Monthly Market Summary: December 2022

Investment Insights Team, Investment Strategist Team, Wealth Management

Investment Insights Team, Investment Strategist Team, Wealth Management

Summary: A weak end to an eventful year

It was a challenging month for capital markets: global equities fell by 3.9% (in USD terms), while global government bonds declined by 1.6% (in USD hedged terms, though they exhibited a modest gain in USD unhedged terms). Key themes included:

- US inflation data continued to moderate, while the Fed hiked by 50bps;

- Central banks in Europe continued to tighten policy;

- China relaxed more covid-related restrictions – an end to “zero covid”.

Risk appetite abated in December despite a better-than-expected US inflation print. Monetary policymakers continued to raise their respective interest rates and reiterated their hawkish policy stance. Russia showed few signs of ending its offensive in Ukraine, with Putin stating that it could be a “long process”. In response, the European Commission announced its ninth sanctions package. EU energy ministers agreed on a natural gas price cap of €180 per megawatt hour (the market price averaged €116 in December, well below this threshold). In commodities, Brent Crude and WTI were roughly unchanged at $86 and $80 p/bl (respectively), gold rose by 3.1% and copper increased by 1.7%.

US: Mixed economic data; CPI surprise (again); Fed hikes

US economic data were mixed over the past month: the flash S&P Global PMIs contracted further in December for both manufacturing (46.2) and services (44.4). More positively, the labour market remained healthy: the unemployment rate was unchanged at 3.7% in November, close to a 50-year low. US CPI data printed below expectations for a second consecutive month: the headline rate fell to 7.1% in November (from 7.7%, y/y), and the core rate declined to 6%. The Fed continued its tightening cycle, albeit at a slower pace, raising its target rate by 50bps to 4.25-4.50%. In fact, the latest Dot Plot reflected a more hawkish stance (relative to September’s projections): the policy rate is projected to rise and remain above 5% through 2023. In politics, the Georgia run-off confirmed Democrats’ majority in the Senate (Republicans won back control of the House).

Europe: Inflation eases; ECB, BoE & SNB all hike

Euro area economic data were generally better than expected in December: the flash Composite PMI edged up again – but remained in contraction territory – while the German Ifo Business Climate Index moved higher for the third consecutive month. UK data were arguably more varied: the monthly GDP estimate expanded by 0.5% in October, though the timelier manufacturing PMI fell to 45.3 in December. Both eurozone and UK headline inflation rates turned lower in November, to 10.7% and 10.1% (respectively). The European Central Bank raised its deposit rate by 50bps to 2%, with a hawkish Lagarde announcing a (passive) balance sheet run-off from March 2023 onwards. The Bank of England and Swiss National Bank also hiked by 50bps to 3.5% and 1%, respectively.

ROW: China easing restrictions; Japan’s inflation; BoJ action!

Economic activity remained muted in China: December’s NBS PMIs contracted at a faster pace for both manufacturing and services, particularly in the latter. Still, Beijing announced further easing of Covid restrictions, while committing to economic support – and possible regulatory relaxation on internet platform companies – at December’s Central Economic Work Conference. In Japan, inflationary pressures continued to build: the headline inflation rate edged up to 3.8%, while core CPI inflation (excluding fresh food and energy) increased to 2.8%. The Bank of Japan kept its main policy rate on hold, at -0.1%, but it surprisingly adjusted its Yield Curve Control policy. The band was widened to 50bps (from 25bps) around its 0% yield target on 10-year government bonds.

Performance figures (as of 30/12/2022 in local currency)

| Fixed Income | Yield | MTD % | YTD % |

|---|---|---|---|

| US 10 Yr | 3.88% | -1.1% | -14.9% |

| UK 10 Yr | 3.66% | -3.2% | -17.1% |

| Swiss 10 Yr | 1.62% | -3.7% | -11.5% |

| German 10 Yr | 2.57% | -4.4% | -18.9% |

| Global IG (hdg $) | 5.18% | -0.6% | -14.1% |

| Global HY (hdg $) | 9.42% | 0.0% | -11.0% |

| Equity Index | Level | MTD % | YTD % |

|---|---|---|---|

| MSCI World($) | 318 | -3.9% | -18.4% |

| S&P 500 | 3,840 | -5.8% | -18.1% |

| MSCI UK | 13,819 | -1.4% | 7.1% |

| SMI | 10,729 | -3.6% | -14.3% |

| Eurostoxx 50 | 3,794 | -4.0% | -8.5% |

| DAX | 13,924 | -3.3% | -12.3% |

| CAC | 6,474 | -3.8% | -6.7% |

| Hang Seng | 19,781 | 6.4% | -12.6% |

| MSCI EM ($) | 486 | -1.4% | -20.1% |

| Currencies (trade-weighted) | MTD % | YTD % |

|---|---|---|

| US Dollar | -1.9% | 6.4% |

| Euro | 1.6% | 1.5% |

| Yen | 3.9% | -8.7% |

| Pound Sterling | -1.6% | -4.9% |

| Swiss Franc | 0.9% | 5.7% |

| Chinese Yuan | 0.8% | -1.8% |

| Commodities | Level | MTD % | YTD % |

|---|---|---|---|

| Gold ($/oz) | 1,824 | 3.1% | -0.3% |

| Brent ($/bl) | 85.91 | 0.6% | 10.5% |

| Copper ($/t) | 8,365 | 1.7% | -14.1% |

Source: Bloomberg, Rothschild & Co

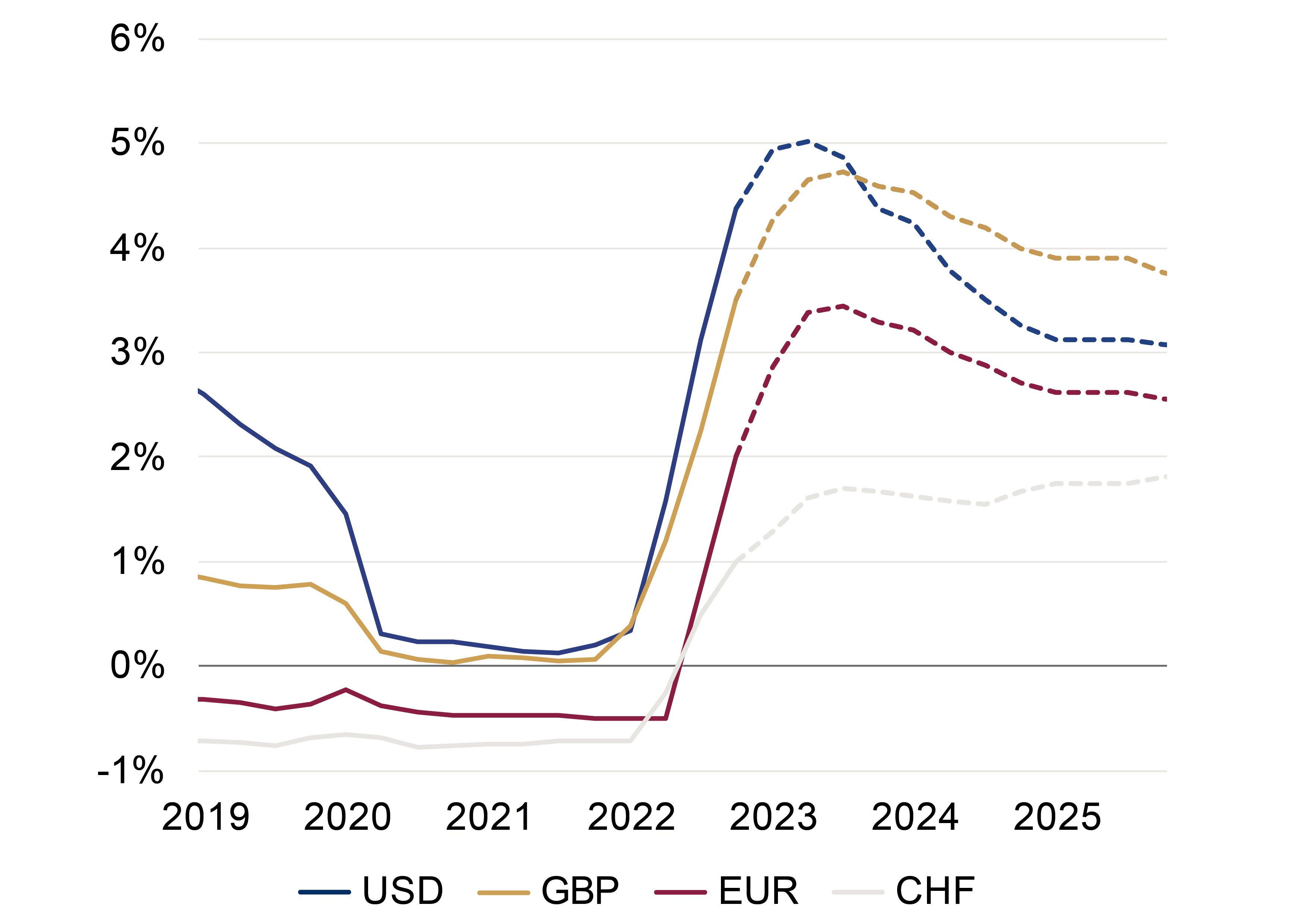

Policy rate expectations

Actual and market-implied rates (OIS, %)

Source: Rothschild & Co, Bloomberg, 01.01.2019 – 31.12.2025