Private debt: An All-Weather investment strategy

Clément Schappler, Private Debt Investment Director, Hermance Capital Partners

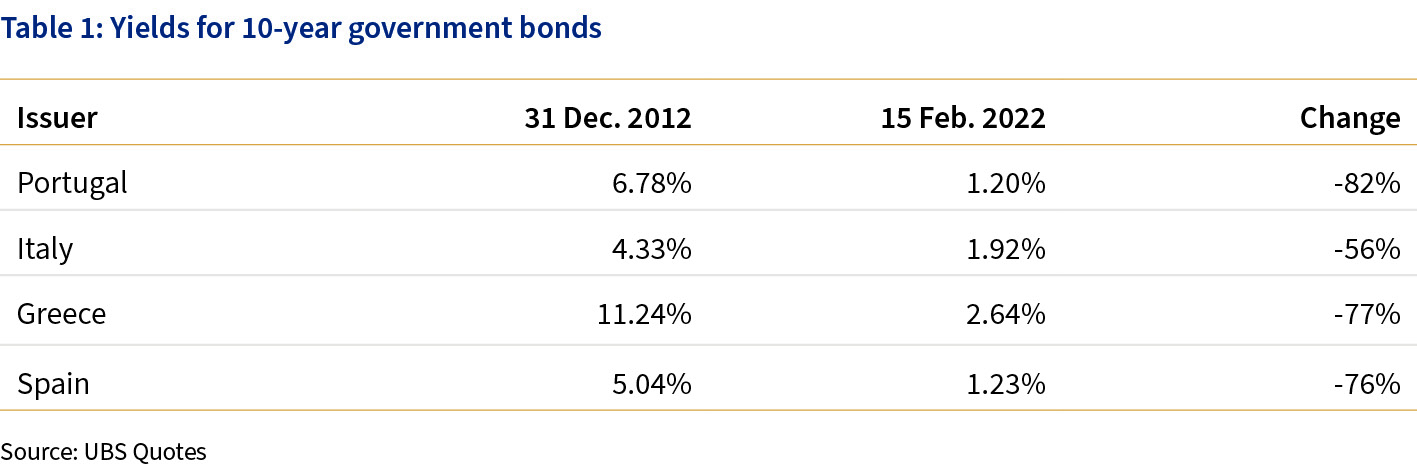

All investors are confronted with the problem of historically low interest rates, whatever the credit instrument (bond, syndicated bank loan), the type of issuer (sovereign, corporate, institutional), the maturity (short term, medium term) and sometimes even the level of credit risk (Investment Grade vs. Non-Investment Grade). The current interest rate abnormality is best illustrated by the yields on the sovereign bonds of the former “PIGS” countries:

By way of comparison, the yield on 10-year Swiss government bonds was +0.26% on 15 February 2022, compared to +0.41% on 31 December 2012, a drop of more than 35%. Note that the German 10-year Bund suffered a similar fate over the same period.

In addition to low yields, there are the economic uncertainties at the moment, namely the real impact of the health crisis on the economy, the impact of sanctions from the war in Ukraine and the pressure on multi-decade high inflation from rising oil prices. In this context, it is still not clear how central banks will react in terms of monetary policy, despite signalling multiple interest rate rises this year.

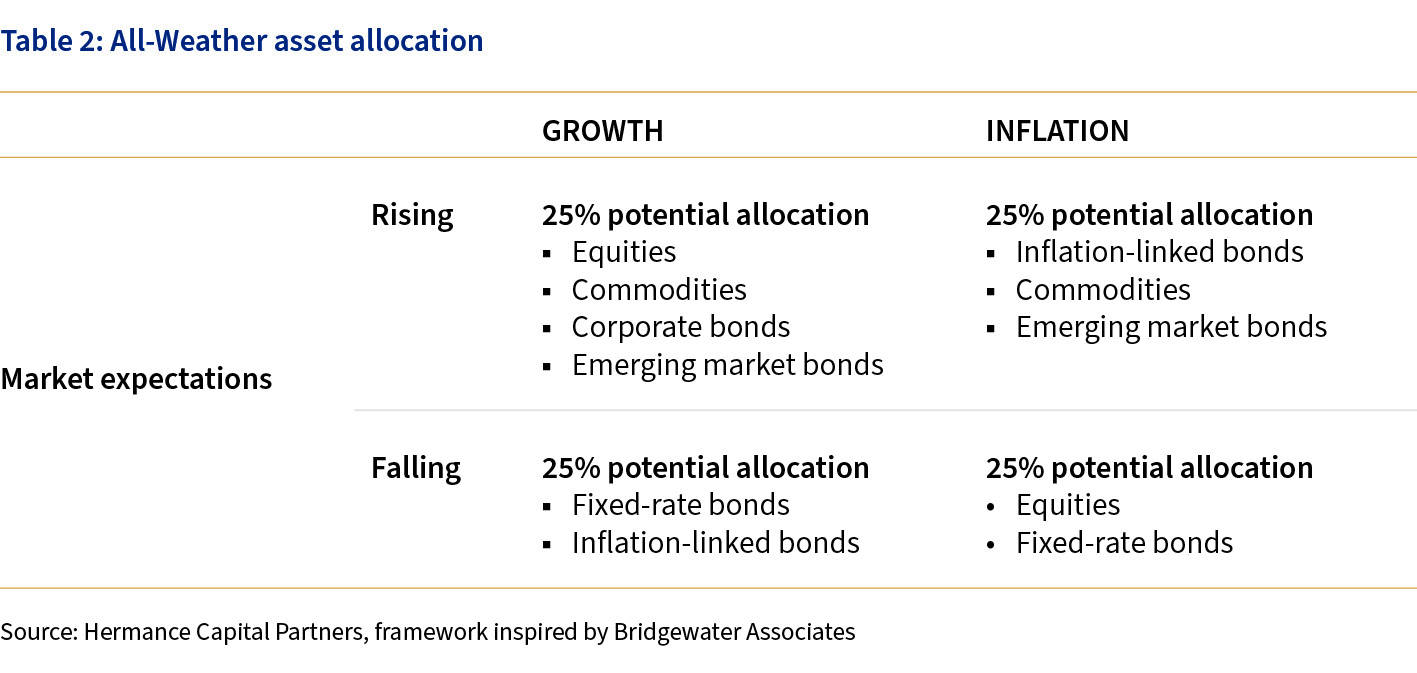

The current environment seems like the right timing to explore the concept of an All-Weather investment strategy (concept borrowed from Bridgewater Associates) and to demonstrate how private debt assets fit particularly well within this concept.

As a reminder, the All-Weather investment strategy makes it possible to navigate uncertain environments with the framework assumption that economic growth and inflation are the two driving factors of asset class performance.

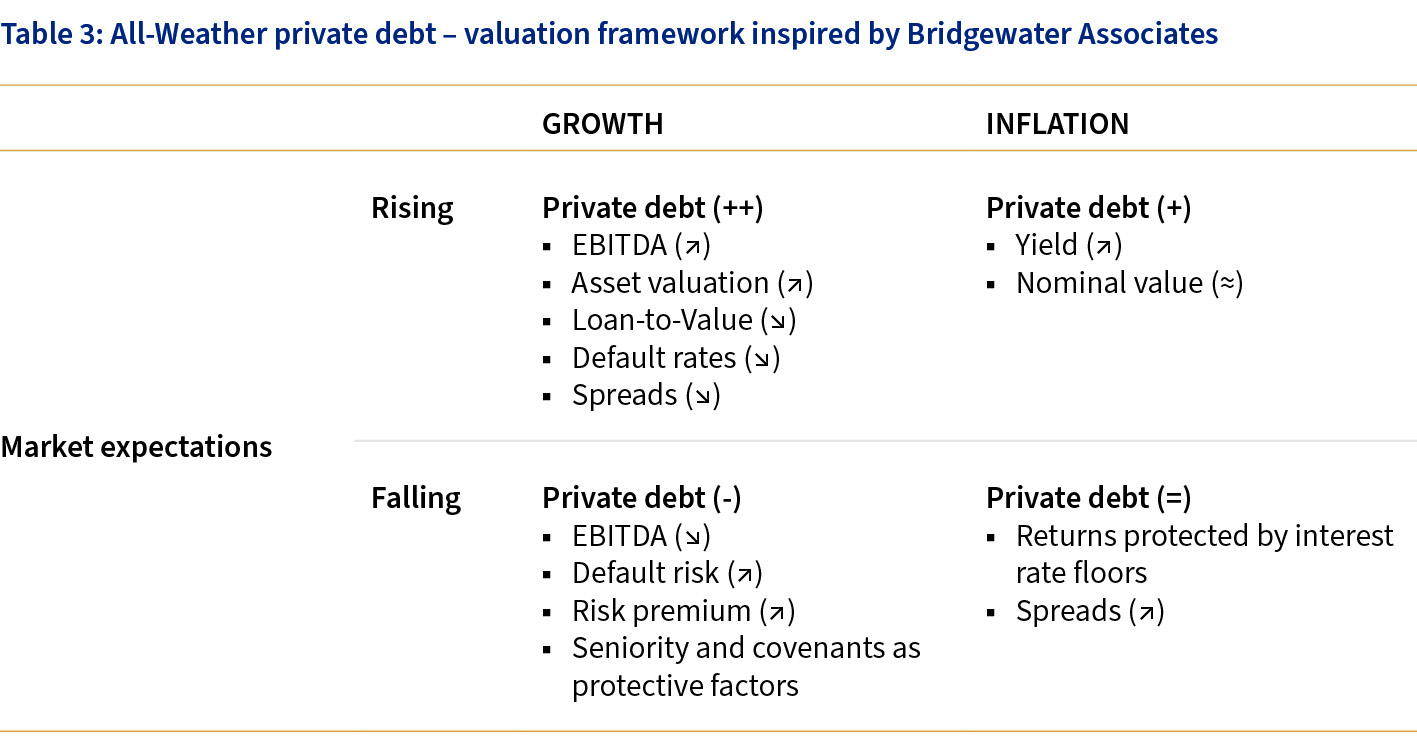

By transposing this analysis grid to private debt, we realise that private debt has the capacity to perform well independently of market expectations.

Clearly, private debt performs better in rising environments, be it growth or inflation. In this context, similar to the one that we are currently living in, private debt has the potential to deliver attractive risk-adjusted returns; especially if the inflation factor remains at current levels and triggers central bank action.

On the other hand, should expectations of higher growth and inflation be disproved, say in the course of 2022 or next year, private debt would also be under pressure, but it would offer tangible protection to investors against the devaluation of their capital. And we believe it would still generate positive returns in real terms.

Private debt thus lives up to its name of an All-Weather investment. This is a term that is increasingly used by private debt asset managers, particularly in relation to opportunistic strategies. These private debt strategies aim to take advantage of particular market situations, such as a sudden increase in risk premiums or a liquidity crisis.

This is where the selection of private debt managers makes all the difference. By ensuring that the investment teams extending the loans have the required credit cycle experience and that the credit covenant packages in place provide a safeguard should the economic situation deteriorate.

Hermance Capital Partners

Hermance Capital Partners was created in 2015 on the initiative of Banque Paris Bertrand as an investment boutique focusing on private markets. Rothschild & Co acquired Banque Paris Bertrand including Hermance Capital Partners in 2021. Hermance provides a wide range of investment solutions across high-conviction strategies with attractive risk-return profiles. Through its modular approach, Hermance enables qualified investors to build a diversified portfolio of high-quality private equity, private debt and private real estate assets. Today Hermance manages $700m in private market assets.