Why the US middle market is attractive for Private Equity Investors

When thinking about the US economy, most people associate it with the billion-dollar corporations and global tech companies that dominate stock market indices. Hence, people often overlook the segment of mid-size companies.

The "middle market" – or "midmarket"- is defined as the segment of American businesses with an annual revenue in the range of USD10 million to USD1 billion. In the US there are more than 200,000 of these firms that are generating a combined revenue of USD10 trillion and that are employing roughly 50 million workers. While this middle market represents barely 3% of all US businesses, it is responsible for one-third of the US GDP and employment. These numbers underline the middle market as a powerhouse of the US economy, and if it was treated as an own country, it would be the fifth-largest economy in the world.

Historically, the US "midmarket" has been resilient in times of uncertainties. For example, during the financial crisis of 2007-2009, middle market companies added over 2 million new jobs, while large businesses shed 3.7 million positions. And more recently, the National Center for the Middle Market (NCMM) released data from its 2022 Mid-Year Middle Market Indicator, revealing that the year-over-year revenue growth throughout the middle market remains strong at 12.2%, close to 12.3% growth reported in December 2021. Nearly four out of five middle market companies reported revenue growth compared to a year ago with over half of these firms experiencing growth of 10% p.a. or more. The record-high employment growth of 2021 continued into 2022 with 58% of middle market companies increasing the size of their workforce.

The middle market is very attractive for private equity investors because it is highly fragmented and offers opportunities for companies to grow organically and through acquisitions. Middle market firms also tend to offer more scope for operational enhancement compared to their larger peers. They are more flexible and better positioned to adapt quickly, embrace innovation and take advantage of opportunities to grow and capture market. For private equity investors the value creation drivers are primarily revenue growth and margin expansion. At the same time, companies are less reliant on the use of debt since midmarket transactions consistently use less leverage than buyout in larger companies. Lower valuations for acquisitions are another factor that makes middle market private equity funds attractive. Over the past seven years, valuation multiples for acquisitions of midsize companies were 16% lower on average than for larger companies, according to a study from Pinebridge1, a global asset manager.

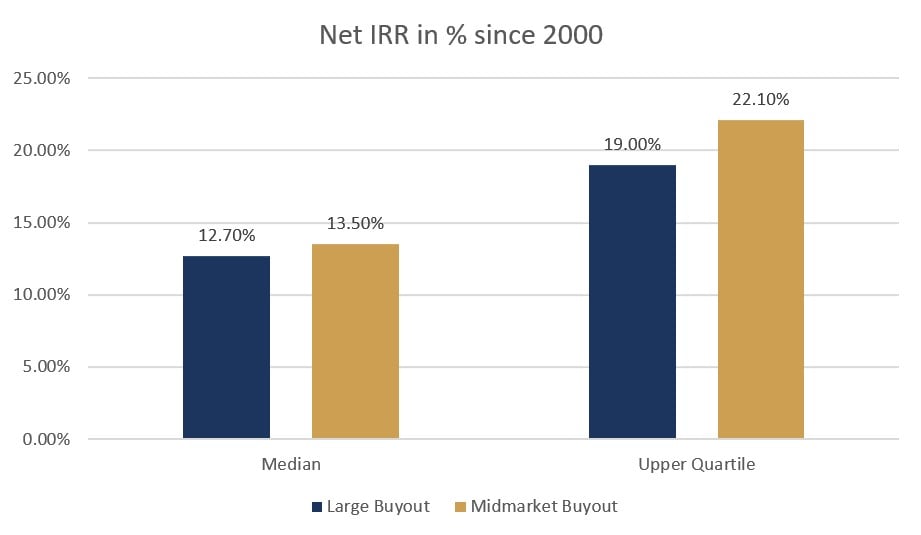

Hence, it is not surprising that private equity investments in middle market buyouts provide the opportunity to generate higher returns than investing in the larger end of the market. This implies that there exists a meaningful performance gap between top-tier buyout funds focused on middle market companies and those focused on large buyouts. As illustrated in the subsequent graph, upper quartile middle market buyout funds generated a net IRR of 22.1% since the year 2000 compared to 19.0% for upper quartile large buyout funds. This is a significant incremental net IRR of 3.1% for top-performing middle market funds. Ultimately, this return difference not only confirms that investing in middle market companies can lead to outperformance versus larger companies, but also that the outperformance increases when you partner with the right managers. The impact of the manager selection is underlined by the fact that the performance difference for Median performing Large Buyout and Midmarket Buyout Funds is only 0,80% p.a.

Chart 1: Middle Market Buyout Funds are overperforming Large Cap Buyout Funds

Source: BURGISS. Data as of December 31, 2021. Consists of 2000-2013 vintage funds. Geography: US.

The number of middle market companies – most of them founder-owned - is constantly growing. Additionally, USD30 to USD40 trillion in wealth will be passed on in the US from the baby boomer generation to their successors over the next 25-30 years, suggesting that many family-owned middle market businesses will need capital for management transitions and other strategic issues. Today, less than 5% of the 200,000 US middle market companies have private equity backing, indicating that there are still many investment opportunities for private equity funds.

1 https://www.pinebridge.com/insights/the-potential-of-middle-market-businesses-for-private-equity-firms

Hermance Capital Partners (HCP) was created in 2015 on the initiative of Banque Paris Bertrand as investment boutique focusing on private markets, offering a wide range of investment solutions across high-conviction strategies with attractive risk-return profiles. Rothschild & Co acquired Banque Paris Bertrand including Hermance Capital Partners in 2021. HCP has developed a solid expertise in the US midmarket segment, generating outstanding performance for its investors over the years. In September 2022, Hermance is launching its third private equity fund "HCP US MidCap Fund III". The fund will follow the success and the strategy of its predecessors by investing in up to ten funds and 20 co-investments, building a portfolio of over 150 US middle market companies.