Monthly Market Summary: March 2023

Investment Communications Team, Investment Strategist Team, Wealth Management

Investment Communications Team, Investment Strategist Team, Wealth Management

Summary: Banking stress moves into focus

Despite concerns over the banking system, global equities rose by 3.1% in March (in USD terms) – though the MSCI World Banks Index declined by 12.2% – and global government bonds rallied 3.7% (USD, unhedged terms). Key themes included:

-

- Economic activity remains robust as inflation gradually subsides;

- Major central banks continue to hike policy rates despite banking jitters;

- China announces new 2023 GDP growth target of ‘around 5%’.

Banking contagion fears emerged in March following the collapse of Silicon Valley Bank (SVB) and the subsequent forced takeover of Credit Suisse by UBS. Authorities reacted quickly: the Federal Reserve and Swiss National Bank announced new lending facilities to boost liquidity, with other central banks on high alert. The risk-off mood prompted a sharp rally in government bonds and gold (+7.8% to $1969), while Brent Crude oil fell by 5% to $80 p/b. In stock markets, cyclically-tilted sectors came under pressure, but the technology-tilted cohort of growth stocks performed better as bond yields moved lower.

US: Robust economy; Inflation fading; Fed stays the course

Activity momentum continued to build in March, with the manufacturing and services PMIs moving higher. The labour market also looked healthy: the unemployment rate edged up to 3.6% – still low by historical standards – and over 300,000 jobs were added in February. Overall, real-time first-quarter GDP estimates are tracking at a healthy 2.5% (q/q, annualised). Headline and core inflation rates continued to trend lower to 6% (y/y) and 5.5%, respectively. Despite financial stability concerns, the Fed pressed ahead with normalising policy rates, raising its interest rate by 25bps to 4.75-5%, with the median FOMC member anticipating a year-end policy rate above 5%.

Europe: Sticky inflation; ECB, BoE & SNB hike; France protests

Business surveys continued to signal economic resilience in March: the euro area and UK Composite PMIs stayed in ‘expansion’ territory (the former accelerated), while the German Ifo Business Climate Index rose for the fifth consecutive month. Eurozone headline inflation fell to 6.9% in March, though the core rate edged up to a record high of 5.7%. UK inflation surprised to the upside in February, with both the headline and core rates reaccelerating to 10.4% and 6.2%, respectively. The major central banks continued to hike their respective policy rates, including the ECB (+50bps to 3%), BoE (+25bps to 4.25%) and SNB (+50bps to 1.5%). The ECB also begun its passive balance sheet run-off in March. Despite nationwide protests in France, Macron’s government remained on course to raise the retirement age by two years to 64. Separately, the first Franco-British summit was held in five years, while the Windsor Framework was formally adopted by the UK and EU.

ROW: China’s growth target; Japan CPI and wages; Farewell Kuroda

Policymakers set a 2023 GDP growth target of ‘around 5%’ at the National People’s Congress, just as China’s economic indicators continued to rebound from their covid slump: retail sales growth turned positive in February; the timelier NBS Non-Manufacturing PMI rose to its highest reading since 2011 in March. Still, inflation remained muted: the headline rate fell to 1% (y/y) in February, while the core rate was even lower (0.6%). In Japan, headline inflation fell by a percentage point to 3.3%, as a result of energy subsidies, but core inflation rose to 3.5% in February – its highest rate since 1982. Japanese firms also agreed on a 3.8% overall wage hike at the annual ‘Shunto’ negotiations. Finally, the BoJ kept monetary policy unaltered in March, marking the end of Kuroda’s ten-year tenure.

Performance figures (as of 31/03/2023 in local currency)

| Fixed Income | Yield | 1M % | YTD % |

|---|---|---|---|

| US 10 Yr | 3.47% | 3.7% | 3.5% |

| UK 10 Yr | 3.49% | 2.6% | 2.7% |

| Swiss 10 Yr | 1.25% | 1.9% | 3.3% |

| German 10 Yr | 2.29% | 3.0% | 2.7% |

| Global IG (hdg $) | 4.96% | 2.1% | 3.1% |

| Global HY (hdg $) | 9.18% | 0.5% | 2.9% |

| Equity Index | Level | 1M % | YTD % |

|---|---|---|---|

| MSCI World($) | 8,603 | 3.1% | 7.7% |

| S&P 500 | 4,109 | 3.7% | 7.5% |

| MSCI UK | 14,265 | -2.7% | 3.2% |

| SMI | 11,106 | 1.6% | 5.1% |

| Eurostoxx 50 | 4,315 | 2.0% | 14.3% |

| DAX | 15,629 | 1.7% | 12.2% |

| CAC | 7,322 | 0.9% | 13.4% |

| Hang Seng | 20,400 | 3.5% | 3.5% |

| MSCI EM ($) | 505 | 3.0% | 4.9% |

| Currencies (trade-weighted) | 1M % | YTD % |

|---|---|---|

| US Dollar | -1.3% | -1.3% |

| Euro | 1.2% | 1.8% |

| Yen | 1.5% | -1.6% |

| Pound Sterling | 0.6% | 1.0% |

| Swiss Franc | 0.5% | -0.3% |

| Chinese Yuan | -0.4% | -0.6% |

| Commodities | Level | 1M % | YDT % |

|---|---|---|---|

| Gold ($/oz) | 1,969 | 7.8% | 8.0% |

| Brent ($/bl) | 79.77 | -4.9% | -7.1% |

| Copper ($/t) | 9,004 | 0.6% | 7.6% |

Source: Bloomberg, Rothschild & Co.

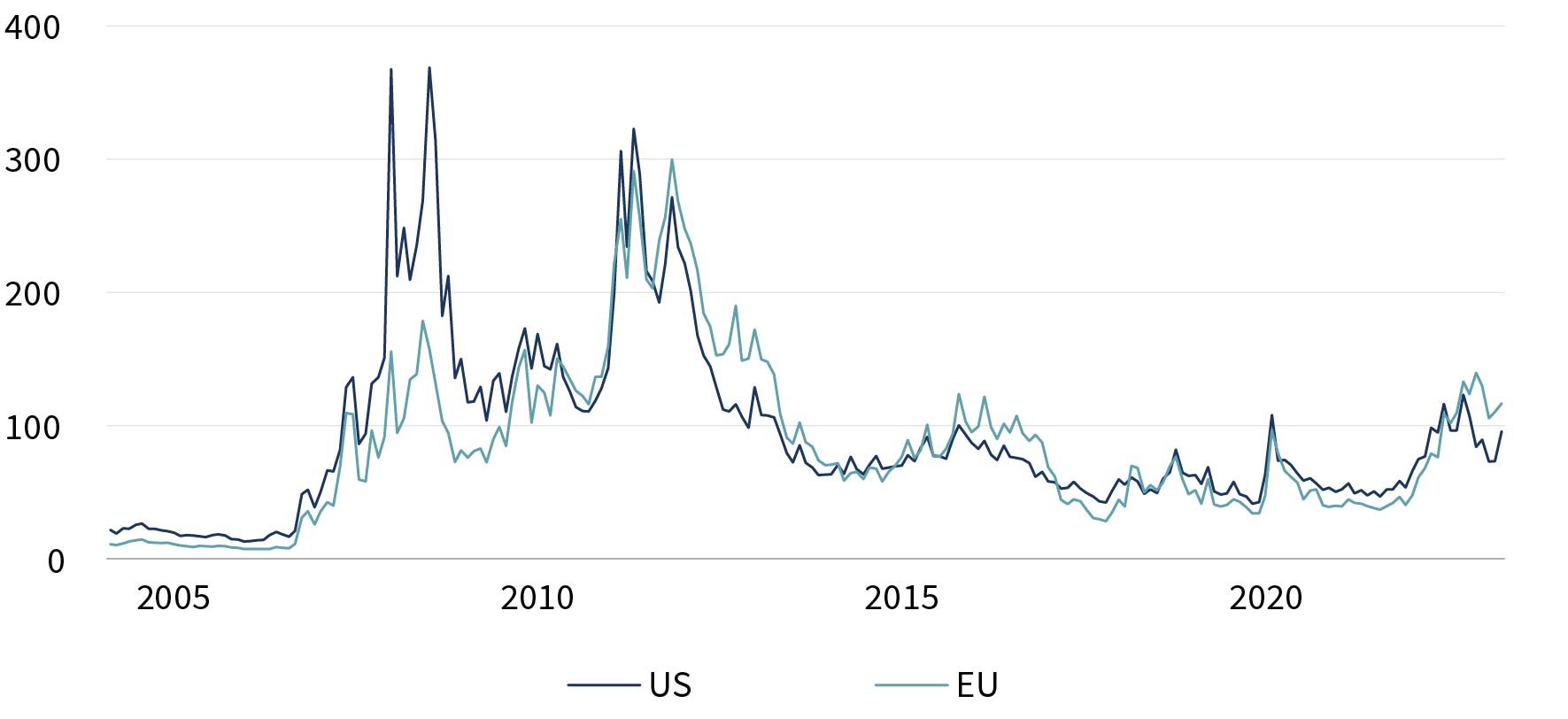

Banking system stress

Major banks: average 5-year senior CDS spreads (bps)

Note: US series consists of JP Morgan, Bank of America, Wells Fargo, Citigroup, Goldman Sachs and Morgan Stanley. EU series consists of Banco Santander, BNP Paribas, UBS, Société Générale, Credit Suisse and Deutsche Bank

Source: Bloomberg, Rothschild & Co., 01.01.2005 – 31.03.2023