Strategy blog: The energy crisis - one year on

One of the two big threats to growth has abated.

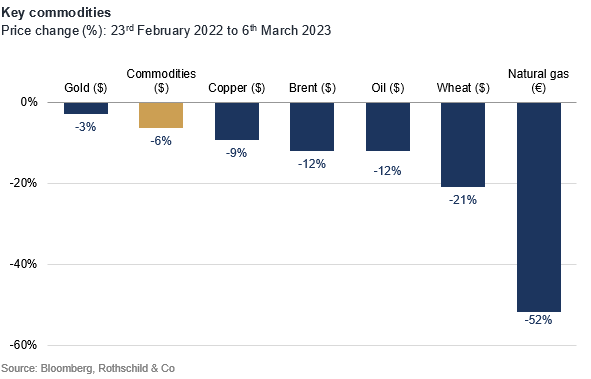

It has been one year since the outbreak of war in Ukraine, and most commodity prices – including energy prices, which spiked to unsustainable levels – are significantly lower, and in many cases down by double digit amounts since the end of February last year.

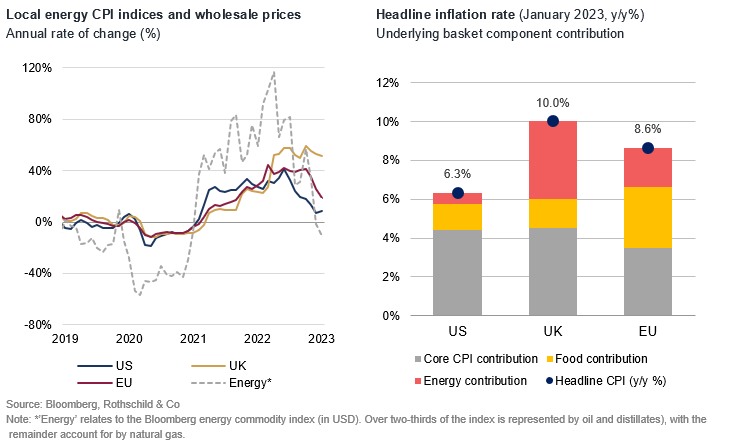

Those lower commodity prices have already started to trickle down to consumers – inflation has (mostly) been fading in recent months, with energy central to this disinflationary process. Remarkably, ‘energy’ (in direct terms) only up makes up a tenth of the consumer price baskets across the US, UK and Europe, yet it contributed more than double that to inflation in 2022.

But the retreat in those wholesale energy costs is passing through to consumer prices to differing degrees.

In the US, for example, where domestic energy supply was less at risk to begin with, energy price inflation peaked at lower levels and has now fallen back sharply. The situation in Europe remains more challenging with gas prices still elevated historically at twice their pre-pandemic average (in the US they have broadly returned to their long-term average). But even there, energy inflation has started to roll over from its delayed October peak. Bucking the trend, as always, is the UK – energy prices have plateaued at very high levels, which is why the UK’s headline rate remains so elevated. Energy still accounts for two fifths of the UK’s annual inflation rate:

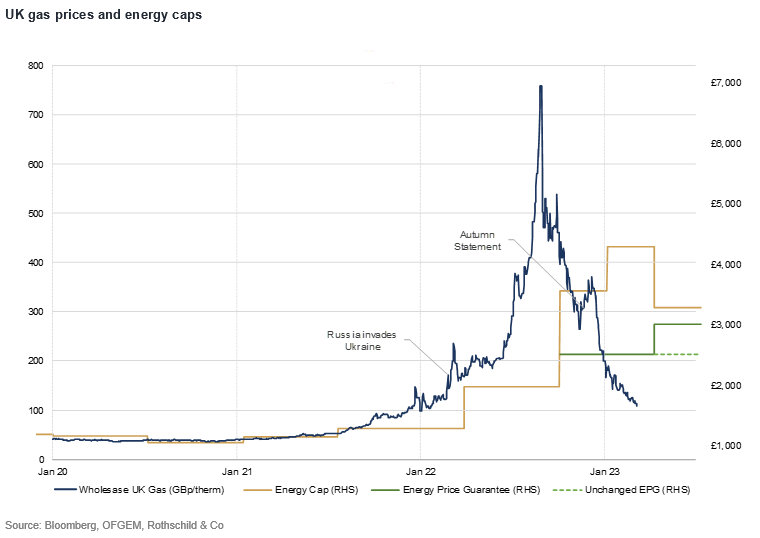

The UK actually benefits from greater energy security (half of its gas comes from the North Sea) and its domestic natural gas price is no more elevated than Europe (approximately double its pre-pandemic level). But the UK is more dependent on gas for its wider energy needs – and the pass-through from wholesale gas costs to the prices paid by consumers has been delayed by regulatory and (more recently) governmental intervention. This also applies in Europe, where the timing and magnitude of government support varies across the bloc.

Encouragingly, the latest UK energy cap – which is revised quarterly and is due to come into effect from 1st April – will fall by a quarter (from c. £4,300 to c. £3,300 per annum). However, the arcane mechanics of the energy regulator’s quarterly price cap ‘observation window’ – which is essentially backward looking – means the price cap is still approximately 50% above wholesale prices (and nearly triple its pre-pandemic level).

Perversely, the latest fall in the energy cap will do little the change the arithmetic for households. The government’s Energy Price Guarantee (EPG) – which has subsidised household and business bills since October 2022 – has been set far below the cap and is primed to rise by a quarter from April (but disappear altogether for businesses), even as wholesale prices fall well below both the cap and EPG.

However, positive developments lie ahead. It seems inevitable that both the regulatory cap and the government guarantee will fall back markedly after the spring - assuming wholesale gas prices don’t suddenly rebound of course. The discourse in Westminster appears to be shifting too – one of the reasons the government seems poised to extend the energy support scheme in its current form may be its awareness of the falling cost of shielding households going forwards.

For consumers on both sides of the Atlantic, the combination of favourable base effects and (eventually) lower price levels will likely have a potent impact on inflation and wider spending power as we go through this year.

The energy crisis may not yet be over, but the direction of travel is clear.

Ready to begin your journey with us?

Past performance is not a guide to future performance and nothing in this blog constitutes advice. Although the information and data herein are obtained from sources believed to be reliable, no representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by Rothschild & Co Wealth Management UK Limited as to or in relation to the fairness, accuracy or completeness of this document or the information forming the basis of this document or for any reliance placed on this document by any person whatsoever. In particular, no representation or warranty is given as to the achievement or reasonableness of any future projections, targets, estimates or forecasts contained in this document. Furthermore, all opinions and data used in this document are subject to change without prior notice.