Monthly Market Summary: January 2023

Investment Insights Team, Investment Strategist Team, Wealth Management

Investment Insights Team, Investment Strategist Team, Wealth Management

Summary: A strong start to the year for stocks and bonds

Capital markets experienced their strongest January gains in years: global equities rose 7.2% and global government bonds increased 3.1% (both in USD terms). Key themes in January included:

- ‘Risk-on’ resumes as inflation moderates and peak interest rates move into focus

- Economic indicators stabilise but corporate earnings continue to be downgraded;

- China’s rally persists as Covid-19 reopening boosts sentiment.

Moderating inflation, easing energy prices and expectations of a slowing tightening cycle, particularly in the US, buoyed both stock and bond markets in January. The upbeat mood was also supported by China's lifting of Covid-19 restrictions and signs of possible further fiscal and monetary support from Beijing. Fourth quarter earnings season has been mixed, with aggregate US earnings now falling 5% and slightly below analysts’ expectations. In commodity markets, gold and copper outperformed, while the oil price was rangebound.

US: Solid growth; Fed in focus; Debt ceiling impasse

The US Economy expanded by an annualized 2.9% in Q4 2022, beating forecasts of 2.6%, and with output expanding by 2.1% over 2022 as a whole - in line with its 10-year trend. The manufacturing ISM data for January were still below 50 – with the closely-watched New Orders sub-index looking notably week (at 42.5). Other data were mixed: retail sales for December fell by 1.1% (m/m), but durable goods order jumped by 5.6%. The US headline inflation rate slowed for a sixth straight month to 6.5% (y/y) in December and the core inflation rate also subsided to 5.7%. Despite hawkish comments by Fed officials, money markets are still discounting rate cuts in the second half of 2023. On Capitol Hill, legislators risked another federal shutdown without an agreement to raise the US debt ceiling. The new Republican Speaker of the House of Representatives, Kevin McCarthy, is seeking spending cuts as part of the negotiations.

Europe: Growth continues; Rebounding PMIs; ECB hawkish

Preliminary GDP estimates suggest the Euro Area economy avoided a contraction in the final quarter of 2022, expanding 0.1% (q/q). However, it was the weakest pace of expansion since Q1 2021. The Euro area’s ‘flash’ PMIs continued to stabilise, ticking modestly higher across both manufacturing (48.8) and services (50.7) in January, supported by the abating energy shock. The eurozone headline inflation rate fell to 8.5% (y/y %) in January (down from 9.2%), while the core inflation rate (which excludes volatile items such as energy and food) remained at its record high of 5.2%. Reflecting this stickier inflation, ECB policymakers continued their hawkish rhetoric, with markets discounting 50bps hikes at each of the next two policy meetings. In politics, Croatia joined the eurozone and the borderless Schengen Area on 1 January 2023.

ROW: China’s reopening; Solid Japanese data

Chinese equities outperformed in January, driven by the end of China's zero-covid policy and brighter prospects for economic growth in 2023. The Chinese economy grew by 2.9% (y/y) in Q4, with output expanding by a respectable 3% in 2022, but still falling short of the official target of c.5.5%. The removal of covid measures overshadowed any Lunar NY data weakness, with the official NBS PMI increasing sharply in January to 50.1 and 54.4 for manufacturing and services, respectively. In Japan the inflation rate for December increased to 4.0%, while industrial production and the retail sales surprised positively.

Performance figures (as of 31/01/2023 in local currency)

| Fixed Income | Yield | MTD % | 1Y % |

|---|---|---|---|

| US 10 Yr | 3.51% | 3.2% | -10.1% |

| UK 10 Yr | 3.33% | 2.9% | -12.4% |

| Swiss 10 Yr | 1.28% | 2.7% | -7.7% |

| German 10 Yr | 2.28% | 2.5% | -15.7% |

| Global IG (hdg $) | 4.73% | 3.5% | -8.7% |

| Global HY (hdg $) | 8.63% | 3.9% | -5.5% |

| Equity Index | Level | MTD % | 1Y % |

|---|---|---|---|

| MSCI World($) | 8,551 | 7.1% | -7.5% |

| S&P 500 | 4,077 | 6.3% | -8.2% |

| MSCI UK | 14,382 | 4.1% | 9.5% |

| SMI | 11,286 | 5.2% | -5.1% |

| Eurostoxx 50 | 4,163 | 9.9% | 3.4% |

| DAX | 15,128 | 8.7% | -2.2% |

| CAC | 7,082 | 9.6% | 4.3% |

| Hang Seng | 21,842 | 10.4% | -5.1% |

| MSCI EM ($) | 524 | 7.9% | -12.1% |

| Currencies (trade-weighted) | MTD % | 1Y % |

|---|---|---|

| US Dollar | -2.1% | 3.6% |

| Euro | 0.9% | 3.1% |

| Yen | -0.4% | -8.0% |

| Pound Sterling | 0.1% | -5.1% |

| Swiss Franc | -1.4% | 5.2% |

| Chinese Yuan | -0.2% | -2.5% |

| Commodities | Level | MTD % | 1Y % |

|---|---|---|---|

| Gold ($/oz) | 1,928 | 5.7% | 7.3% |

| Brent ($/bl) | 84.49 | -1.7% | -7.4% |

| Copper ($/t) | 9,200 | 10.0% | -4.0% |

Source: Bloomberg, Rothschild & Co.

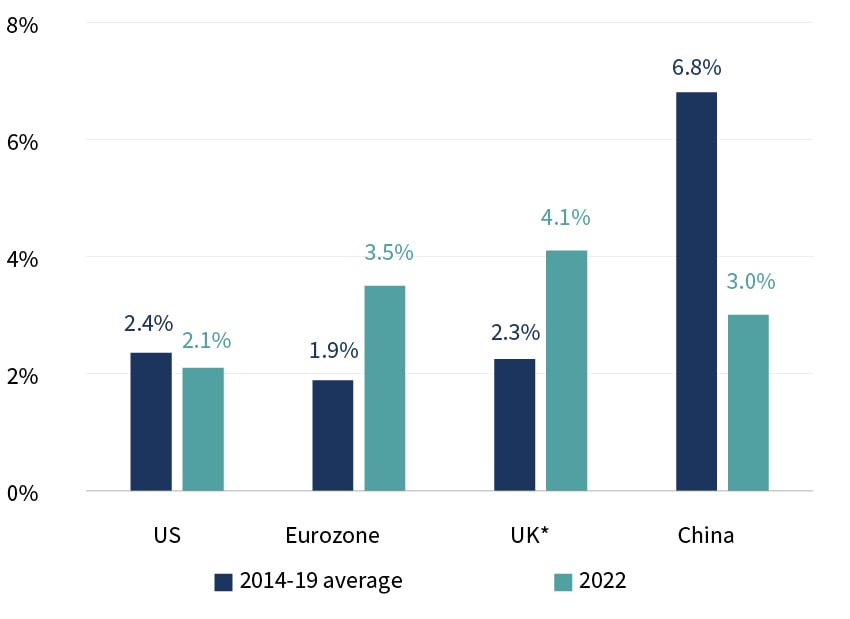

Real GDP growth

(2022 growth relative to pre-pandemic trend, %)

*UK full-year estimate based on Bloomberg Consensus data

Source: Bloomberg, Rothschild & Co., 01.01.2014 – 31.12.2022