Monthly Market Summary: May 2023

Investment Communications Team, Investment Strategist Team, Wealth Management

Investment Communications Team, Investment Strategist Team, Wealth Management

Summary: Fragile markets and narrow leadership

Despite the US large-cap tech stock rally in May, global equities fell by 1.1% and global government bonds declined by 2.2% (USD, unhedged terms). Key themes included:

- Banking risk stabilises, with broader stress metrics subdued;

- Major central banks continue to raise interest rates amid sticky core inflation;

- US debt ceiling suspended for two years following a last-minute deal.

Following the failure of First Republic, financial distress faded in May as stress measures receded. Western Alliance – a struggling US regional bank – reported deposit growth since the end of the first quarter. China tensions somewhat deescalated after the G7 summit: a joint communiqué emphasised ‘de-risking’ rather than ‘de-coupling’, while Biden sounded more positive on relations. The narrow stock market rally continued: the seven largest US technology-related stocks – which represent nearly 30% of the S&P 500 index – accounted for all of its c.10% year-to-date return. Commodity prices fell last month (in USD terms), including Brent Crude (-8.6%), copper (-5.9%) and gold (-1.4%).

US: Tight labour market; Peak interest rates?; Debt ceiling resolution

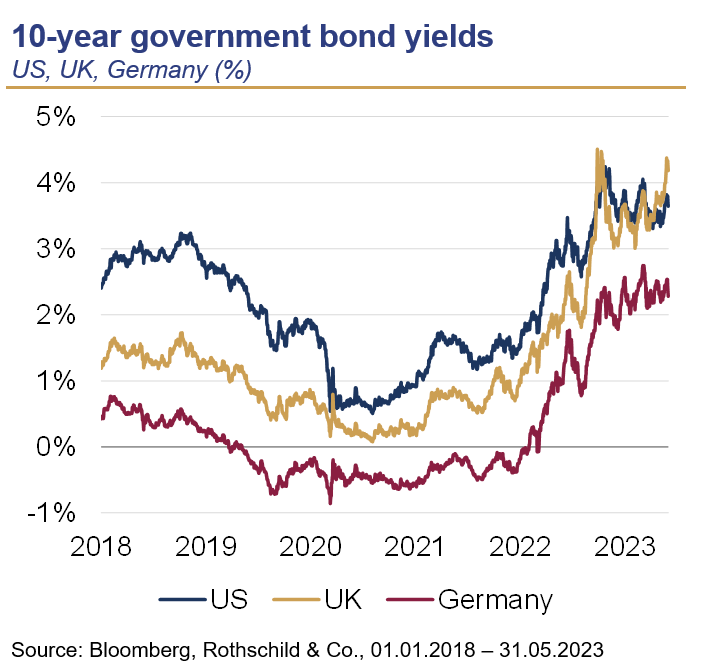

US economic activity remained upbeat, albeit patchy. Consumption was robust – core retail sales grew by 0.6% in April – and the labour market remained tight, with the unemployment rate moving lower to 3.4% (its joint lowest reading since 1969). On the other hand, the ISM Manufacturing PMI remained in contraction territory in May, with the closely-watched New Orders sub-index falling to 42.6. Inflation continued to gradually abate: the headline rate edged lower to 4.9% (y/y) in April, as did core inflation to 5.5%. The Federal Reserve raised its target rate range by 25bps to 5-5.25% – initially thought to be the final hike – though policymakers hinted that the tightening cycle may not be over. Finally, Joe Biden and Republican House Speaker McCarthy agreed to suspend the US debt ceiling for two years, in exchange for non-defence government spending to be ‘roughly flat’ next year.

Europe: Sticky inflation; Hiking continues; Elections in focus

Economic momentum decelerated in both the euro area and UK: the flash Composite PMIs edged lower in May – though still signalled expansion – and the manufacturing to services PMI gap widened further. First-quarter GDP estimates revealed that Germany entered a technical recession, after a downward revision, while UK output grew by 0.1% (q/q). Euro area headline inflation declined to 6.1% (y/y) in May, while core inflation fell to 5.3%. The UK headline CPI rate also fell sharply to 8.7% in April, but core inflation accelerated to 6.8% – its highest reading since 1992. Both the ECB and BoE raised interest rates by 25bps to 3.25% and 4.5%, respectively. A busy electoral calendar saw Erdogan and Mitsotakis retain their leadership in Turkey and Greece, respectively, while Spanish PM Sánchez called a July snap election following poor results in local polls.

ROW: China’s cautious recovery; Japan’s economic revival?

China’s activity data were generally weaker than anticipated in April, but still reflected a rebounding economy: retail sales grew by almost 20% (y/y) – partly due to base effects – while new home prices rose for the third consecutive month. The NBS Manufacturing PMI contracted at a slightly faster pace in May (48.8), although the Non-Manufacturing PMI remained comfortably above the neutral 50-mark. Even so, headline inflation decelerated to 0.1% (y/y), along with producer price inflation to -3.6%. Elsewhere, Japan’s economy appeared resilient: output expanded by a healthy 1.6% (q/q, ann.) during the first quarter, and the timelier services PMI rose to a record high in May. Core inflation accelerated to 4.1% (y/y), its highest reading since 1981.

Performance figures (as of 31/05/2023 in local currency)

| Fixed Income | Yield | 1M % | YTD % |

|---|---|---|---|

| US 10 Yr | 3.65% | -1.4% | 2.9% |

| UK 10 Yr | 4.18% | -3.0% | -1.6% |

| Swiss 10 Yr | 0.89% | 1.6% | 6.3% |

| German 10 Yr | 2.28% | 0.6% | 3.4% |

| Global IG (hdg $) | 5.12% | -0.9% | 3.0% |

| Global HY (hdg $) | 9.47% | -0.5% | 2.8% |

| Equity Index | Level | 1M % | YTD % |

|---|---|---|---|

| MSCI World($) | 8,667 | -1.0% | 8.5% |

| S&P 500 | 4,180 | 0.4% | 9.6% |

| MSCI UK | 14,003 | -5.2% | 1.3% |

| SMI | 11,218 | -1.6% | 7.7% |

| Eurostoxx 50 | 4,218 | -1.9% | 14.2% |

| DAX | 15,664 | -1.6% | 12.5% |

| CAC | 7,099 | -3.9% | 12.3% |

| Hang Seng | 18,234 | -7.9% | -6.9% |

| MSCI EM ($) | 491 | -1.7% | 1.1% |

| Currencies (trade-weighted) | 1M % | YTD % |

|---|---|---|

| US Dollar | 1.6% | 0.4% |

| Euro | -1.1% | 1.8% |

| Yen | -1.1% | -4.4% |

| Pound Sterling | 1.2% | 2.9% |

| Swiss Franc | 0.3% | 2.2% |

| Chinese Yuan | -1.4% | -2.2% |

| Commodities | Level | 1M % | YDT % |

|---|---|---|---|

| Gold ($/oz) | 1,963 | -1.4% | 7.6% |

| Brent ($/bl) | 72.66 | -8.6% | -15.4% |

| Copper ($/t) | 8,070 | -5.9% | -3.5% |

Source: Bloomberg, Rothschild & Co.