Gold rush?

Gold has risen more than 5% over the past week, to an all-time high of $2160/oz.

Identifying its drivers is difficult to do at the best of times. It does not generate income, unlike other assets such as stocks (dividends) or bonds (coupon payments), and so can be hard to value. But the roots of this latest gold rush seem particularly tricky to disentangle.

At times, gold seems to be negatively correlated with inflation-linked (real) government bond yields, with investors favouring such bonds when they provide more positive real yields (there is an opportunity cost of owning gold relative to other 'risk-free' assets). However, despite the recent retreat in bond yields, this loose negative relationship has broken down since the start of 2022: gold has risen by 20%, alongside 10-year US TIPS yields increasing by almost 300bps, over that period. Meanwhile, this year's modest appreciation in the US dollar somewhat contradicts gold's rise, both for law-of-one price reasons (fewer dollars are needed to buy the same quantity of gold), and because the wider monetary consequences of a weak dollar are one of the popular motives for owning gold.

Arguably, it is also a bit strange to see gold's resilience in the context of global stock markets at fresh highs, as it is usually perceived to be a safe haven asset and less likely to do well at 'risk on' times. Perhaps it is indeed reflecting heightened geopolitical risk and ongoing banking system jitters. But if so, why haven't bonds, a more reliable safe haven asset, been doing better of late?

Other explanations have also been mooted, including non-Western central bank gold purchases, and more recently, Chinese consumers divesting away from local stocks and property to gold.

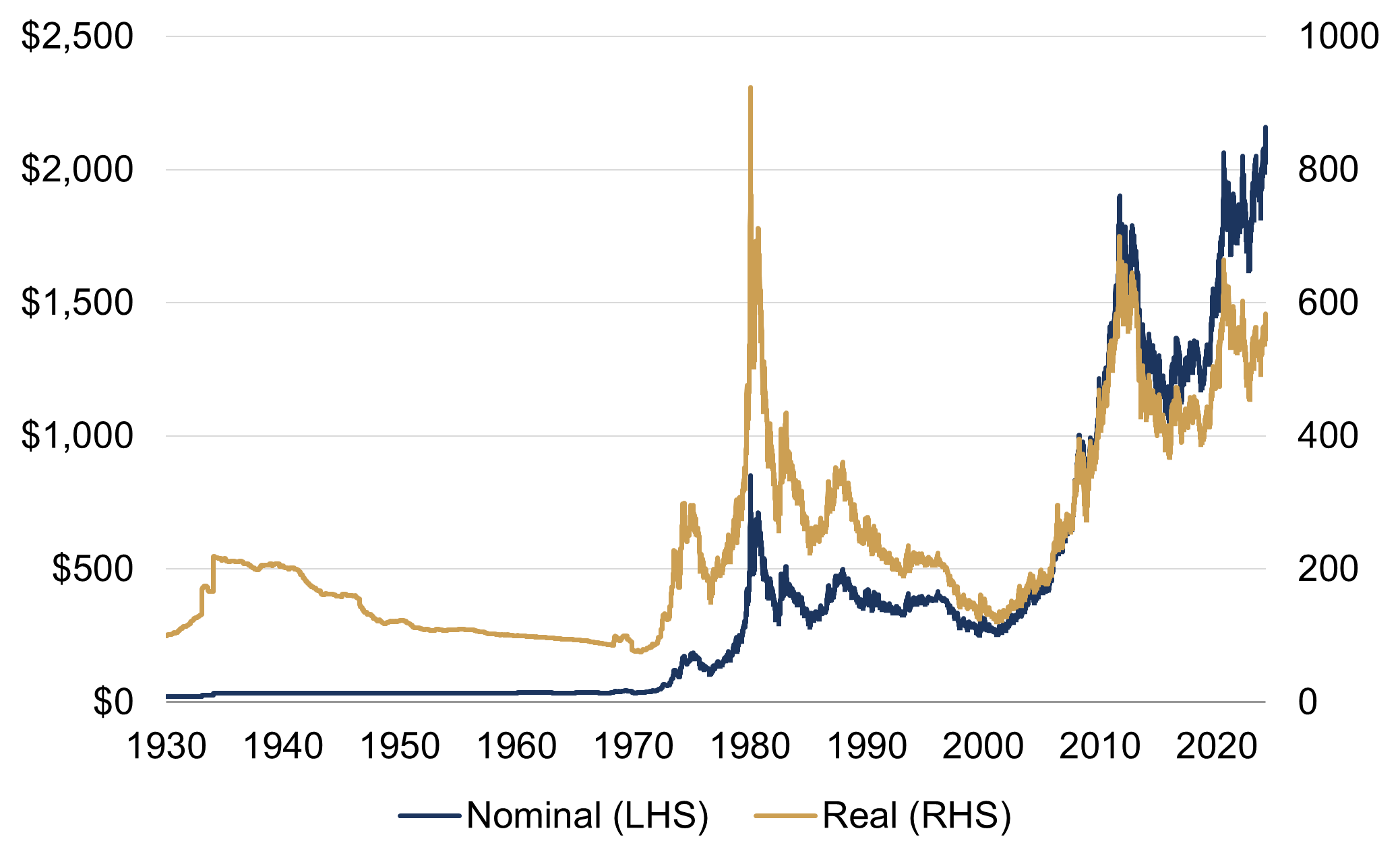

Whatever the reasons for its rise, it's important to put the latest moves in context. Gold was actually down this year up until the turn of the month, meaning it is still lagging global stock markets in 2024 (in US dollar terms). And while it may have reached an all-time high in nominal terms, it is still well below – 37% to be precise – its inflation-adjusted peak from 1980 (figure 1). Meanwhile, global stock returns are closer to the equivalent threshold: the MSCI ACWI is 5% below its late-2021 high in real terms (stock returns of course include dividends, as noted above).

Figure 1: Gold spot price

LHS: USD/oz, RHS: inflation-adjusted index (Jan 1930 =100)

Source: Rothschild & Co, Bloomberg

Stocks and bonds will usually have the highest weightings in balanced portfolios, by virtues of their income-generating potential. There is a strategic case for a small allocation to gold, not least as a diversifier of liquidity, but there have to be compelling macro reasons for altering this. That said, we strongly prefer gold to another asset recently surging in price – namely bitcoin. Despite our misgivings, gold has been seen as a store of value for thousands of years, with little help from central banks – or internet connection.

Ready to begin your journey with us?

Speak to a Client Adviser in the UK or Switzerland

Past performance is not a guide to future performance and nothing in this article constitutes advice. Although the information and data herein are obtained from sources believed to be reliable, no representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by Rothschild & Co Wealth Management UK Limited as to or in relation to the fairness, accuracy or completeness of this document or the information forming the basis of this document or for any reliance placed on this document by any person whatsoever. In particular, no representation or warranty is given as to the achievement or reasonableness of any future projections, targets, estimates or forecasts contained in this document. Furthermore, all opinions and data used in this document are subject to change without prior notice.