Banking update

It has been exactly two months since Silicon Valley Bank's collapse triggered wider concerns over the US regional banking system.

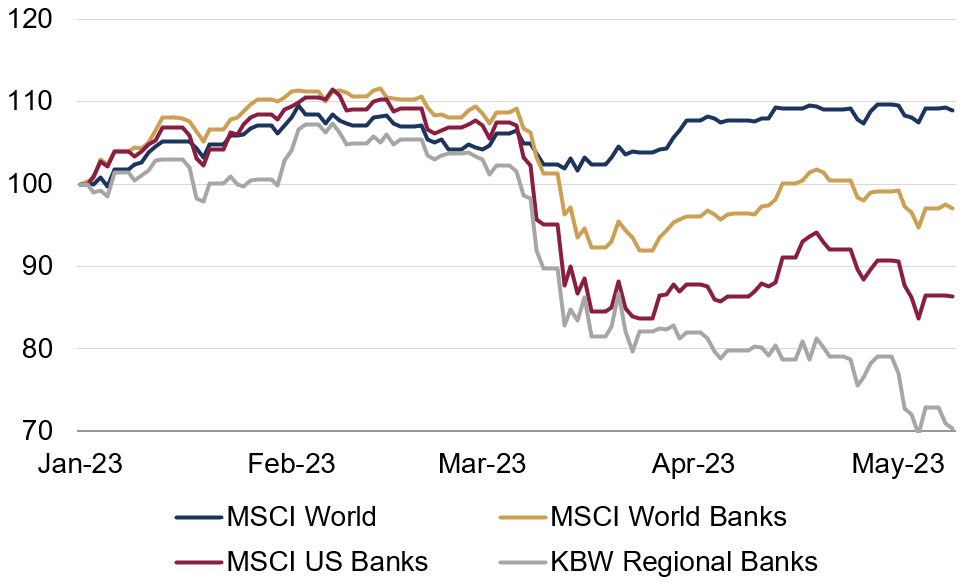

First Republic was the latest – and second largest ever – US bank to fail. Despite JP Morgan's acquisition of its assets at the start of the month, contagion fears have prevailed: the KBW Regional Banking Index fell by 8% last week, with both PacWest (-43%) and Western Alliance (-27%) looking particularly weak. Even so, the broader stock market has been resilient: developed market equities are still up around 9% this year, in US dollar terms (Chart 1).

Chart 1: Bank stock indices (USD, total return, rebased indices: Jan '23 = 100)

Source: Rothschild & Co, Bloomberg

Source: Rothschild & Co, Bloomberg

So far, broader bank risk metrics have been contained. The major banks' credit default swap spreads, for instance, have risen modestly – but have not blown out (and remain well below average Global Financial Crisis levels). The interbank market also seems to be operating smoothly, with TED spreads – the difference between interest rates on interbank loans and on short-term government debt – still muted.

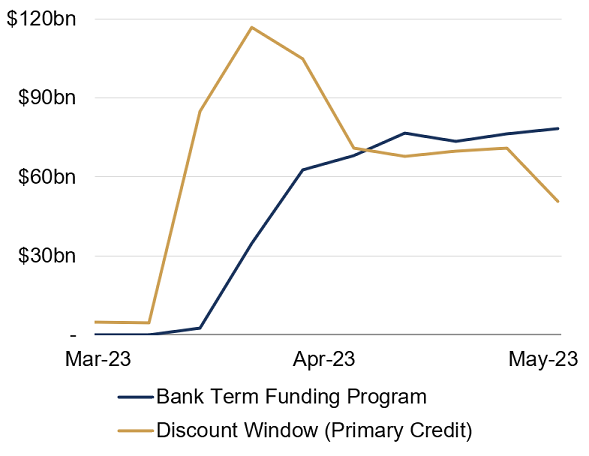

The Fed's weekly balance sheet data perhaps suggest that the situation may be improving. Average daily borrowing by depositary institutions from the Fed's Discount Window and new Bank Term Funding Program has cooled in recent weeks (Chart 2). Promisingly, the former – a source of short-term liquidity for commercial banks during periods of systemic stress – has more than halved from its peak. In fact, daily borrowing via the Discount Window was close to zero as of Wednesday last week (something that is not reflected in Chart 2, given that it shows the average daily figure from each week). This likely means that liquidity issues have been idiosyncratic – i.e., related to First Republic – rather than broad-based across the US regional banks.

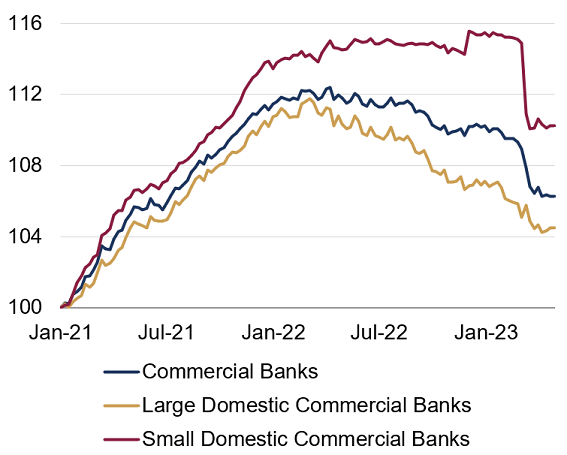

Moreover, there has not yet been a sudden, large-scale deposit flight (Chart 3). Commercial bank deposits have been steadily declining for a year – likely due to customers shifting their cash to higher yielding money market funds and perhaps due to households spending their accrued savings – and are only 5% below their April 2022 high. Deposits at smaller domestic banks experienced a brief squeeze during March but have stabilised since then.

Chart 2: Average daily borrowing from the Fed (weekly data, USD, billions)

Source Rothschild & Co, Bloomberg, Federal Reserve

Chart 3: US commercial bank deposits (rebased indices: Jan ’21 = 100)

Source Rothschild & Co, Bloomberg, Federal Reserve

Source Rothschild & Co, Bloomberg, Federal Reserve

Finally, there are still few signs of an imminent credit 'crunch'. According to the latest, and widely-watched, Federal Reserve Senior Loan Office Survey (SLOS) – conducted after the SVB fallout – bank lending standards were only modestly tighter on balance than in January. Moreover, only 7% of banks reported that they were looking to tighten lending standards for business (C&I) loans 'considerably' over the remainder of 2023 (although 48% said they would 'somewhat' tighten lending standards).

We continue to think that the banking system overall looks healthier than in the period leading up to the Global Financial Crisis. The major banks are better capitalised and more liquid, borrower and asset quality is generally better, lending has not been reckless, and authorities have so far reacted quickly and decisively.

Ready to begin your journey with us?

Past performance is not a guide to future performance and nothing in this blog constitutes advice. Although the information and data herein are obtained from sources believed to be reliable, no representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by Rothschild & Co Wealth Management UK Limited as to or in relation to the fairness, accuracy or completeness of this document or the information forming the basis of this document or for any reliance placed on this document by any person whatsoever. In particular, no representation or warranty is given as to the achievement or reasonableness of any future projections, targets, estimates or forecasts contained in this document. Furthermore, all opinions and data used in this document are subject to change without prior notice.