -4.0% |

| Commodities | Level | 1M % | YDT % |

|---|---|---|---|

| Gold ($/oz) | 1,919 | -2.2% | 5.2% |

| Brent ($/bl) | 74.90 | 3.1% | -12.8% |

| Copper ($/t) | 8,322 | 3.1% | -0.5% |

Source: Bloomberg, Rothschild & Co.

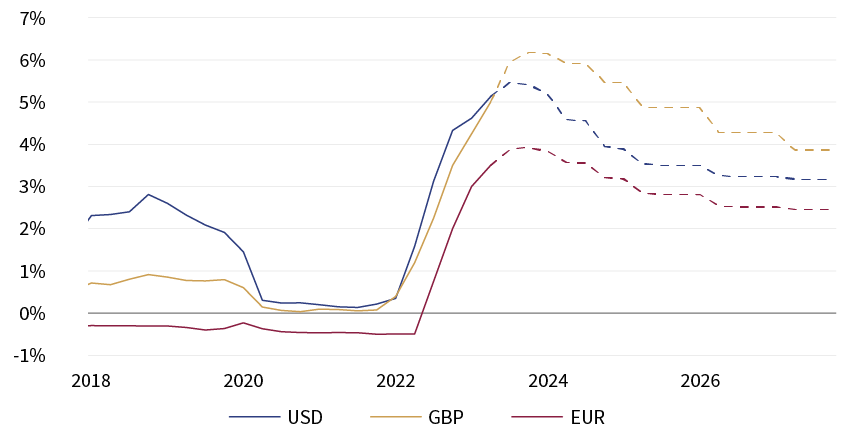

Implied policy rates

Estimates derived from OIS curves (%)

Footnote: three-month tenor; USD - SOFR, GBP - SONIA, EUR - ESTR

Source: Bloomberg, Rothschild & Co., 01.01.2018 – 31.12.2027