A regional roundup

Asia: Japan’s revival - handle with care

After three decades of lacklustre growth and protracted bouts of mild deflation, the mood music has turned decidedly positive in Japan. Since the start of the year, Japan’s stock market has rallied 24% (in local currency) against the wider stock market return of +14%. Inflation is moving higher and first quarter growth – already the fastest amongst the G7 cohort - was recently revised positively to 0.7% (non-annualised). Sentiment has also been boosted by an improving local political backdrop - the latest G7 meeting in Hiroshima, and a détente with South Korea, have boosted PM Kishida’s standing.

But whether this cyclical upturn is enduring remains to be seen: there have been other, temporary, revivals. Japan’s striving for higher inflation (imported or otherwise) misses the point – its problem is stagnant growth, and without structural reforms, this may be another false dawn (we are still somewhat chastened by our own experience: we felt that Japan was turning a corner in 2016, only for the third of late PM Shinzo Abe’s ‘Three Arrows’ to fall short of expectations).

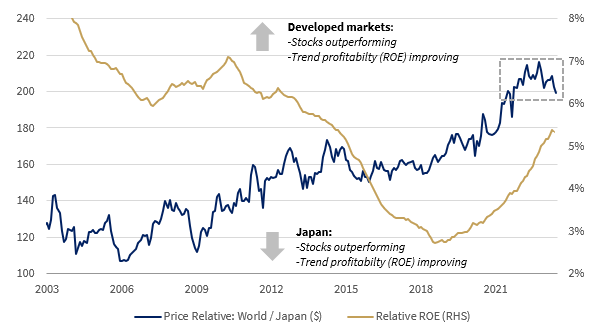

As for the stock market’s resurgence, the relative outperformance is unremarkable in common currency terms – the yen has fallen 7% against the dollar this year. More profoundly, we are still waiting for the revival in Japanese corporate profitability – which if anything has been going in the wrong direction in recent years.

Asia: China finally resorts to (modest) easing

Asia: China finally resorts to (modest) easing

China has lagged the wider global stock market this year. While the global stock market notches new highs, +14% year-to-date (in USD), the wider EM Asian region is up only half that – and this, of course, conceals China’s even more dramatic underperformance, which is broadly flat since the start of the year. The sluggish economic rebound, the fragile property sector and the lack of policy support have been headwinds, and a big political and regulatory risk premium still exists.

However, news of the PBOC’s easing reminds us that a reluctant Beijing still has a lot of monetary manoeuvre – in contrast to the rest of the world: inflation there is negligible. The modest 10bps cut in the seven-day repo rate - and now the Medium-Term Lending Facility – may not be transformative, but it signals a shift in emphasis. Looking ahead, we remain constructive: the domestic picture is slowly improving (the latest activity data for May was soft, not calamitous)– and if we start to see fiscal support, alongside the long-awaited rebound in the beleaguered property market, then there may be scope for a faster recovery.

Europe: UK - no time for policy hesitation

It’s been a remarkable recent turn of fortunes for the UK economy – the OECD has now joined the IMF and the Bank of England (BOE) in revising away a predicted recession this year. The latest batch of labour market data for April showed the unemployment rate falling even further, employment and participation still trending higher, and wages continuing to grow at a strong pace. While this reinforces our belief that growth – underpinned by a resilient consumer – will continue, it may keep core inflation (currently at 6.8%) stubbornly high.

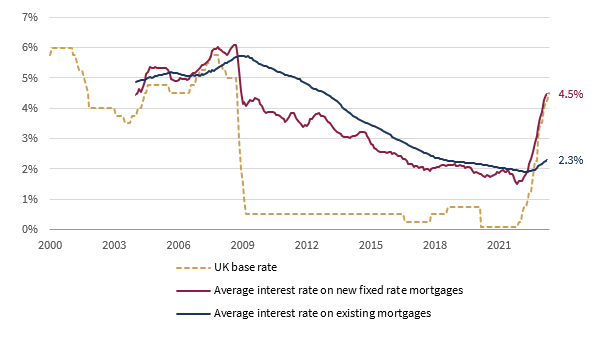

For the BOE, the way forward should be clear. Indeed, the latest gilt sell-off is signalling that interest rates are likely to climb still higher: the 2-year yield – at 4.86% - has now moved above the Truss ‘mini-budget’ turmoil last September and is close to a 15-year high. Money markets are pointing to a further five 25 bps interest rate hikes to c. 5.75% - plausibly higher than the US’ terminal interest rate, and with no appreciable easing discounted until the end of 2024.

The sharp repricing of interest rate expectations is appearing most visibly in the mortgage market, where lenders have been revising the terms of fixed rate products. While the ‘higher for longer’ policy narrative will eventually percolate through to borrowers, most mortgage holders are yet to bear the brunt of these higher rates - a big gulf has opened between the average interest rate on existing mortgages relative to new ones:

Europe: Greece’s road to recovery

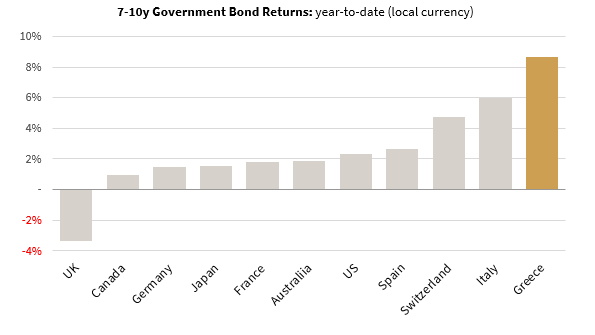

A little over a decade ago, the yield on the Greek 10-year benchmark government bond briefly touched 35%. At the time, Greece was on the brink of second major default in two years, as the country grappled with what were widely seen as unsustainable debt levels – close to 160% of GDP, far above Maastricht thresholds – and a fragile banking system saddled with bad debts. The arrival of a second bailout in 2012 prevented a major reckoning, although for bondholders forced to accept aggressive write-downs it was a cautionary tale.

Today, Greece is one of the fasting growing economies in the eurozone – having recovered most sharply from its covid slump. A continuation of PM Mitsotakis’s investment-friendly policies and a sharp retreat in gross debt ratios prompted S&P to raise its outlook in April. Ahead lies the possibility that ‘uninvestable’ Greece could be promoted from ‘junk’ to ‘investment grade’. Greek bonds have responded vigorously:

The economic turnaround is encouraging, and perhaps not so unexpected given earlier, near-universal pessimism: it vindicates the Troika’s bailout and Greece’s ambitious recovery plan. However, we will not be chasing it. MSCI still formally classifies Greece’s stock market as an Emerging Market (since 2013), while the yield on its 10-year bond – currently at 3.77% - now looks expensive. Currency considerations notwithstanding, we’d still rather lend to Uncle Sam at these levels (US 10-year yield currently at 3.73%).

The economic turnaround is encouraging, and perhaps not so unexpected given earlier, near-universal pessimism: it vindicates the Troika’s bailout and Greece’s ambitious recovery plan. However, we will not be chasing it. MSCI still formally classifies Greece’s stock market as an Emerging Market (since 2013), while the yield on its 10-year bond – currently at 3.77% - now looks expensive. Currency considerations notwithstanding, we’d still rather lend to Uncle Sam at these levels (US 10-year yield currently at 3.73%).

Ready to begin your journey with us?

Past performance is not a guide to future performance and nothing in this blog constitutes advice. Although the information and data herein are obtained from sources believed to be reliable, no representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by Rothschild & Co Wealth Management UK Limited as to or in relation to the fairness, accuracy or completeness of this document or the information forming the basis of this document or for any reliance placed on this document by any person whatsoever. In particular, no representation or warranty is given as to the achievement or reasonableness of any future projections, targets, estimates or forecasts contained in this document. Furthermore, all opinions and data used in this document are subject to change without prior notice.