Portfolio Management and Rising Rates

Over the span of just a few months, we witnessed a spectacular rise in interest rates, as illustrated by the sharp jump in the US 10-year Treasury, from 1.5% at-end 2021 to 3.5% in January1. This historical increase took place against the backdrop of a radical shift in monetary policies, as the central banks, with the Federal Reserve in the lead, have made the fight against the return of runaway inflation their priority. This change in the interest rate environment is set to have major repercussions for the economy: difficulties to access financing, decline in company margins, slowdown in consumer demand, even recession... The rise in rates could also upset pricing benchmarks across all asset classes, with “risk-free” rates reshuffling the cards in terms of valuation. In this environment, portfolio management strategies need to adapt, in particular by seeking new avenues of diversification and some opportunities.

What’s behind this rise in interest rates…

First of all, it is important to note that the current rise in interest rates comes after more than a decade of ultra-accommodative central bank policies, following the economic crisis of 2009. During this period, governments, companies and households benefited from historically attractive financing, which contributed to fuelling global economic growth. Moreover, western companies were able to optimise their cost structures in a globalised world, allowing them to keep prices low, and contribute to curbing inflation.

However, this situation ended over a year ago, with the return of inflation, first in the United States and then in Europe, in a context of an “overheating” of the economy. This phenomenon was itself accelerated by two events. First, the Covid-19 crisis highlighted the weakness of supply chains, with a high degree of interdependence, which hampers companies’ ability to maintain the quality and prices of their production in a more adverse environment. In addition, the massive monetary and fiscal stimulus of the central banks and governments to boost growth further increased the money supply, while demand was slowing. Second, the conflict between Russia and Ukraine accelerated the pressure on commodities and energy prices, at a time when investments in production had already been significantly reduced, especially in Europe. With the allocation of resources becoming inadequate, inflation therefore spread to the rest of the economy. Events that were difficult to anticipate…

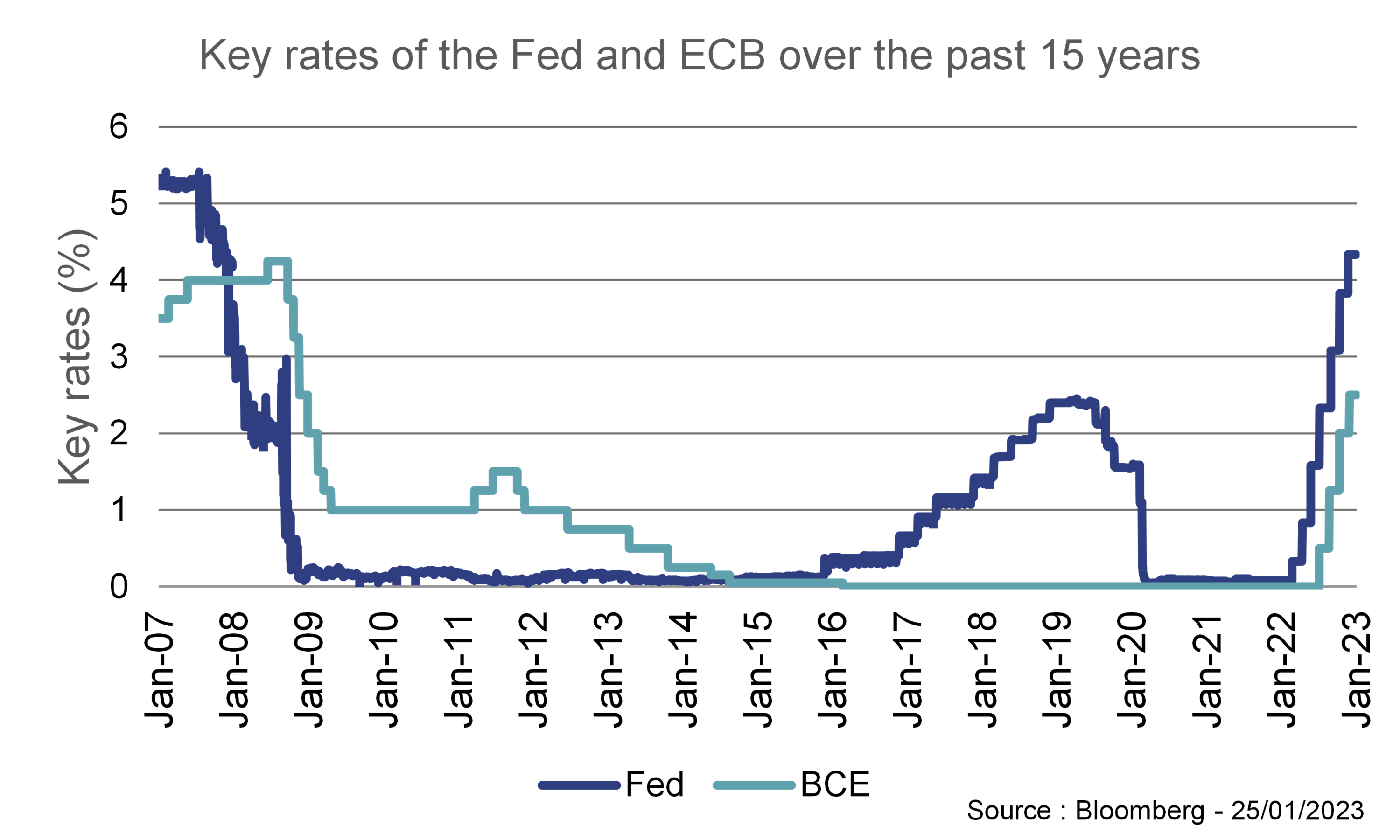

It was in this “surprising” inflation environment that the central banks were forced to embark on a major monetary tightening this year, leading them to raise their key rates. Given the still high inflation levels (6.5% in the US and 9.2% in the eurozone at end-December 20222) and a resolutely hawkish tone at present, controlling inflation could remain the top priority of the central bankers, despite the potential consequences for the economy.

The probable consequences for the economy

In general, the rise in interest rates could create financing difficulties for all players, and potentially lead to a recession. With a significantly higher cost of debt, the countries with the largest debt burdens would see their financial leeway become greatly reduced, which would lead to budgetary restrictions (delayed investment, lower subsidies) as well as potential tax increases, which would have a negative impact on corporate investment and household consumption.

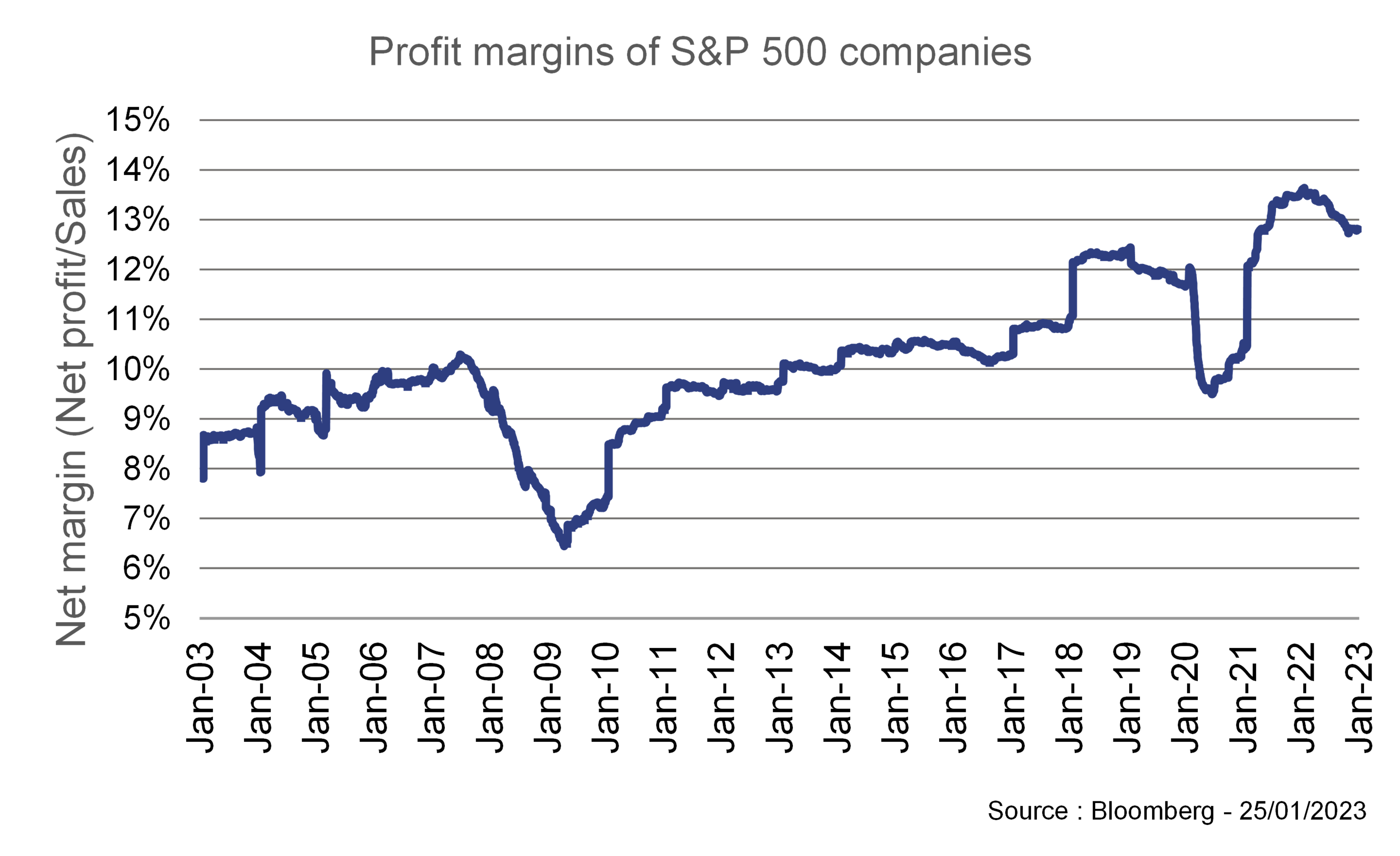

Companies could also struggle to find financing and would be forced to reduce their investment in Research and Development or in Marketing, which would have the effect of hampering their growth, even threaten bankruptcy for the most vulnerable among them. At the same time, after hitting historical highs (see chart below – Profit margins of S&P 500 companies), company margins could decline, in a less dynamic macroeconomic environment, that is more volatile and with smaller scale effects.

With regard to households, the rise in rates could encourage savings at the expense of consumption, while real estate purchases could be greatly restricted in the short term, due to a sharp increase in mortgage rates (see chart of 30-year mortgage rates in the United States).

And the asset classes…

Beyond the purely economic aspects, the rise in interest rates is also likely to have major consequences for investors, with an impact on their assessment of all asset classes. Overall, the main consequence will be the return to “real prices”, that better reflect the fundamentals of the assets and their related risks.

Indeed, in a context in which the central banks are no longer the the “buyers of last resort”, investors are less inclined to accept a lower yield (and hence higher valuations), de facto entailing higher risk premiums.

For bonds, the higher rates will negatively impact the valuations of past bond issues, while new bond issues will offer higher yields, and therefore better income for their subscribers.

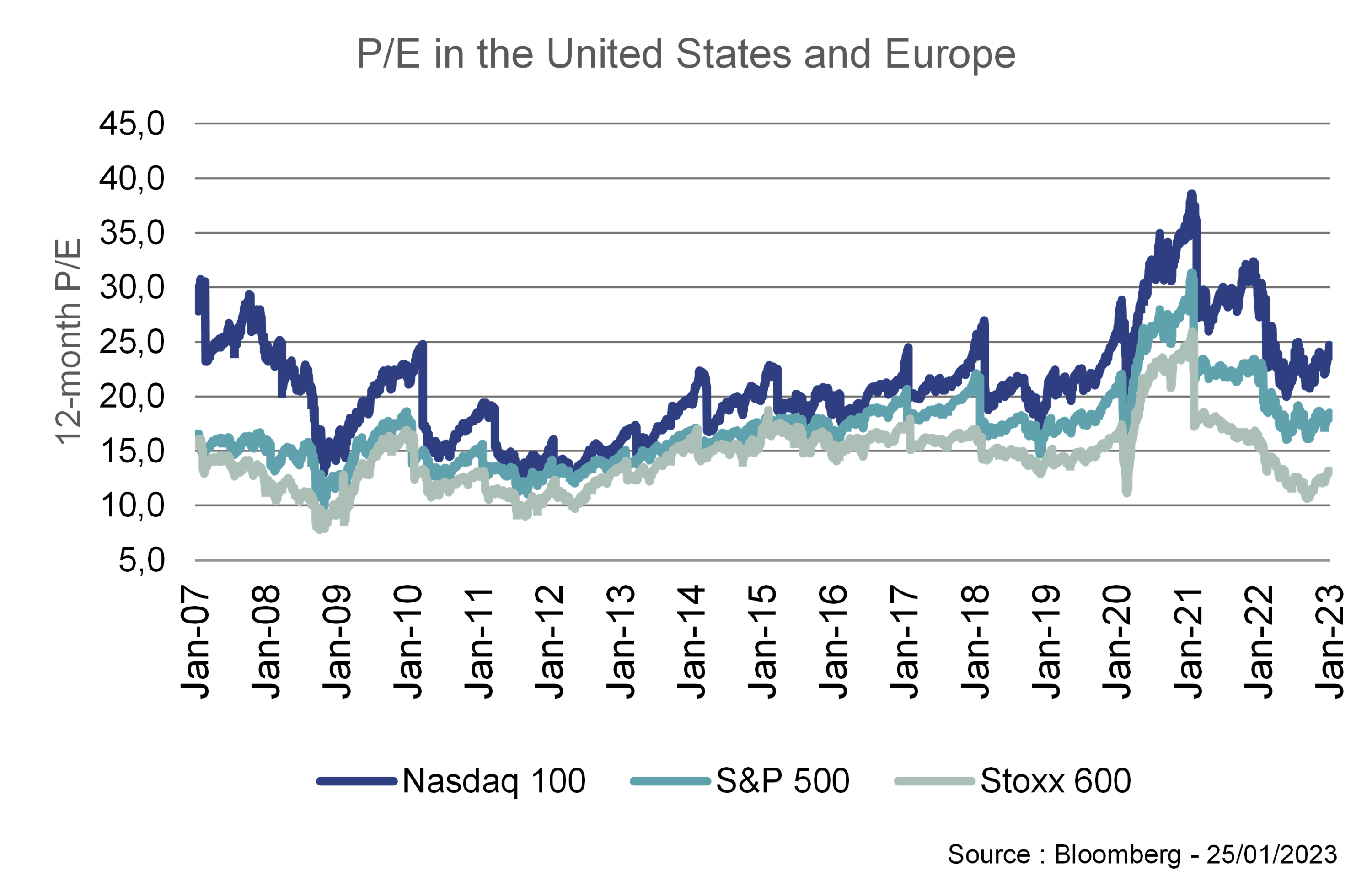

Regarding equities, the immediate impact is a compression of valuation multiples, in particular for the expensive stocks, such as US “growth” stocks, which have undergone a correction since the start of the year (see chart below showing the average P/E of the Nasdaq 100 and other indices). Furthermore, in a difficult economic environment, investors are likely to be more cautious in their earnings growth assumptions, in particular for the most cyclical, capital-intensive or energy-consuming names.

Among the other asset classes, commodities prices could stay at higher levels than in the previous cycle, in a content of a fragmentation of the world economy.

Investment strategies will need to adapt

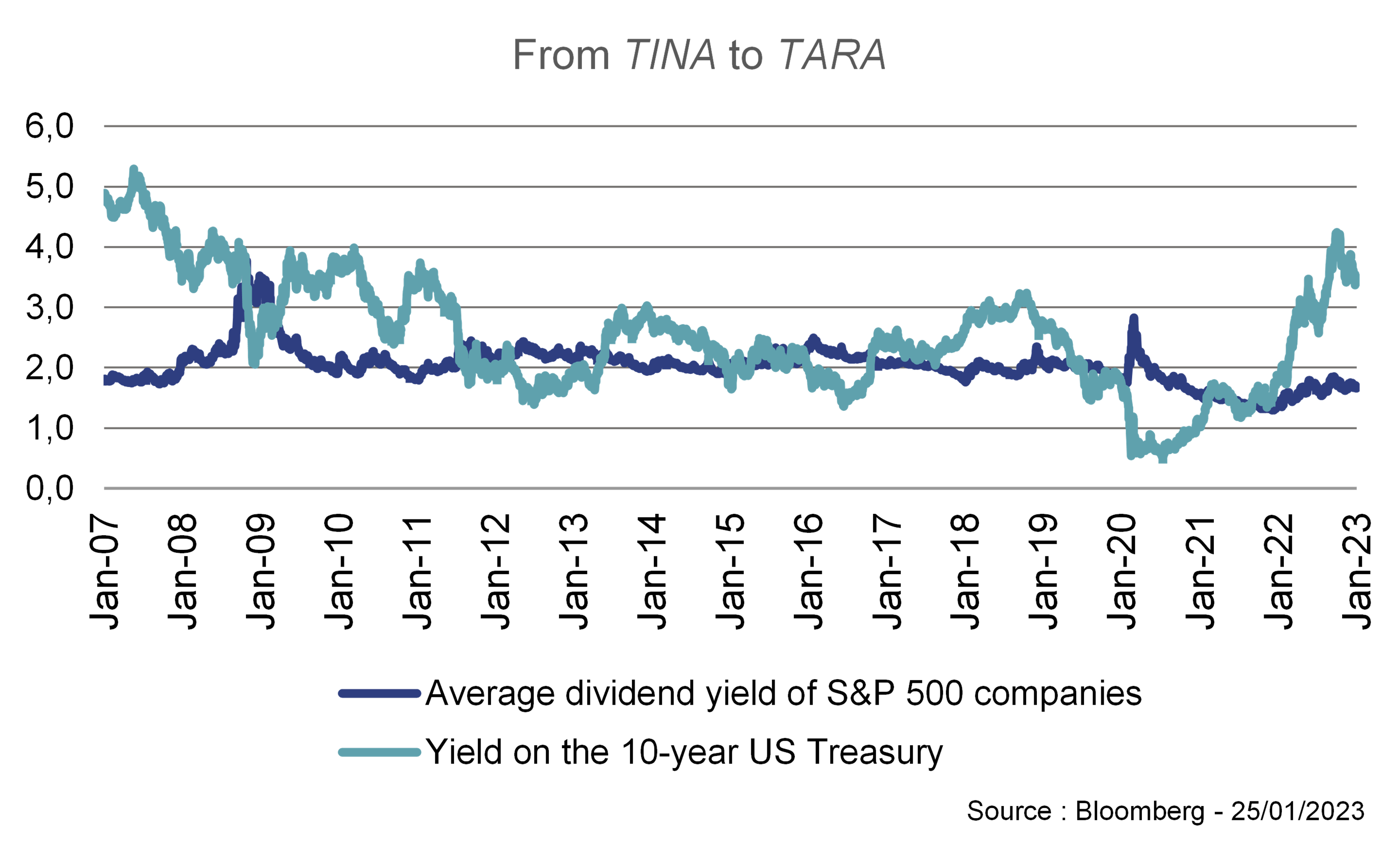

In this market environment in upheaval, portfolio management strategies will have to adapt, with greater agility and selectivity. As risk premiums rise, the valuation gap between asset classes will grow, and it will again make sense to seek diversification. This will notably be done by adding more bonds into the portfolios, with carry strategies, as the yields on investment grade3 issues can now offer equivalent, even higher, returns than high-quality equities (see chart comparing the 10-year US Treasury rate with the dividend yield4 of the S&P 500), but with lower volatility. This change marks the end of “TINA” (There is No Alternative to the equity markets) that has prevailed over the last decade, and the arrival of “TARA” (There Are Reasonable Alternatives).

The rise in rates also calls for more selectivity in investments. The selection of securities for direct investment could thus focus primarily on the quality of the issuers’ fundamentals (excellence, ability to maintain margins, healthy balance sheet, resilient business model, etc.). Indeed, investors will likely demand much higher risk premiums than the ones that have prevailed over the last decade for the most speculative securities. Lastly, portfolio management could require greater agility, in order to rapidly adapt to any major macroeconomic developments.

The trends of the last months proved to be spectacular, transforming a monotonous landscape in which only equities could harbour any real performance potential into a broad range of opportunities with widely differentiated characteristics!

1 Source Bloomberg – 30/01/2022

2 Source Eurostat and U.S. Bureau of Labor Statistics

3 Debt security issued by a company or State having a rating between AAA and BBB- according to the rating scale of Standard & Poor’s.

4 Dividend yield corresponds to the amount a company pays in dividends each year divided by its share price.