Monthly Market Summary: April 2022

Investment Insights Team, Investment Strategist Team, Wealth Management

Investment Insights Team, Investment Strategist Team, Wealth Management

Summary: Equity and bond markets under pressure

In April, investor sentiment deteriorated as the prospect of even tighter monetary policy moved into focus. Global equities lost 8.0% over the month (in USD terms), while global investment grade bonds fell 4.2% (in USD). Key themes included:

- Stocks fell despite upbeat earnings reports because of growth concerns;

- Yields of 10-year US Treasuries rose to highest level since the end of 2018;

- China's economy suffers from severe Covid-19 lockdowns.

Lacklustre results by tech heavyweights such as Amazon, Netflix and Paypal weighed on markets and overshadowed a so far positive corporate earnings season. First companies warned that China's lockdowns, including factory shutdowns, and resulting supply chain bottlenecks pose a risk for their outlook. Commodities recorded mixed results: The price of Brent Crude oil ended April at $109 per barrel and gold closed April at $1,897 per ounce, down 2.1% over the month. The International Monetary Fund (IMF) cut its global growth forecast for 2022 to 3.2% due to the war in Ukraine. In the case of an embargo on Russian oil and gas, growth could deteriorate further.

US: Q1 Contraction; surging dollar; hawkish Fed

Economic output unexpectedly declined in the first quarter (-1.4% Q/Q, SAAR) as temporary factors – including earlier Omicron-related weakness – led to a widening trade deficit and inventory destocking. Inflationary pressures continued to build, with the annual rate accelerating to 8.5% in March (from 7.9%), its highest since 1981. Despite headwinds from rising costs, ongoing logistical and supply chain challenges, the ISM Services PMI increased to 58.3 (from 56.5), and the wider labour continued to strengthen, with jobless claims falling to a half century low. The US dollar surged to its highest level in two decades as the market discounted an even more aggressive path of hiking ahead. Fed Chair Powell signalled that the Fed remains committed to taming inflation, opening the door for a 50bp interest rate hike in May and June.

Europe: Euro depreciates; weak GDP growth

The Euro Area economy expanded by 0.2% QoQ in the first three months of 2022, the least since Q1 2021 and below market expectations of a 0.3% advance. Meanwhile, investors are coming to terms that the ECB is faced with slowing growth and surging inflation. The annual inflation rate in the Euro Area was revised slightly lower to 7.4% in March (from 7.5%) but remains the highest inflation rate on record as the war in Ukraine and sanctions on Russia pushed fuel and natural gas prices to record high levels. ECB president Lagarde said that the central bank is likely to end its bond purchase scheme in early third quarter and raise rates before the end of 2022. On the political stage, Macron defeated his far-right rival Marine Le Pen to be re-elected president of France.

ROW: Chinese GDP rises; Yen hits a multi-decade year low

China’s GDP rose 4.8% compared with the same period a year earlier, but official data revealed a contraction in consumer activity as lockdown measures to counter the spread of Covid-19 weighed on the country’s outlook and the Renminbi which saw its steepest monthly fall. Meanwhile, China’s central bank reduced the amount of reserves that banks must maintain in an attempt to boost the economy. Japanese yen hit a 20-year low (¥129.39 against the dollar) after the Bank of Japan vowed to keep bond yields at zero. Driven by tax payments supporting the currency, the Russian rouble clipped a more than two-year high against the dollar and euro.

Performance figures (as of 29/04/2022 in local currency)

| Fixed Income | Yield | 1 M % | YTD % |

|---|---|---|---|

| US 10 Yr | 2.94% | -4.2% | -10.5% |

| UK 10 Yr | 1.90% | -2.1% | -6.6% |

| Swiss 10 Yr | 0.87% | -1.7% | -6.7% |

| German 10 Yr | 0.94% | -3.0% | -8.6% |

| Global IG (hdg $) | 3.74% | -4.2% | -10.7% |

| Global HY (hdg $) | 7.40% | -3.5% | -8.5% |

| Equity Index | Level | 1 M % | YTD % |

|---|---|---|---|

| MSCI World($) | 339 | -8.0% | -12.9% |

| S&P 500 | 4,132 | -8.7% | -12.9% |

| MSCI UK | 13,645 | 1.0% | 5.8% |

| SMI | 12,129 | 0.9% | -3.5% |

| Eurostoxx 50 | 3,803 | -2.0% | -10.7% |

| DAX | 14,098 | -2.2% | -11.2% |

| CAC | 6,534 | -1.3% | -7.9% |

| Hang Seng | 21,089 | -4.1% | -9.5% |

| MSCI EM ($) | 534 | -5.6% | -12.1% |

| Currencies (trade-weighted, nominal) | 1 M % | YTD % |

|---|---|---|

| US Dollar | 3.7% | 4.5% |

| Euro | -0.6% | -1.8% |

| Yen | -3.9% | -9.3% |

| Pound Sterling | -0.9% | -3.1% |

| Swiss Franc | -1.8% | -2.5% |

| Chinese Yuan | -1.7% | -0.6% |

| Commodities | Level | 1 M % | YTD % |

|---|---|---|---|

| Gold ($/oz) | 1,897 | -2.1% | 3.7% |

| Brent ($/bl) | 109 | 1.3% | 40.6% |

| Copper ($/t) | 9,771 | -5.8% | 0.3% |

Source: Bloomberg, Rothschild & Co.

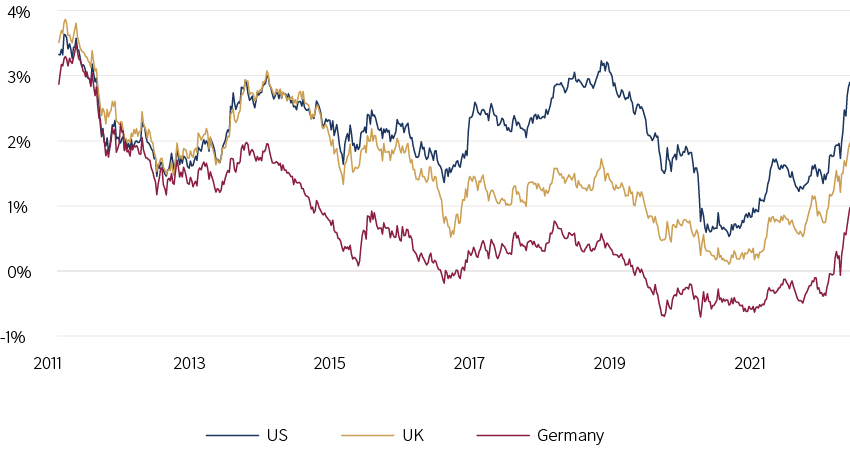

Development of 10-year government bond yields

Source: Bloomberg, Rothschild & Co, 1/1/2011 – 28/04/2022

Related Files

Download the full Monthly Market Summary (PDF 197 KB)