Monthly Market Summary: February 2023

Investment Insights Team, Investment Strategist Team, Wealth Management

Investment Insights Team, Investment Strategist Team, Wealth Management

Summary: ‘Higher for longer’ prompts market rout in February

Capital markets experienced a difficult month, as renewed interest rate risk moved into focus: global equities fell by 2.9% (MSCI ACWI in USD terms) and government bonds declined by 3.5% (USD, unhedged terms). Key themes in February included:

- Global economic activity remains resilient as inflation slowly abates;

- Major central banks continue to raise interest rates with further tightening ahead;

- Kazuo Ueda revealed as the new Bank of Japan Governor.

Geopolitical developments were in focus during February. US-China tensions re-escalated after a suspected Chinese ‘spy balloon’ incurred into US airspace, prompting a pause in diplomatic talks. Elsewhere, Russia pulled out of the New START nuclear treaty, just days before the one-year anniversary of the invasion of Ukraine. Commodity prices moved lower last month: the European natural gas benchmark fell to its lowest level since August 2021; gold fell by over 5% (in USD terms), after the US dollar appreciated in February. A disappointing fourth-quarter US reporting season saw corporate earnings decline by 4.8%.

US: Consumer strength; Inflation fading; Fed hikes by 25bps

US consumer spending was remarkably strong in January: retail sales rose by 3% – rebounding from weakness in December – and ‘real’ personal consumption expenditures grew by over 1%. The ISM Manufacturing PMI also moved up to 47.7 in February. Real-time first-quarter GDP estimates are tracking at a trend-like 2.8% (q/q, annualised). Labour market tightness persisted, with the unemployment rate falling to 3.4%, its lowest reading since 1969, but average hourly earnings growth remained negative in ‘real’ terms. Headline and core CPI rates continued to edge lower to 6.4% (y/y) and 5.6% (respectively), though the Fed’s preferred inflation measure, the PCE deflator, crept (marginally) higher in January. The Fed raised its target rate range by 25bps to 4.5-4.75%, with policymakers signalling further tightening to come.

Europe: Robust activity; ECB & BoE hike by 50bps; Windsor Framework

European economic activity tilted higher: the eurozone and UK Composite PMIs expanded at a faster pace in February (mostly driven by service sector activity). This year’s recession forecasts continued to be revised away: the European Commission raised the EU’s 2023 growth forecast to 0.8%. The UK stagnated in the fourth quarter, in turn narrowly avoiding a year-end recession. Headline inflation rates moved lower again in the eurozone (8.6% y/y) and UK (10.1%) in January, though euro area core inflation edged up to a record high of 5.3%. The ECB raised its deposit rate by 50bps to 2.5% in February, with Lagarde signalling a similar-sized hike at the next meeting. The Bank of England increased its base rate by 50bps to 4% and upgraded its economic projections. The UK also struck a new post-Brexit deal with the EU over trade arrangements with Northern Ireland.

ROW: China PMIs rebound; Turkey earthquake; New BoJ Governor

Despite Chinese equities underperforming in February, economic indicators continued to rebound: the NBS manufacturing PMI rose to 52.6, while the non-manufacturing equivalent increased to 56.3. Multiple major earthquakes hit Turkey, where the mounting human and economic toll have yet to be discerned. Elsewhere, Japan’s headline inflation rate rose to 4.3% (y/y), its highest reading since 1981. Kazuo Ueda, a former member of the BoJ Board, was announced as the next Governor – his tenure should begin in April.

Performance figures (as of 28/02/2023 in local currency)

| Fixed Income | Yield | 1M % | YTD % |

|---|---|---|---|

| US 10 Yr | 3.92% | -3.2% | -0.1% |

| UK 10 Yr | 3.82% | -2.7% | 0.1% |

| Swiss 10 Yr | 1.47% | -1.3% | 1.3% |

| German 10 Yr | 2.65% | -2.7% | -0.3% |

| Global IG (hdg $) | 5.23% | -2.4% | 1.0% |

| Global HY (hdg $) | 9.14% | -1.4% | 2.4% |

| Equity Index | Level | 1M % | YTD % |

|---|---|---|---|

| MSCI World($) | 8,345 | -2.4% | 4.5% |

| S&P 500 | 3,970 | -2.4% | 3.7% |

| MSCI UK | 14,661 | 1.9% | 6.1% |

| SMI | 11,098 | -1.7% | 3.4% |

| Eurostoxx 50 | 4,238 | 1.9% | 12.1% |

| DAX | 15,365 | 1.6% | 10.4% |

| CAC | 7,268 | 2.6% | 12.4% |

| Hang Seng | 19,786 | -9.4% | 0.0% |

| MSCI EM ($) | 490 | -6.5% | 0.9% |

| Currencies (trade-weighted) | 1M % | YTD % |

|---|---|---|

| US Dollar | 2.1% | 0.0% |

| Euro | -0.3% | 0.6% |

| Yen | -2.6% | -3.0% |

| Pound Sterling | 0.4% | 0.4% |

| Swiss Franc | 0.7% | -0.8% |

| Chinese Yuan | 0.0% | -0.2% |

| Commodities | Level | 1M % | YDT % |

|---|---|---|---|

| Gold ($/oz) | 1,827 | -5.3% | 0.2% |

| Brent ($/bl) | 83.89 | -0.7% | -2.4% |

| Copper ($/t) | 8,951 | -2.7% | 7.0% |

Source: Bloomberg, Rothschild & Co.

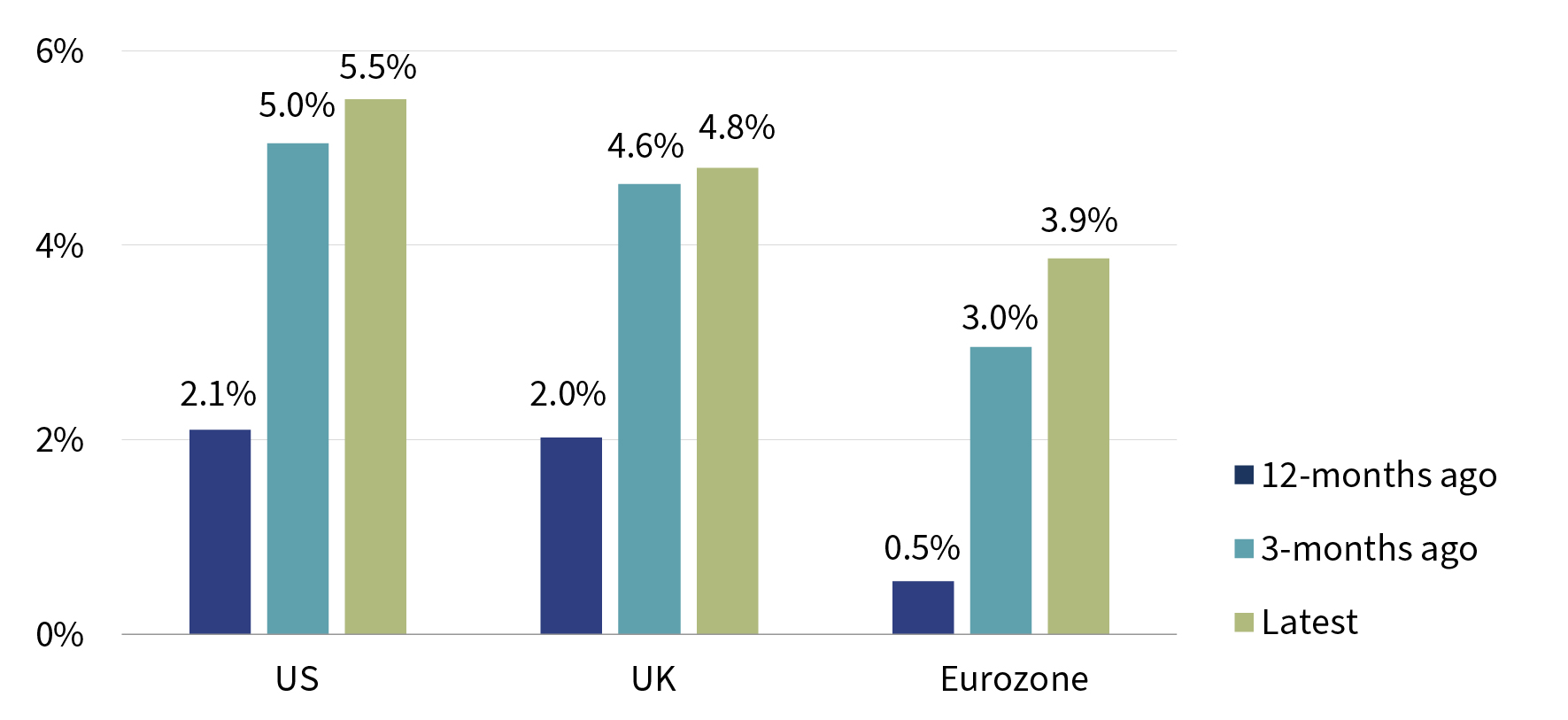

Implied terminal policy rates

2023 peak rate estimates derived from OIS curves (%)

Footnote: three-month tenor; USD – SOFR; GBP – SONIA; EUR – ESTR

Figures refer to highest point estimate during 2023

Source: Bloomberg, Rothschild & Co., 01.01.2022 – 28.02.2023