Wealth Management: Challenging the challengers – In with the new, out with the old?

William Haggard, Head of Investment Insights, and Willis Palermo, Financial Analyst, Rothschild & Co Bank AG

Who are the challengers?Revolut, Monzo, Starling and N26 are becoming household names across Europe. These businesses are part of a new wave of challenger banks that have disrupted retail banking services, divided critics and amassed millions of users. They have attracted global headlines in the last two years as they enjoy compound annual growth rates nearing 45%. In a recent conversation with our financial analyst Willis Palermo, we explored three key issues for Europe's fintech fighters:

The following is an edited transcript of the interview, which you can listen to in full by clicking here. |

A key ingredient of challenger banks' success has been their user-friendly mobile interfaces. Talk us through the user experience.

Download the online app on your phone, create your login details, send over a picture of your ID card and you are up and running with a bank account. Many of us have joined this new wave of quick and easy challenger banks that have sprung up to facilitate everyday payments and foreign exchange transactions. The ease and simplicity of joining these banks (see Figure 1) is particularly popular with younger generations. In the UK, Monzo boasts 68% of users aged between 18 and 34, while the same age group makes up more than 50% of Revolut and N26's customers.

Sources: Fincog Benchmark on Challenger Banks Features and Profitability, Fintechnews.ch October 2019, The Verge, Monzo.com, Business Insider, Sifted, Revolut.com, Starlingbank.com, N26.com, Monzo Blog.

Since appearing on the market around 2015, challenger banks have enjoyed rapid growth. Which of the names are you keeping a close eye on?

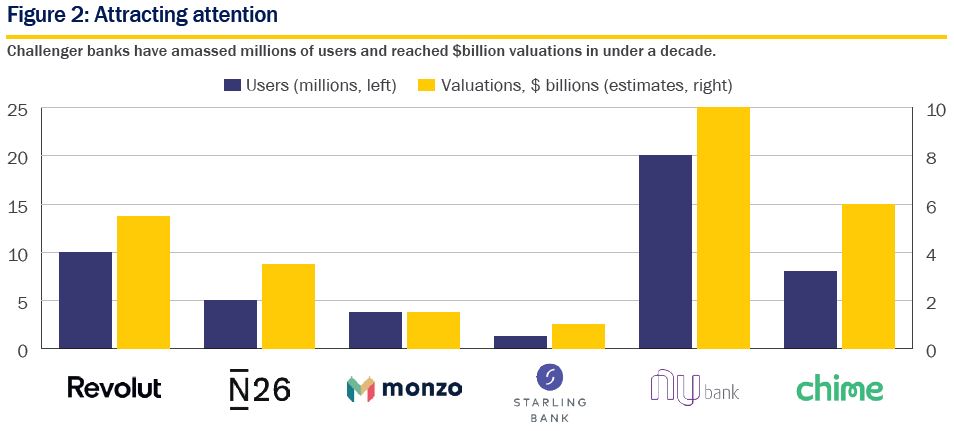

The largest European fintech player in this sector remains Revolut. Emerging from a Canary Wharf fintech incubator in London in the summer of 2015, Revolut as of 2020 now has close to 10 million users and is valued at $5.5 billion (see Figure 2).

Another challenger bank we've taken a close look at is Germany-based N26. Founded in 2013, this platform counts more than 5 million users and is valued at $3.5 billion. Two competitors we are watching in the UK are Monzo, with 3.8 million users and valued at $1.5 billion, and Starling Bank, which has amassed some 1.3 million users and is valued at around $1 billion.

Outside of Europe, we're also watching Nubank. Tencent has invested in this well-funded Brazilian challenger bank, which now has over 20 million users and is valued above $10 billion; and also Chime in the US, which recently reached a valuation of $6 billion.

Source: Forbes, TechCrunch, February 2020, Fintechnews Switzerland, 18.01.2020, and Reuters, 25.02.2020.

The numbers are impressive given that their scale has been achieved in just a couple of years. Should established banks be concerned?

Overall, not particularly - we think the headlines continue to remain larger than the facts. This is particularly the case when we consider challenger banks from the perspective of our wealth management clients.

A key challenge for newcomers in this sector will be to convert a strong growth in numbers of users into profits. In particular, based on three facts:

- Fees generated by card transactions are very small, hence require very large volumes.

- The more lucrative financial service products are often provided at a discount.

- Margins are all too often diluted through partnerships.

What additional factor has caught your eye when it comes to these new banks' ability to generate profits?

Customer loyalty remains an underlying concern - simply put, how many people use challenger banks as their primary account against an established institution like UBS, Credit Suisse or HSBC. In order to thrive, challenger banks need to convert customers into primary account holders. In developed markets like the UK, where one in five users now holds an account with a challenger bank, there are signs that this strategy is starting to have some success.

A promising product from a revenue perspective is the premium subscription model offered by the likes of Revolut for €7.99 a month. This gives customers higher spending limits, insurance benefits and access to advanced features, such as disposable virtual cards.

Why are these extras so important?

These premium extras may sound like gimmicks but they help solidify customers' loyalty, an essential part of increasing revenues, and, more importantly, ensure their recurring nature via subscription, which is a beautiful business model.

Would you say then that the simplicity of using challenger banks can work against them when it comes to retaining clients?

Absolutely. The challenge for new entrants is that when it comes to mobile payments, customers like to shop around and switch between payment providers. Customers expect to get these services for free, making loyalty an elusive concept.

Does trust also play a big part in customer loyalty?

Yes, challenger banks must resist the temptation to monetise their client data through sales to third parties - you only have to look at the Facebook data privacy scandal to see how damaging that can be. While both challenger and conventional banks hold large amounts of client data that could be monetised, they must remember data's primary purpose within a bank is to:

- assess the credit quality of customers; and

- maximize product placements.

On this point, established banks still have the edge when it comes to customer trust. As challenger banks continue to grow their user base, they will come under increasing regulatory scrutiny for anti-money laundering and data privacy issues. This is something they will have to learn to live with - again, it will be another challenge for the newcomers as they try to become profitable.