Monthly Market Summary: October 2023

Investment Communications Team, Investment Strategy Team, Wealth Management

Investment Communications Team, Investment Strategy Team, Wealth Management

Summary: Economic resilience fails to buoy markets

Global equities declined by 3% in October (USD terms), alongside global government bonds which fell by 0.6% (USD, hedged terms). Key themes included:

- The US economy had a strong third quarter; the euro area contracted;

- Core inflation rates continued to decline across the US and Europe;

- Energy prices were relatively contained despite geopolitical escalation.

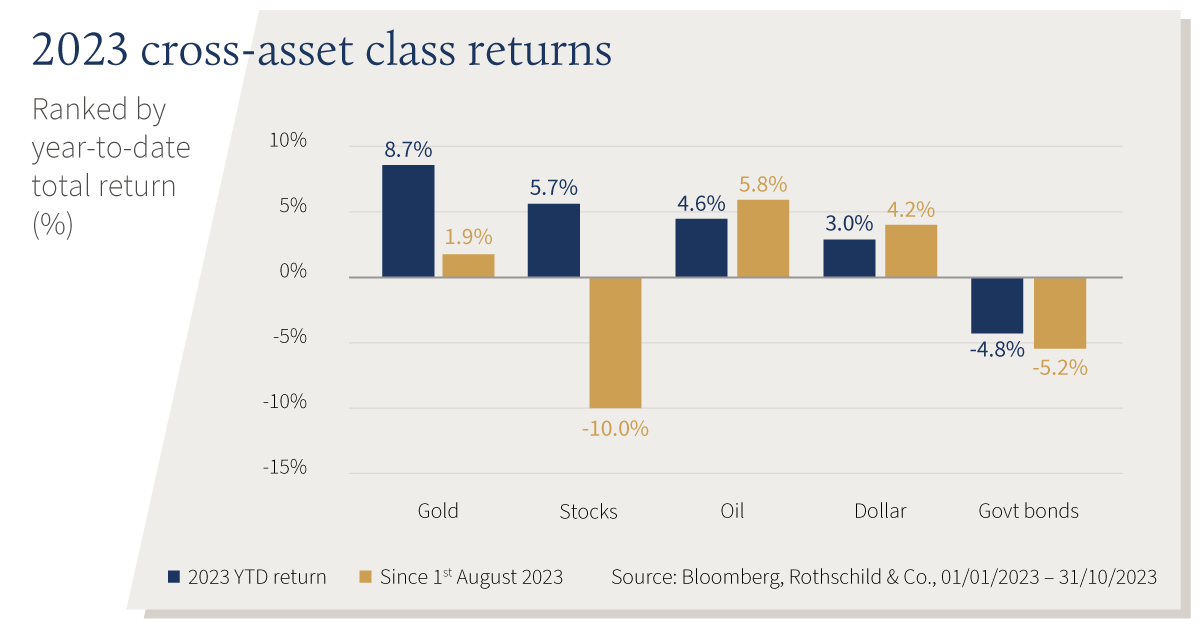

Stock markets fell for the third consecutive month, as broad-based weakness continued to underscore the narrowly led market: the ‘Magnificent Seven’ now account for almost all the global stock market’s 7% year-to-date return. Meanwhile, in fixed income, government bond yields rose further, with the US 10-year treasury yield briefly rising above the 5% mark. Geopolitical risk moved into focus, following the tragic events in the Middle East, but market volatility remained subdued. Elsewhere, oil prices fell by 8% to $87 p/b in October, but gold rose 7%, and briefly breached $2000/oz. Finally, third quarter US earnings season has been better than expected: at the halfway mark, the blended earnings growth rate was +2.7% (y/y).

US: Strong growth; Core disinflation; New House Speaker

The US economy expanded by an above-trend 1.2% (q/q) in the third quarter – its strongest growth rate since late-2021 – largely driven by a strong consumer. However, the survey data remained fragile: the headline ISM Manufacturing PMI (46.7) and new orders (45.5) dipped anew in October, retreating further into ‘contraction’ territory. The US labour market remained healthy: the unemployment rate was unchanged at 3.8% in September, and job openings rose modestly for second month. Initial jobless claims, a timelier measure of the labour market, fell to their lowest level since January. In the political sphere, House Speaker Kevin McCarthy was ousted and, after weeks of Republican gridlock, eventually replaced by Mike Johnson – a Trump ally.

Europe: Output contracts; Inflation eases; ECB pauses

Euro area GDP contracted by 0.1% in the third quarter, though the previous quarter was revised higher to 0.2%. The forward-looking Composite PMIs remained ‘contractionary’ in both the eurozone (46.5) and UK (48.6), with manufacturing activity still subdued in October. Euro area headline inflation fell sharply again in October, to 2.9% (y/y), while core inflation moved down to 4.2%. In the UK, headline inflation remained at 6.7% and core inflation edged lower to 6.1% in September. The ECB left its deposit rate unchanged at 4%, following 10 consecutive rate hikes, though Lagarde did not rule out further tightening. Finally, the Swiss People’s Party solidified its position after receiving the most votes (c.28%) in the Swiss Federal Election.

ROW: China’s growth intact; Beijing’s fiscal support; BoJ tweaks YCC

China’s economy grew by a stronger-than-anticipated 4.9% (y/y) in the third quarter, with both retail sales and industrial production beating expectations again in September. The October NBS PMIs were slightly weaker than expected, with the manufacturing PMI dipping into ‘contraction’ territory (49.5). Headline inflation eased to 0% (y/y) in September, though this was mostly due to falling food prices. Ongoing property market distress prompted Beijing to offer more economic support by raising its 2023 fiscal deficit ratio. In Japan, both headline and core inflation cooled down, to 3% and 4.2% (respectively). The Bank of Japan ‘increased flexibility’ in its Yield Curve Control program: it adopted a less restrictive tone on the previously strict 1% yield cap on 10-year JGBs, prompting the yen to come under renewed pressure.

Performance figures (as of 31/10/2023 in local currency)

| Fixed Income | Yield | 1M % | YTD % |

|---|---|---|---|

| US 10 Yr | 4.33% | 4.5% | -0.4% |

| UK 10 Yr | 4.17% | 2.7% | 0.5% |

| Swiss 10 Yr | 2.45% | 1.8% | 6.6% |

| German 10 Yr | 2.80% | 0.6% | 0,7% |

| Global Govt (hdg $) | 3.27% | 3.0% | 3.7% |

| Global IG (hdg $) | 5.23% | 4.7% | 5.1% |

| Global HY (hdg $) | 9.01% | 4.7% | 9.5% |

| Equity Index | Level | 1M % | YTD % |

|---|---|---|---|

| MSCI ACWI ($) | 370 | 9.2% | 16.6% |

| S&P 500 | 4,568 | 9.1% | 20.8% |

| MSCI UK | 14,334 | 2.3% | 3.7% |

| SMI | 10,854 | 4.5% | 4.3% |

| Euro Stoxx 50 | 4,382 | 8.1% | 19.4% |

| DAX | 16,215 | 9.5% | 16.5% |

| CAC | 7,311 | 6.3% | 16.3% |

| Hang Seng | 17,043 | -0.2% | -10.6% |

| MSCI EM ($) | 514 | 8.0% | 5.7% |

| Currencies (trade-weighted) | 1M % | YTD % |

|---|---|---|

| US Dollar | 1.0% | 3.2% |

| Euro | 0.4% | 3.6% |

| Yen | -0.9% | -9.2% |

| Pound Sterling | -0.6% | 4.0% |

| Swiss Franc | 0.9% | 3.7% |

| Chinese Yuan | 0.2% | -1.9% |

| Commodities | Level | 1M % | YDT % |

|---|---|---|---|

| Gold ($/oz) | 1,984 | 7.3% | 8.8% |

| Brent ($/bl) | 87.41 | -8.3% | 1.7% |

| Copper ($/t) | 8,029 | -2.2% | -4.0% |

Source: Bloomberg, Rothschild & Co.