A rebound in corporate earnings?

The first quarter US earnings season kicks off on Friday, starting with the major banks. Analysts are anticipating a third consecutive quarter of year-on-year earnings growth, albeit at a modest 3.2%. Earnings growth is then forecasted to accelerate in the rest of this year.

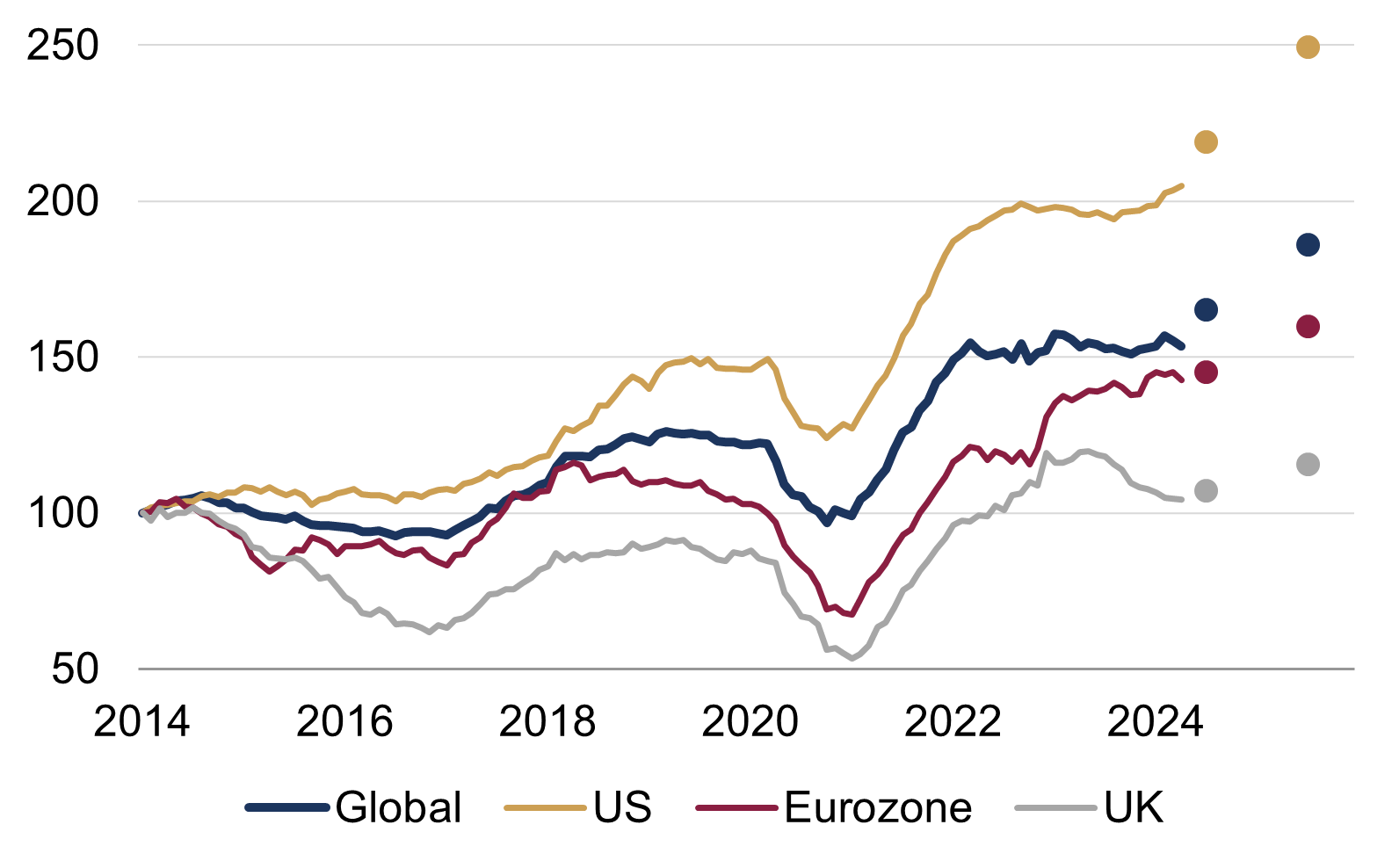

The US earnings season is the most closely watched. It holds the world's most valuable companies, and its share of global earnings has – perhaps unsurprisingly – increased over time (just like its market share). This can be largely attributed to its relatively higher weighting in technology – and other 'growth'-style sectors – which has experienced the strongest earnings growth over the past decade. The rolling average of 12-monthly US earnings stagnated for a year or so from mid-2022, coinciding with a modest decline in its technology sector's earnings, but it has recently firmed up. Moreover, estimates suggest resumed growth of 10% this year – roughly in line with its annualised earnings growth rate during the 2010s – and 14% the year after, according to the IBES dataset1 (figure 1).

Global earnings have followed a similar profile and are expected to rebound by more than 9% this year, which would be slightly above the historic annualised growth rate of 7% (from the 2010s, again).

Figure 1: Trailing and forward earnings per share (EPS) projections by regions

Rebased series (100 = January 2014, USD terms)

Source: Rothschild & Co, Datastream, I/B/E/S

Source: Rothschild & Co, Datastream, I/B/E/S

Note: Based on MSCI indices. Line series are trailing EPS. Dots are EPS estimates for 2024 and 2025.

Continental Europe has more exposure to 'cyclical' and 'value' sectors whose historic earnings have lagged. While eurozone earnings have made up a little lost ground in recent years, forward earnings growth estimates for 2024 are below those of the US. Meanwhile, the UK's earnings backdrop appears particularly uninspiring. It has greater exposure to commodity-producing sectors and almost no technology, which helps explain its weak trailing earnings over the past year – and decade – along with its more subdued forward earnings estimates. Its share of global earnings is of course much smaller, at just 6% (for context, the eurozone is approximately 11% and the US is in the region of 50%).

Turning back to the US, there will be a lot of attention on the 'Magnificent Seven'2 this year – a US mega-cap cohort which accounted for most of the S&P 500's 26% return in 2023. Earnings expectations have rocketed amid heightened AI-related excitement, and any big misses could impact global earnings projections. The cohort's 12-month forward earnings per share (EPS) estimates have collectively more than doubled since the start of 2023, compared to a smaller increase of 5% for the remaining 493 stocks in the S&P 500 (both on an equal-weighted basis). That said, within the cohort, earnings expectations have diverged: Nvidia's 12-month forward EPS has risen seven-fold during that period, while Tesla's equivalent figure has declined by more than 40%.

Of course, earnings expectations are fallible. There is a routine tendency to overpredict – analysts revised away their 2023 earnings growth forecasts following the rise in interest rates – but this has not stopped the market from routinely rising as well (suggesting that earnings expectations are not always fully priced in). Moreover, that headwind may be moving into reverse, while AI-related demand is clearly another potential tailwind for certain sectors (see above) this year.

The earnings cycle may have indeed passed a turning point, following a subdued couple of years. Earnings outturns will be particularly important in 2024, because last year's global stock market returns were largely driven by a valuation re-rating – in other words, on this occasion there may well be a lot ‘in the price’. Ultimately, the trajectory for corporate profits is the most important driver of long-term returns.

1 The IBES dataset compiles different projections made by thousands of stock-market analysts on the future earnings for publicly-traded companies.

2 The 'Magnificent Seven' stocks include Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

Ready to begin your journey with us?

Speak to a Client Adviser in the UK or Switzerland

Past performance is not a guide to future performance and nothing in this article constitutes advice. Although the information and data herein are obtained from sources believed to be reliable, no representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by Rothschild & Co Wealth Management UK Limited as to or in relation to the fairness, accuracy or completeness of this document or the information forming the basis of this document or for any reliance placed on this document by any person whatsoever. In particular, no representation or warranty is given as to the achievement or reasonableness of any future projections, targets, estimates or forecasts contained in this document. Furthermore, all opinions and data used in this document are subject to change without prior notice.