Private debt, an alternative to bank financing

From a short-term solution to an indispensable instrument

Private debt emerged during the 2000s, to satisfy financing needs in between senior debt (bank financing secured by collateral) and shareholders’ equity (shares). The use of private debt has increased sharply since the 2008 global financial crisis, with banks subsequently largely restricting loans granted, particularly to small and midcap companies and highly-leveraged groups. Banking regulations have effectively become stricter, requiring increasingly greater adequacy between shareholders’ equity and investments. Financing private companies was therefore becoming highly penalising in terms of cost of capital for banks. The search for diversification and yield among investors, combined with banking disintermediation reducing traditional financing supply, encouraged the emergence of private debt and its financing by the private institutional sphere (insurers and loan funds).

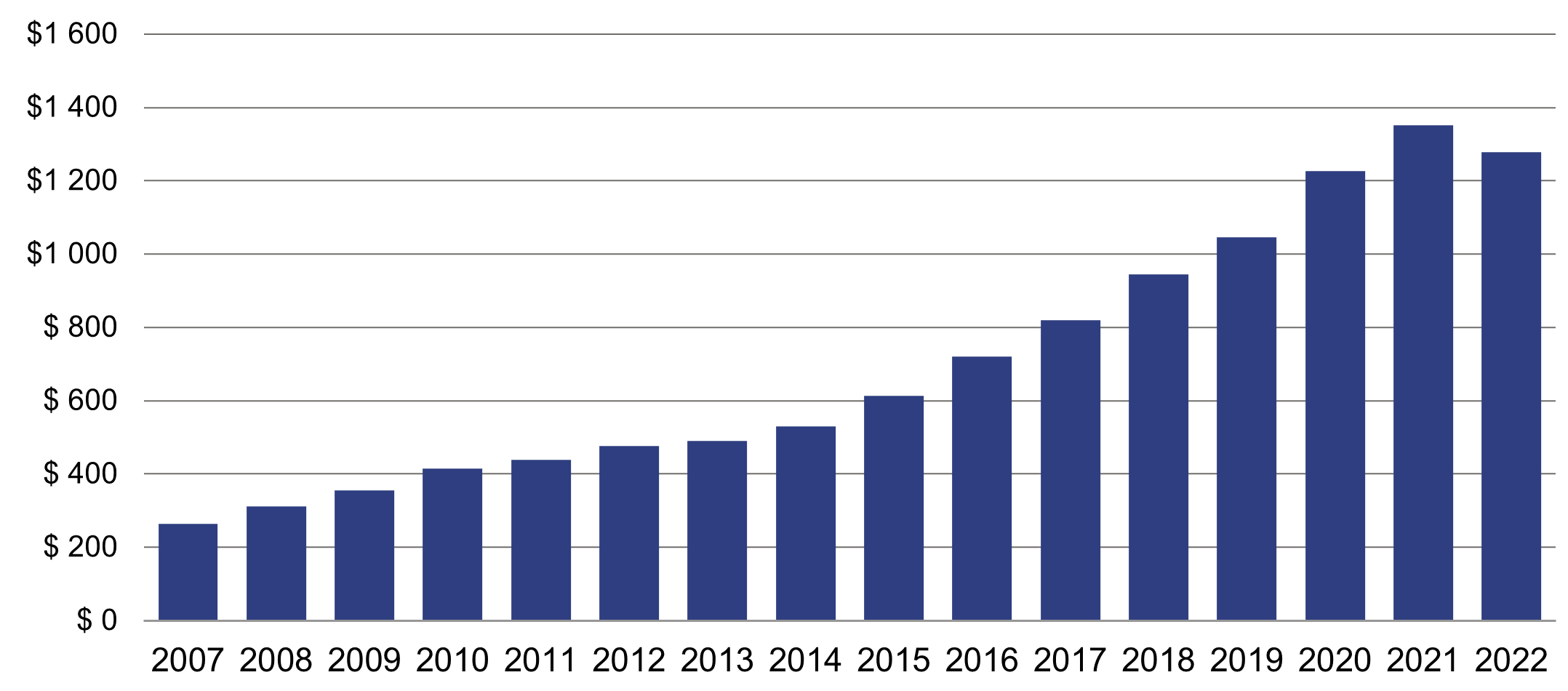

Private debt is now an indispensable alternative to banking loans for midsized companies, particularly those looking to consolidate their position in a market and needing to mobilise cash to finance bolt-on growth through acquisitions. Private debt is therefore an instrument that meets the needs of both borrowers and investors, which explains its strong growth. The private debt market has been growing constantly since its creation, with assets under management increasing three-fold over the past decade (see below chart).

Growth in private debt assets under management (USD Billion)

Source Pitchbook – 31/12/2022

Finance structuring

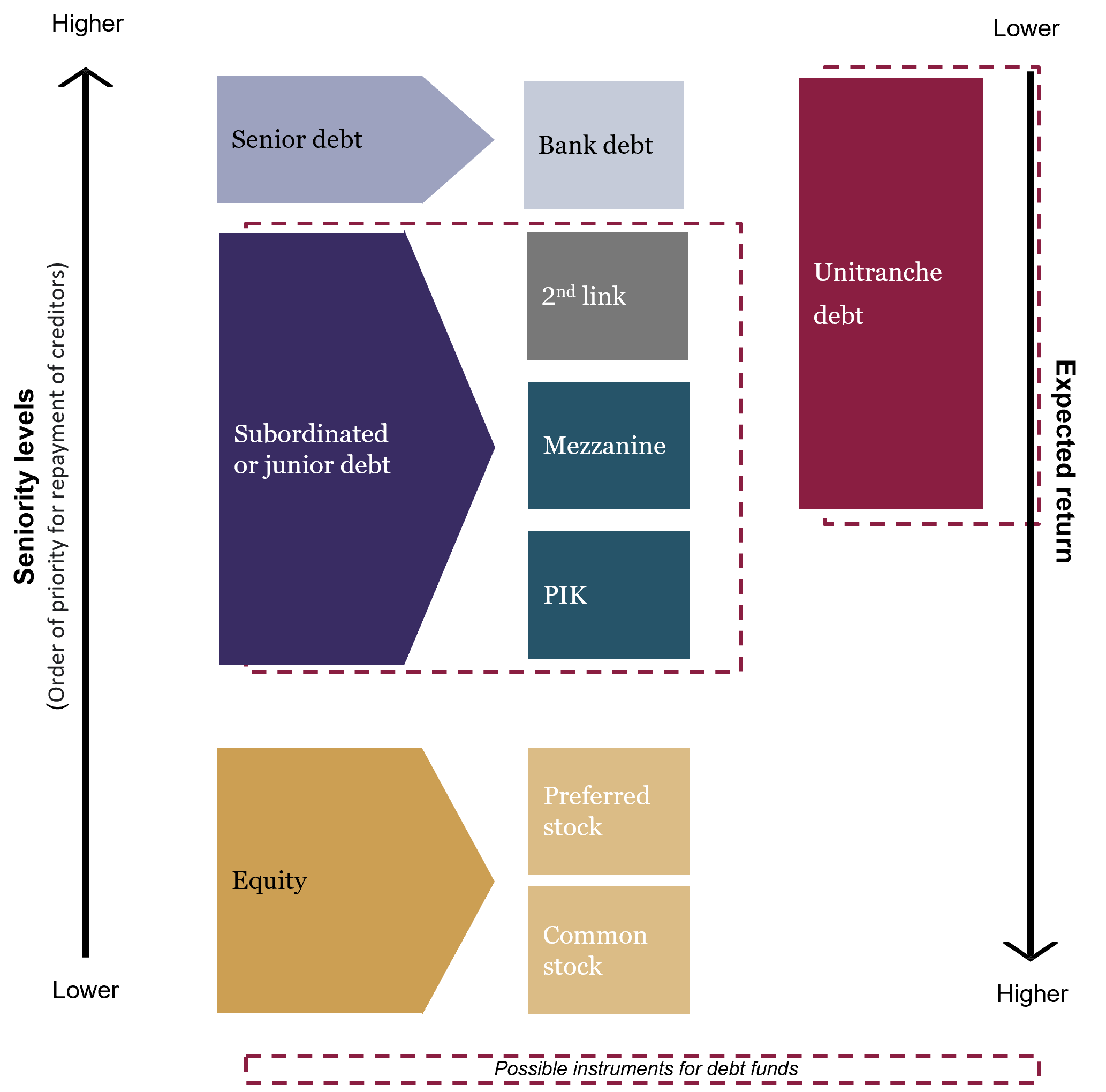

In general, private debt refers to senior debt, known as unitranche debt, as well as subordinated or junior debt.

The development of this asset class has seen the appearance of diversified types of funding, divided into sub-categories based on the level of risk, the collateral used as security and the duration of the financing (see below diagram).

Senior debt, which is generally banking debt, is therefore characterised by its reimbursement priority and is secured by tier-one collateral.

Subordinated or junior debt is situated midway between senior debt and capital, and is secured by tier-two collateral. Its reimbursement is therefore subordinated to that of senior debt. It is riskier than senior debt and will therefore offer a higher yield. On the other hand, it ranks senior to all shareholders’ equity instruments.

The so-called unitranche loans appeared in 2012, with the aim of replacing a combination of junior and senior debt. It mainly enables companies to secure funding from a single lender, rather than a pool of creditors, and therefore develops close relations. The borrowing company will consequently gain flexibility and speed of execution. It is senior debt with tier-one collateral, based on tailor-made contracts, with flexible reimbursement conditions. The cost of this debt will also be higher than classic banking loans, but lower than junior financing, as it is less risky. Unitranche debt provides lenders with the same security as investments in senior debt, but with a slightly higher yield, as it allows for higher levels of leverage, particularly as the loans are reimbursed solely at maturity1.

An asset class in its own right

The highly specific characteristics offered by private debt make it an asset class in its own right.

Firstly, it should be noted that this type of debt, which by its very nature is unlisted and therefore non-volatile, enables investors to benefit from an illiquidity premium and therefore a higher potential yield than traditional listed bonds.

Loan funds have a shorter investment period than private equity, at 2 - 3 years on average (compared to 3 - 5 years for private equity), with a shorter investment holding period as well (2 - 3 years vs 4 - 6 years). Furthermore, as private debt is representing an increasing proportion in capital structures compared to equity (see above diagram), the risk for investors is therefore lower in the event of borrower default.

Loan funds are distributive. In most cases, barring a credit event, this type of instrument effectively offers predictable cashflow in the form of the payment of regular, scheduled coupons. These are generally paid quarterly throughout the duration of the deal, over 6 - 8 years, which represents the lifespan of a loan fund, which provides regularity and the capacity to generate current yield over very long periods. This type of cashflow profile is therefore complementary to private equity investments, which are characterised by negative cashflow during the first years of an investment, before reaping the potential benefits.

Another key feature is that private debt is generally issued at a floating rate, which, in the current environment of high interbank interbank rates, is a favourable situation for lenders and therefore for investors.

A new market environment

The war in Ukraine, rising inflation and increasing interest rates have calmed the particularly dynamic market, which was previously characterised by very strong inflow of liquidity and investors, in a generally bullish environment.

The market is split between large cap deals (over 300 million euros) and small & midcaps. Financing large caps has become much more complex with fewer deals completed in 2023. Most deals were concluded with debt funds. However, since the end of 2023, banks have regained the ability to syndicate their paper, thanks to a return of liquidity to the markets.

The small & midcaps market remains as active as ever however, although lenders have been highly selective over the past 24 months. The rising cost of debt, combined with significant macroeconomic uncertainties, has led to a structural decline in leverage. With some margins increasing significantly, the risk-return balance is adjusting favourably for lenders, including loan funds. At the same time, we have seen a resurgence of subordinated / junior instruments (PIK2, mezzanine), which had hitherto almost disappeared but are now making a comeback to further decrease leverage.

This significantly less favourable macroeconomic context than 2 years ago for borrowers has led to a slight increase in default rates and restructuring deals, with a rising number of distressed situations3.

Conversely, investors are benefitting from attractive yields. Today, the unitranche financing of a quality company will effectively deliver a gross annual yield of between 11 and 12%4.

Selectivity: a key issue

Although borrowers have been enjoying historically low financing conditions over the past fifteen years, due to very low or even negative interest rates, they are currently facing a much less favourable environment.

In this context, some companies have struggled to secure financing. This is notably the case for cyclical companies (retail, certain industries, etc.), with low profitability or which are unprofitable, or which have changed management, or are penalised by inflation (commodities, wages) or which depend mainly on a single client.

On the contrary, for certain non-cyclical sectors such as healthcare, recurrent revenues, wide margins, low capex, high entry barriers and a leader or co-leader position in a market, are all factors which will be valued by lenders.

For loan funds, selectivity and identifying risks are determining factors for lenders. Deeper due diligence, close relations and ongoing dialogue are also key aspects.

ESG criteria are being taken increasingly into consideration

Over the past few years, the integration of ESG criteria in private debt instruments has become a priority issue, in response to strong demand from investors and also from financed companies looking for support and hoping to affirm their capacity to raise green funding.

Certain innovative formats give these criteria particular importance. This is notably the case with ESG margin ratchet loans which enable the interest rate to be indexed to the achievement of environmental, social or governance objectives, such as the reduction of greenhouse gas emission. There is no doubt that the generalisation of these instruments, while still needing to be rationalised, will be positive at all levels.

1 - Unitranche debt is senior debt reimbursable at maturity.

2 - Payment In Kind (PIK) is a loan characterised by interest payments which are not systematically in cash. Interest can be paid in other debt securities, or by shares in the borrowing company, or by the issue of equity call options.

3 - Credit in difficulty

4 - H2 2023: arrangement fee of 3% + 3-month Euribor 3.9% + cash coupon between 6.25% and 7.25%.

Contact us

The Rothschild Martin Maurel teams are at your disposal to provide you with the best possible advice on these subjects.