Monthly Market Summary: April 2023

Investment Communications Team, Investment Strategist Team, Wealth Management

Investment Communications Team, Investment Strategist Team, Wealth Management

Summary: A return to calmer seas

Capital markets were quiescent in April: global equities rose by 1.4%, while global government bonds edged higher by 0.1% (USD, unhedged terms). Key themes included:

- Activity momentum continues, albeit unevenly

- Headline inflation rates broadly move lower but core inflation remains stickier;

- Bank of Japan (BoJ) policy unaltered at Kazuo Ueda’s first meeting.

After banking distress in March, contagion risks mostly eased through April as overall stress and default measures remained subdued. Concerns over First Republic Bank re-emerged towards month-end, but they were short-lived as JP Morgan acquired the bank in a government-led deal. Geopolitical developments – conflict in Sudan and Chinese military exercises near Taiwan – had little appreciable market impact. Implied stock and treasury market volatility retreated sharply – falling by a third from their March highs. OPEC+ unexpectedly announced a production cut amounting to roughly one million barrels per day, but crude oil prices ended the month little changed. Gold continued to climb – temporarily surpassing the $2000-mark – while copper declined by 4.7% (in USD terms). Finally, first-quarter US earnings were better than expected (so far), tracking at -3.7% (y/y).

US: Growth persists; Disinflation continues; Debt ceiling impasse

The US economy expanded by a respectable 1.1% (q/q, annualised) in the first quarter of 2023, but slightly below consensus expectations. Labour market tightness persisted: the unemployment rate edged lower to 3.5% – close to multi-decade lows – and almost 250,000 jobs were added in March. April’s PMI survey data painted a mixed growth picture: services momentum continued, but manufacturing remained more subdued. The headline inflation rate fell by a full percentage point to 5% (y/y), but core inflation edged up to 5.6%. Political developments were in focus: Biden formally announced his 2024 re-election bid, though the US debt ceiling took centre stage. The Republicans are seeking to rein in spending, while the Democrats are seeking an unconditional increase in the debt limit.

Europe: Output stagnates; Sticky core inflation; State visits in focus

The euro area economy grew by a subdued 0.1% (q/q) in the first quarter of 2023 (following a modest 0.1% contraction in the fourth quarter). Monthly UK GDP data reflected a 0.4% expansion over January and February. But survey data improved in April – both the UK and eurozone Composite PMIs expanded at their fastest pace in a year – though there was also a clear divergence between services (expanding) and manufacturing (contracting) activity. Both the euro area and UK headline inflation rates moved lower to 6.9% (y/y) and 10.1% in March, respectively. Conversely, core inflation rose to 5.7% in the eurozone and was unchanged at 6.2% in the UK. Macron’s state visit to China prompted criticism after he distanced himself from the US-Taiwan axis. Meanwhile, Biden’s convivial visit to Ireland coincided with the 25-year anniversary of the Good Friday agreement.

ROW: China’s rebound; Japanese inflation; Ueda’s BoJ debut

China’s economic revival continued after GDP grew by a higher-than-expected 4.5% (y/y) during the first quarter of 2023, though the timelier NBS PMIs signalled softer activity April – particularly from the manufacturing sector. Despite the rebound, headline and core inflation rates remained muted, both at 0.7% (y/y) in March. In Japan, headline inflation also edged lower to 3.2% – but core inflation rose to 3.8%, its highest rate since 1981. As expected, Kazuo Ueda’s first meeting as Bank of Japan Governor delivered no change to monetary policy, with stimulus measures firmly in place. However, he initiated a long-term review of the Bank’s policies – widely seen as a signal of greater policy flexibility ahead.

Performance figures (as of 30/04/2023 in local currency)

| Fixed Income | Yield | 1M % | YTD % |

|---|---|---|---|

| US 10 Yr | 3.43% | 0.9% | 4.4% |

| UK 10 Yr | 3.72% | -1.3% | 1.4% |

| Swiss 10 Yr | 1.05% | 1.2% | 4.5% |

| German 10 Yr | 2.31% | 0.1% | 2.8% |

| Global IG (hdg $) | 4.89% | 0.8% | 4.0% |

| Global HY (hdg $) | 9.22% | 0.3% | 3.3% |

| Equity Index | Level | 1M % | YTD % |

|---|---|---|---|

| MSCI World($) | 8,754 | 1.8% | 9.6% |

| S&P 500 | 4,169 | 1.6% | 9.2% |

| MSCI UK | 14,779 | 3.6% | 6.9% |

| SMI | 11,437 | 4.1% | 9.4% |

| Eurostoxx 50 | 4,359 | 1.8% | 16.4% |

| DAX | 15,922 | 1.9% | 14.4% |

| CAC | 7,492 | 3.0% | 16.8% |

| Hang Seng | 19,895 | -2.4% | 1.0% |

| MSCI EM ($) | 500 | -1.1% | 2.8% |

| Currencies (trade-weighted) | 1M % | YTD % |

|---|---|---|

| US Dollar | 0.1% | -1.2% |

| Euro | 1.0% | 2.8% |

| Yen | -1.8% | -3.4% |

| Pound Sterling | 0.6% | 1.6% |

| Swiss Franc | 2.1% | 1.8% |

| Chinese Yuan | -0.2% | -0.8% |

| Commodities | Level | 1M % | YDT % |

|---|---|---|---|

| Gold ($/oz) | 1,990 | 1.1% | 9.1% |

| Brent ($/bl) | 79.54 | -0.3% | -7.4% |

| Copper ($/t) | 8,577 | -4.7% | 2.5% |

Source: Bloomberg, Rothschild & Co.

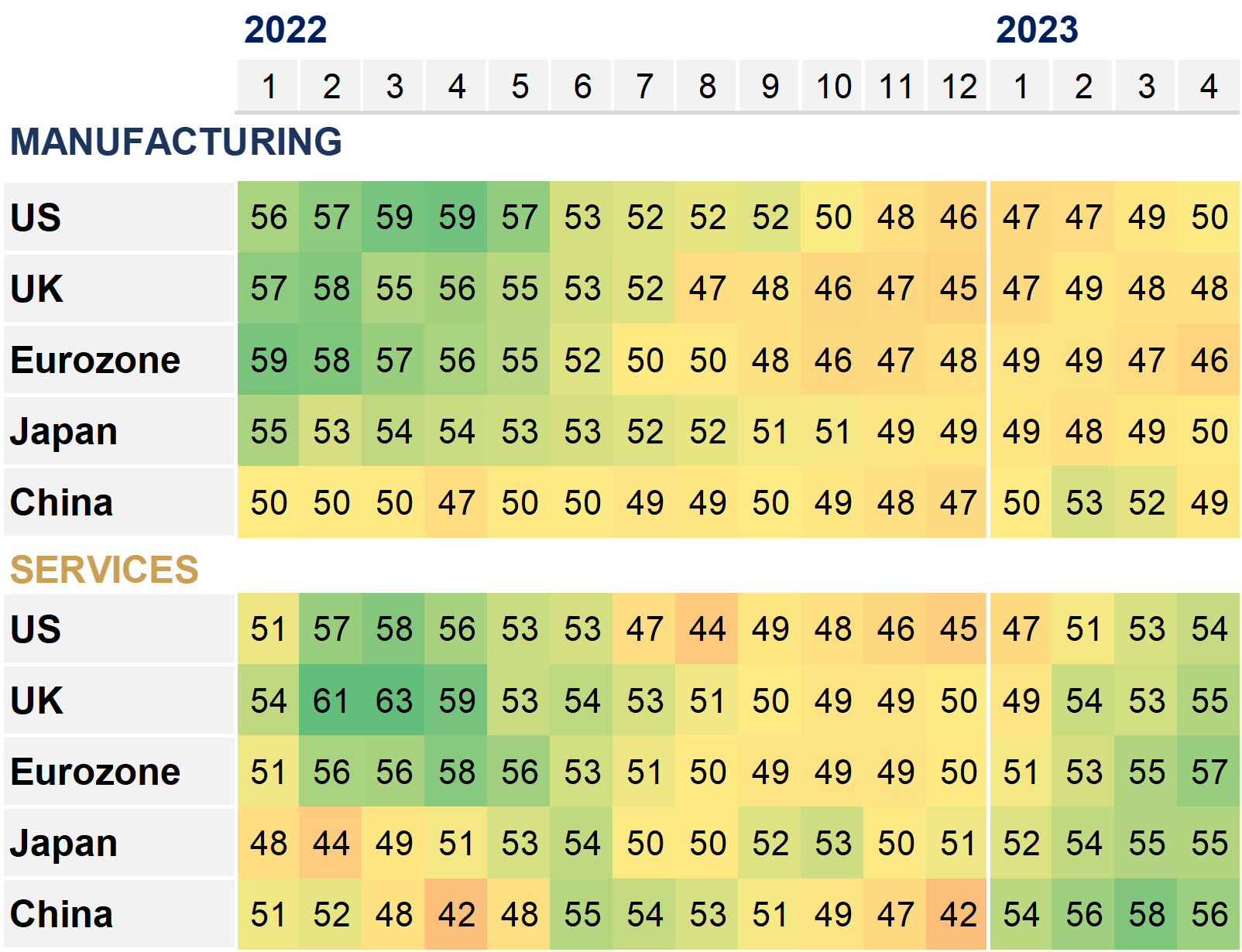

Purchasing Managers’ Indices

Manufacturing & services diffusion indices, 50 = ‘no change’

Source: Bloomberg, Rothschild & Co., S&P Global, National Bureau of Statistics of China, 01.01.2022 – 30.04.2023