Supply chains: A quick health check

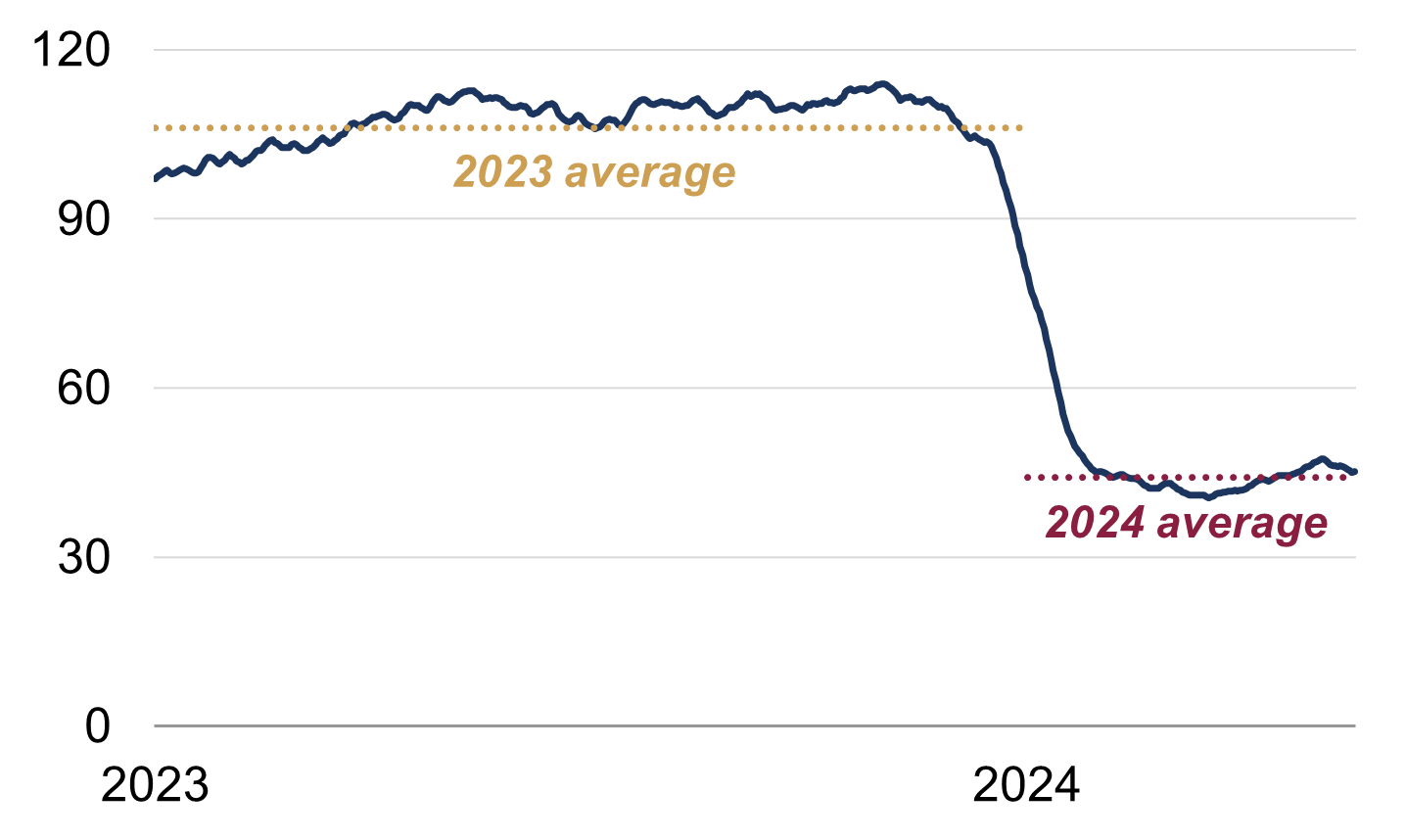

It’s been roughly six months since shipping disruptions in the Red Sea began. As noted earlier this year, it is a major maritime trade route, providing the quickest connection between Europe (via the Suez Canal) and Asia (via the Bab Al-Mandab Strait). Strikingly, the average number of container ships in the Red Sea has fallen by around 60% this year (figure 1), with fleets diverting to the longer path around Africa's Cape of Good Hope – prolonging journey times by up to two weeks.

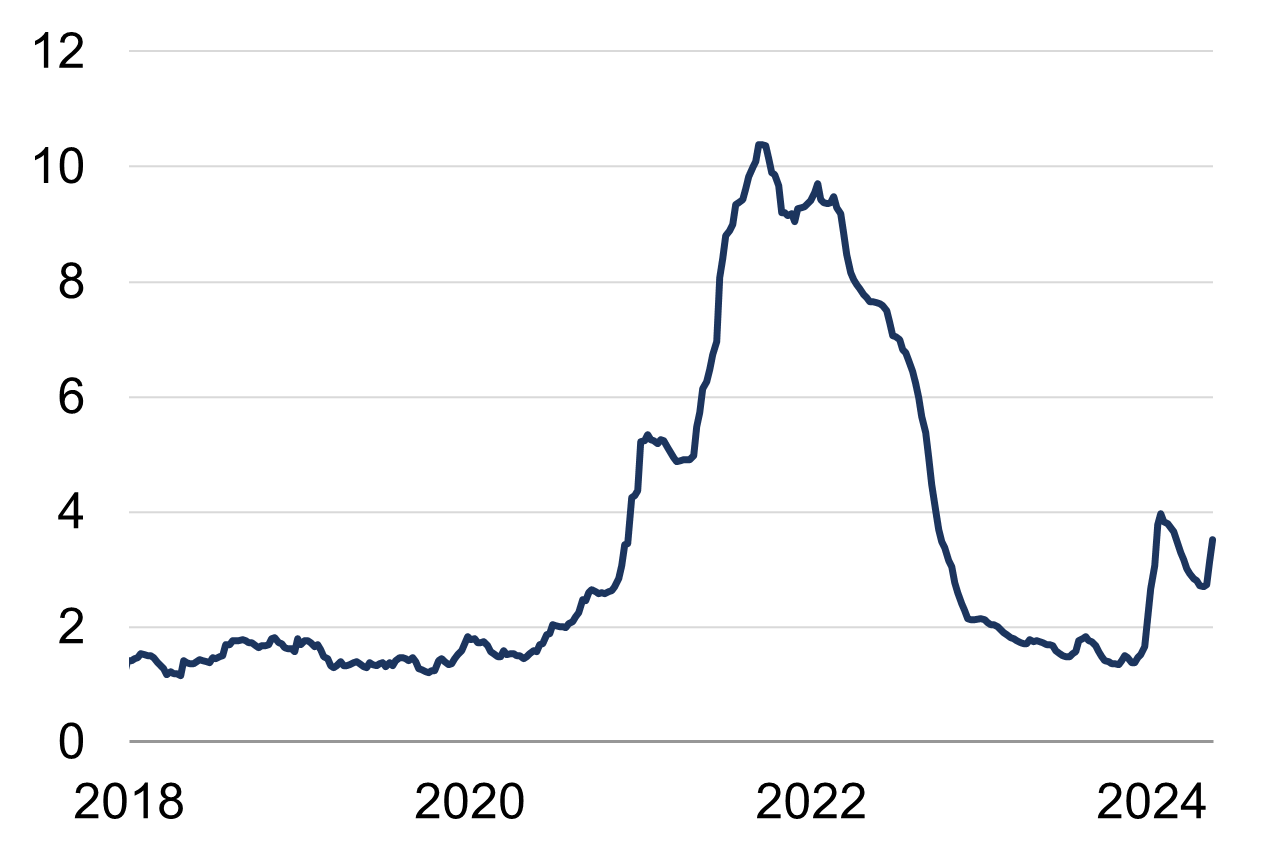

Global shipping container spot freight rates – one way to gauge supply chain health – more than doubled in January, likely due to a temporary shortage of 40-foot shipping containers (figure 2). Such containers – in which you can fit the contents of a typical two- to three-bedroom apartment – are central to today’s more ‘globalised’ world, as described by economist Marc Levinson.

Since January, spot rates have been somewhat volatile: they fell between February and April as the market digested the re-routing of trade and the initial shock faded, but then rose again in May. The reasons behind the latter are unclear, though some analysts have cited stronger demand as companies are trying to get a head start ahead of peak shipping season (which usually does not begin until August). Even so, global container rates remain two-thirds below their late-2021 high, and the closely-watched New York Fed Supply Chain Pressure Index – a broader metric which combines supply-related PMI sub-indices with transportation cost data – showed that global supply chain conditions were still ‘loose’ in April.

For now, at least, the Red Sea events do not appear to have caused another major disruption to global supply chains, though the situation in the Middle East could always escalate further. Goods producers may still face higher inputs costs on the back of this – alongside the recent surge in industrial metal prices – which may put modest pressure on goods-related CPI inflation, should they choose to pass on these higher costs to consumers. But these developments alone are also unlikely to cause overall inflation to rush higher again from here.

|

Figure 1: Number of container ships in Red Sea

Source: Rothschild & Co, Kiel Trade Indicator |

Figure 2: Global spot container freight rates

Source: Rothschild & Co, Bloomberg, Drewry Research |

Ready to begin your journey with us?

Speak to a Client Adviser in the UK or Switzerland

Past performance is not a guide to future performance and nothing in this article constitutes advice. Although the information and data herein are obtained from sources believed to be reliable, no representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by Rothschild & Co Wealth Management UK Limited as to or in relation to the fairness, accuracy or completeness of this document or the information forming the basis of this document or for any reliance placed on this document by any person whatsoever. In particular, no representation or warranty is given as to the achievement or reasonableness of any future projections, targets, estimates or forecasts contained in this document. Furthermore, all opinions and data used in this document are subject to change without prior notice.