Strategy blog: Global inflation update

A combination of loose monetary and fiscal policy have contributed to a sustained period of strong demand. But there have also been several supply shocks over the past two years: most notably, ongoing pandemic-related bottlenecks, and (more recently), Russia's invasion of Ukraine and China's renewed lockdowns. This mix of 'demand-pull' and 'cost-push' dynamics have fed through to surging consumer prices.

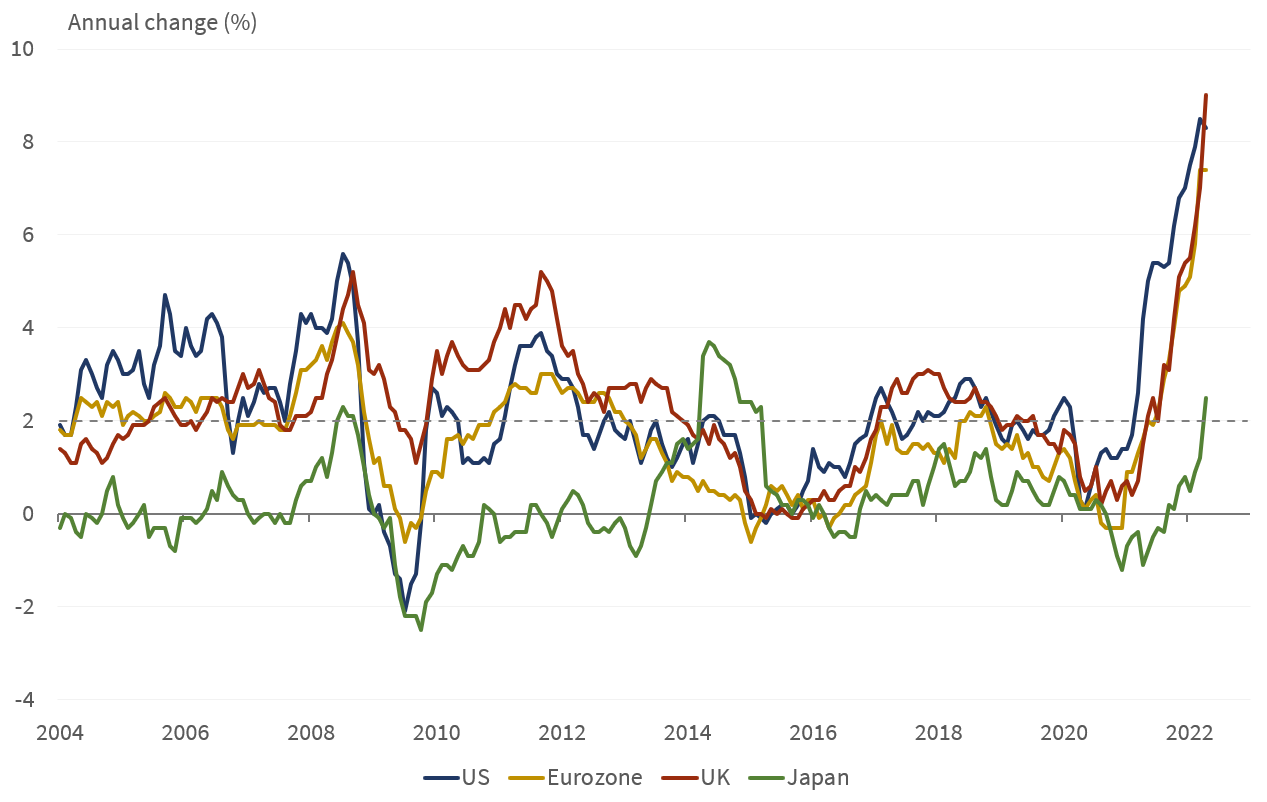

In most developed market economies, inflation rates remained elevated in April. The US headline and core CPI readings fell, but still surprised to the upside – the former edged marginally lower to 8.3% in year-over-year terms, while the latter also moved down to 6.2%. Moreover, the eurozone's inflation rate was unchanged at 7.4%, remaining at a record high. The UK CPI print was perhaps the most eye-catching. The headline figure jumped to 9.0%, its highest level in 40 years, following the energy price cap raise.

Of the major economies, China, Japan and Switzerland continued to report modest inflationary pressures. Headline inflation rates moved higher in all three countries, but were in a muted range of 2.1-2.5%. Core rates also appeared less concerning in comparison to the rest of the world. They were less than 1% in China and Japan, and only 1.5% in Switzerland.

Emerging and frontier market nations have generally experienced strong cost pressures. The humanitarian costs associated with higher food prices are concerning. The UN's Food and Agriculture World Food Price Index edged marginally lower in April but were almost 30% higher than last year's levels. What's more, wheat prices have risen nearly 60% this year (according to CBT futures), a major problem for countries that are highly dependent on this staple food. Egypt already asked for further IMF support in March, and, unfortunately, more developing countries are likely to follow.

Overall, the 'transitory vs permanent' inflation debate continues to rage. The good news is that headline inflation rates should subside going into the second half of the year, primarily due to energy price contributions easing up. Still, we think that core rates will prove to be 'stickier'. While there were signs of goods-related inflation moderating in the recent US data, there was also evidence that bottleneck effects spread to services. For instance, airline fares were over 30% higher than last year's levels, while shelter costs continued to pick up (and remained comfortably above their pre-pandemic trend). The risk of a wage-price spiral also can't be ruled out, amid tight labour markets. The Atlanta Fed's median wage tracker remained elevated in April, unchanged at 6% in year-over-year terms. Similarly, UK average weekly earnings were 7% higher than last year in March, while the unemployment rate fell to (almost) a 50-year low. As a result, we think inflation eventually will settle in the above-target 2-4% range over the medium term – uncomfortable for central banks, but not for businesses.

These developments have prompted central banks to shift to a more hawkish rhetoric, prioritising lower inflation. And, unsurprisingly, a steeper tightening cycle has been priced in by markets (implied rates based on Overnight Index Swaps). The Fed's target range of 0.75-1.00% is expected to rise by 200bps by year-end, including three consecutive 50bps hikes in the upcoming meetings. The European Central Bank is also predicted to raise its deposit rate by at least 100bps this year – the last time they raised it was in 2011. Similarly, the Bank of England's target rate is expected to increase by 125bps to 2.25%.

Because they don't need higher rates, the People's Bank of China (PBoC), Bank of Japan (BoJ) and Swiss National Bank (SNB) have bucked this trend. The PBoC is more likely to cut its main policy rates, the BoJ is still pressing on with its stimulative policy, and the SNB may hike once this year, from -0.75%. Although, the SNB's subsequent actions will likely be influenced – as often – by the performance of the franc relative to the euro: if the franc were to weaken appreciably, SNB rates might move closer to the ECB trajectory.

Finally, most emerging market countries were already well into their hiking cycles. Our estimates suggest that the latest GDP-weighted policy rate is already at 5.50%. But the recent surge in food and energy prices are likely to prolong their rate hiking cycle, in turn raising growth and debt serviceability concerns.

Ready to begin your journey with us?

Disclaimer

Past performance is not a guide to future performance and nothing in this blog constitutes advice. Although the information and data herein are obtained from sources believed to be reliable, no representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by Rothschild & Co Wealth Management UK Limited as to or in relation to the fairness, accuracy or completeness of this document or the information forming the basis of this document or for any reliance placed on this document by any person whatsoever. In particular, no representation or warranty is given as to the achievement or reasonableness of any future projections, targets, estimates or forecasts contained in this document. Furthermore, all opinions and data used in this document are subject to change without prior notice.