Is the US election over before it even started?

In selecting the next leader of the free world, America faces a decidedly uncompelling choice: the unpopular incumbent octogenarian or a legally encumbered (soon-to-be octogenarian) polemicist.

Unlike the beleaguered President Biden’s, Trump’s cult-like supporters are energised and enthused about his ascension. His momentum is undeniable: absent a remarkable plot twist, Trump remains the shoo-in Republican nomination. The pathway from there to the White House currently looks wide open.

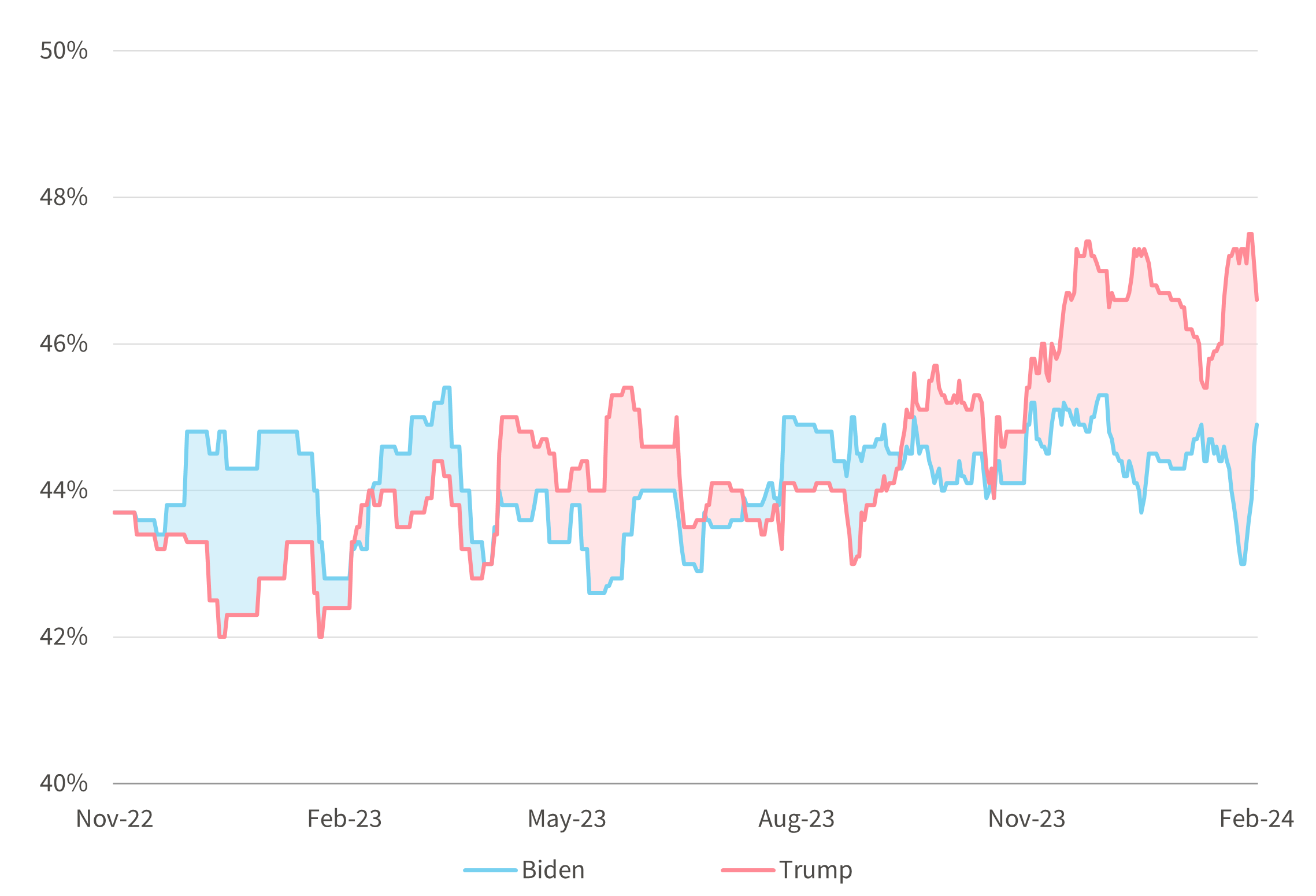

2024 US Presidential Election polls (average, %)

Source: Bloomberg, RealClearPolitics

While here in Europe we quietly grimace at the noisy campaign ahead, as investors we need to keep an open mind about what another Trump presidency might mean for client portfolios. In the narrow, impersonal investment context, Trump’s first term was far from a calamity. The domestic economy did OK, and despite his aggressive stance on trade – and China’s retaliations – the global economy, and the wider post-war US-led liberal international order remained intact.

This is in no way to suggest that his actions were admirable, or that his attempt to refute the 2020 election was result was in any way defensible. But as we often note, what’s bad for us as people is not always bad for us as investors. It is quite possible – probable – that portfolios could tolerate another four more years. Disaster is not inevitable.

'The Trump Doctrine'

Trump is an instinctive, isolationist populist with a short attention span and a limited vocabulary. Those instincts are not always coherent or consistent, though they are often pro-business (that is, US Inc).

When he arrived on the national stage in 2016, he seemed the only candidate capable of sticking it to the proverbial man. He promised to ‘drain the swamp’ - an antidote to the deeply unpopular 'Beltway' establishment. He campaigned aggressively to halt immigration, level the playing field with China and revitalise domestic industry. But he also promised to lower taxes, deregulate key sectors and boost infrastructure spending.

Rothschild & Co 2016 Analysis of Trump election pledges (Sep ’16)

Despite the bluster, his legislative success was mixed. He delivered on lowering and reforming taxes. However, he failed to repeal ‘Obamacare’, and his protectionist stance had less impact (for good or bad) than intended. The aggregate rise in import tariffs was relatively muted and narrowly targeted, for example. NAFTA’s replacement – the uncannily similar USMCA – seems to have been a case of window dressing.

He did rescind the US’s commitment to the 2016 Paris Climate Accord and leased extensive areas of public land for oil exploration. Deregulating (again) the financial sector – namely, watering down the Dodd-Frank Act – may have contributed to recent regional bank failures. And his infrastructure efforts fell short – the Biden administration has had more success there.

But perhaps his most damaging legacy is political division – not just across the aisle, but within his ‘own’ party, where Republicans are paying for their Faustian pact. Partisanship is deep-seated and legislative gridlock is the norm

'Make America Great Again'

Trump’s policy pledges as yet are thin on detail, but déjà vu is in the air.

A return to ‘Trumponomics’ would suggest a more parochial and inward stance. Political vengeance (‘purging’ his opponents?), immigration and protectionism seem high on the agenda. A mooted 10% import tariff on all goods and a 60% tax on Chinese goods imports (up from 12% today) could have big consequences for growth and inflation. His stance on climate related objectives remains troubling: Biden’s climate legacy – namely the green subsidies within the Inflation Reduction Act - could be under threat.

Fiscally, no aggressive spending cuts are proposed yet, nor are radical changes to social security or Medicare. Changes to taxes would likely be modest, but pro-growth - tilted towards business, and the middle-class voter.

In the investment context, the relevance of elections to portfolios is often overstated (a point we’ve made often over the years). Other things often matter more: there are many moving parts. The prospect of lower interest rates, alongside ongoing growth, could easily offset the impact of a new administration.

Indeed, we can imagine a more positive scenario – as occurred the first time around, when the stock market digested the boost to corporate earnings imparted by Trump tax cuts.

Sector-wise, it is too soon to assess possible winners or losers. But we can envisage some sectors coming under renewed pressure – industrials and materials might suffer if tariffs were to rise and green pledges partially reversed. Big pharma – ever the political football – might also suffer in an election year, albeit drug pricing does not appear to be an area of focus. Conversely, energy and financials might benefit from reduced regulatory scrutiny.

Not (yet) a foregone conclusion

If it is not yet possible to position portfolios for the election outcome, we can at least be aware of the key dates ahead.

The ongoing primaries seem largely a formality now – 'Super Tuesday' on 5 March may be something of a non-event. A bigger focus will be the party conventions in mid-July (Republican) and mid-August (Democrat), followed by the presidential debates from mid-September, with the election itself on 5 November.

The result is not a foregone conclusion. Trump’s two percentage point lead in the national polls is within the margin of error, and his lead in the key battleground states is no more decisive. Meanwhile, Congress, which is currently divided, seems likely to remain that way, and a presidency without congressional control would struggle to get things done – which again favours more benign market outcomes.

We should also remember that the economy is growing briskly, inflation continues to fade, and the possibility of an unexpected fiscal boost may yet reverse some of Biden’s unpopularity.

Ready to begin your journey with us?

Speak to a Client Adviser in the UK or Switzerland

Past performance is not a guide to future performance and nothing in this article constitutes advice. Although the information and data herein are obtained from sources believed to be reliable, no representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by Rothschild & Co Wealth Management UK Limited as to or in relation to the fairness, accuracy or completeness of this document or the information forming the basis of this document or for any reliance placed on this document by any person whatsoever. In particular, no representation or warranty is given as to the achievement or reasonableness of any future projections, targets, estimates or forecasts contained in this document. Furthermore, all opinions and data used in this document are subject to change without prior notice.