Wealth Management: Market Perspective – Moving on?

Kevin Gardiner, Global Investment Strategist, Wealth Management

Biden, Hamilton, tech and China

The rear-view mirror

The forecasting game is no respecter of status or smartness at the best of times.

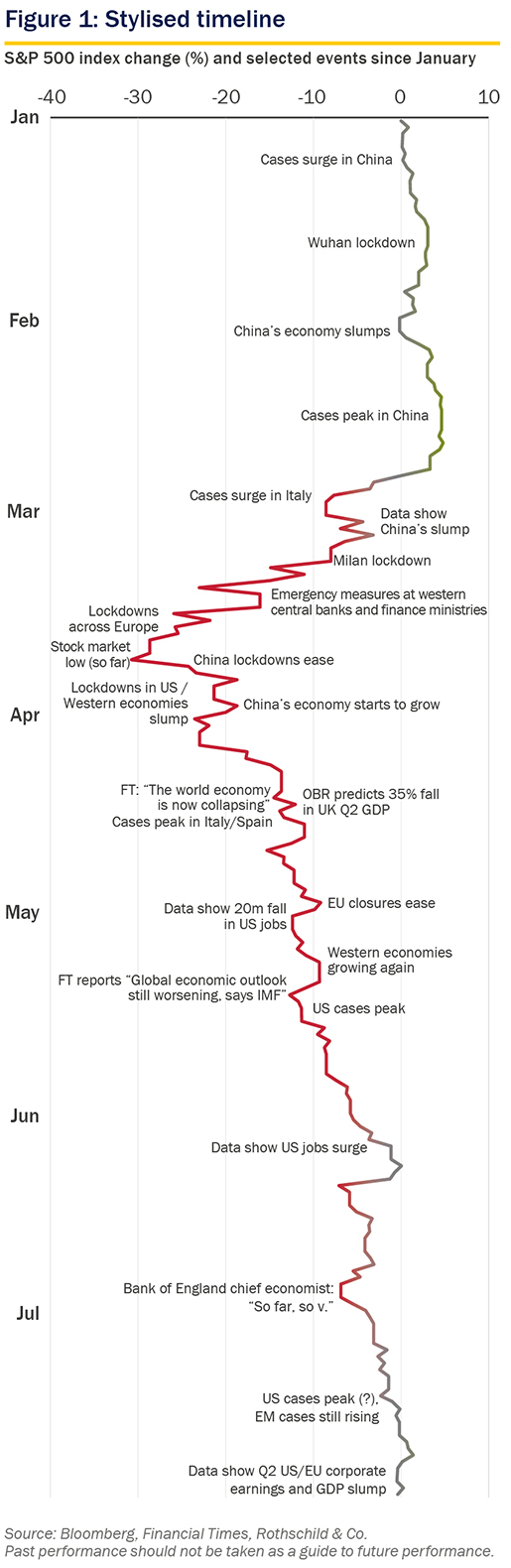

The stylised timeline opposite (figure 1) shows how some of the starkest economic prognoses were made when the worst of the global slump was already behind us. In this sense at least this otherwise very special downturn has been like so many others.

The global economy was not “collapsing” in mid April: it had already collapsed, and was bottoming out. When the IMF said in May that the economic outlook was “still worsening”, the global economy was growing again.

The biggest single forecast miss may have been the UK Office for Budgetary Responsibility’s projection in April of a 35% fall in UK GDP in the (then current) second quarter. In July it quietly revised its guess to a drop of 23% – still a horrendous plunge, but quite a few points of horror to the good (and maybe still too pessimistic).

If the brightest and best can get the short term so wrong, what chance have the rest of us?

Crises trigger a belated appreciation of something we wish we’d spotted in advance, and subconsciously divert our “forecasting” gaze backwards. We end up driving by looking in the rear-view mirror, as it were.

Capital markets don’t feel embarrassed. They can show signs of memory, because their returns are often autocorrelated – but such trends can stop or reverse abruptly. The timeline shows the US stock market falling before the economic data, and rebounding faster too.

The stock market is far from infallible. Like many pundits, it may have exaggerated the scale of likely long-term damage, falling by a third to 23rd March. It could now be exaggerating the scale of the rebound, though we are less convinced about that (looser policy has boosted markets too). But when it makes mistakes, it quickly realises and corrects them.

Luckily for pundits, the public rarely hold them to account, and few seem to audit themselves. One honourable exception is the Bank of England’s chief economist, who noted in late June how the global rebound has defied his, and others’, initial pessimism – in his words: “so far, so V”.

Why such little accountability? The public is more sensitised to losses at the best of times. But when it hears the boy cry wolf, it can then forget he did so. Our collective memory, though longer than the markets’, can be pretty short nonetheless.

It is hard to remember how we felt before all this, in January. It is getting difficult to recall just how bleak so many people felt in March. How will we feel in a few months’ time?

Happy shiny people

Stocks are not the only asset to have performed strongly of late. Corporate bonds have unsurprisingly also done well – but so have gold and silver, and their gains likely have less to do with economic revival.

Typically, precious metals do well when inflation risk is rising, the dollar is falling, banks are in jeopardy and/or expected real interest rates are falling (when their own lack of yield counts less against them). They can be a sort of financial “panic button”.

Precious metals are scarce. The World Gold Council (WGC) estimates that there are perhaps 200,000 tonnes of gold above ground, with annual supply around 2,000 to 3,000 tonnes and maybe around 50,000 to 60,000 remaining below ground. Others have suggested that all the gold on the planet would fit into two Olympic-sized swimming pools.

Gold and silver are also intrinsically attractive. The WGC suggests that roughly half of all that mined gold is in the form of jewellery. A fifth is held as an investment, another fifth by central banks and the rest has gone to practical uses. Among other things, they can function as catalysts, and silver is an input to solar energy cells – though it is not that “green” because it still has to be mined.

Their scarcity and decorative appeal has made them natural stores of value over several millennia, to be treasured (literally) when man-made stores of value are being questioned.

We are sceptical of their investment appeal, however. We prefer them to cryptocurrencies, whose supply is unlimited, and whose security and liquidity is dependent on internet access. But we do not see current financial risk as being sufficiently intense to warrant sheltering in such inert assets.

Gold and silver’s multi-millennial credibility masks their shorter-term volatility, which in this context can last for an investor’s lifetime (both have yet to regain 1980’s highs in real terms – particularly silver, which in 1980 was squeezed higher by an attempted market corner). That said, to make a difference to overall portfolio performance we’d still need to own a lot of them.

We didn’t expect them to do this well. But to have recommended a large position would have been irresponsible even if we had. Other gauges of inflation and banking risk have been pretty stable, and the dollar, though soft, is hardly collapsing (see below).

Time to move on

The recovery has some way to go yet, and many things could knock it off course. But we see the disappointing level of contagion in the US and emerging economies as a prolonged first wave – and, in the case of the US, partly perhaps a reflection of wider testing.

A vaccine remains some way off, and a genuine second wave of contagion is always possible – as we write there are renewed worries in Spain, Hong Kong and South Korea, among others. It is not inevitable, however, and responses to a second wave might differ from the scale of suppression seen in March.

The imminent reduction in unemployment support in the US, and the approaching fading of furlough schemes in Europe, also pose a threat. However, if lockdowns have eased, the need for that support may be a little less pressing: stall speeds may be rising.

As we see it, economies are moving forwards again, and will likely continue to do so. The corporate news seems also a little less grim than feared: projected earnings have risen slightly.

And we can see a modest silver lining to this dark cloud (remember, we’re talking here only about economics, not wider human concerns): the wait for the next US recession that has dogged the last few years has been lifted.

We didn’t think the longest-ever US expansion had to end just yet, but with the lockdown from March, the cyclical clocks have been reset. Arguably, the future should feel a bit more open-ended than it did.

But if we’re moving on, there may be a few bends in the road to negotiate.

Biden time?

Perhaps most visibly, the US election looks more open, and this could matter for markets. The president’s credibility has fallen further as contagion has risen and GDP fallen: Biden is firmly ahead in the polls, and the Democrats have a chance of a clean sweep.

November is still three months off, and as we’ve just noted the economy is likely improving. Moreover, Mr Trump’s very vocal critics often make the mistake of taking him literally, but not seriously: his supporters are quieter, and less troubled by his verbal and logical stumbles.

A Biden win, however, may need to be considered carefully by investors: he seems likely to hike taxes, particularly those on business, and the minimum wage. This may be a price many would be happy paying, particularly since the wider economic and business impact would be muted by the recycling of those taxes into environmental, educational, healthcare and infrastructure projects. Nonetheless, it could affect the relative performance of US assets at least – particularly since it may coincide with a positive development in (continental) Europe, and an ongoing revival in risk appetite (the dollar and US stock market are often perceived as relative safe havens).

A more credible EU?

European federalism has advanced in the last month. The parallel with Alexander Hamilton’s historic mutualisation of the American states’ debt is overstated, but something significant has happened.

Some mutual borrowing and no-strings-attached grant aid made it into the EU pandemic recovery fund that was finally agreed in July – and the scale of the overall package (at roughly 5% of EU GDP) is larger than initially proposed.

The vast bulk of outstanding debt will remain the responsibility of individual countries. But the German-led initiative is striking even so, and as we noted in June, borrowing is not (money) printing. The long-term credibility of the union, and implicitly of the euro, has been boosted.

It could be, then, that US businesses are about to lose some appeal just as European assets gain some. American stocks and the dollar have outperformed the rest of the world in the last decade, and are looking more expensive than usual. Is it time to look for new market leadership?

Bubble watch

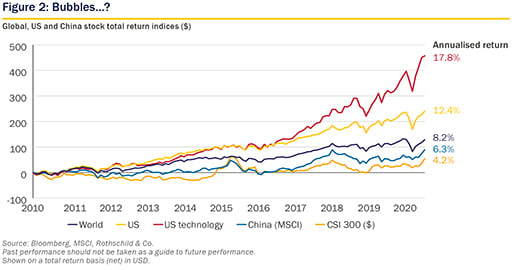

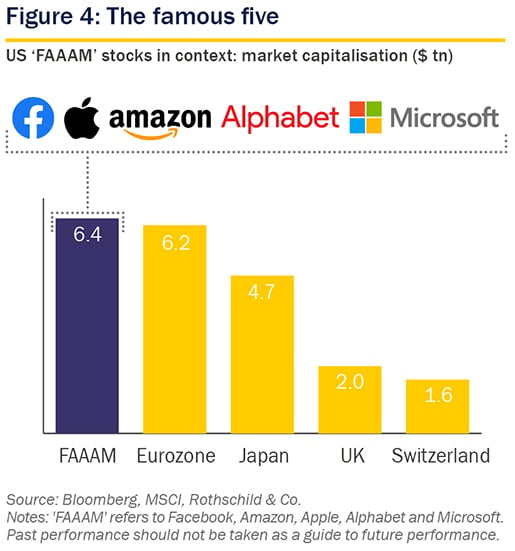

Meanwhile, two outperforming segments of the global stock market are attracting attention as possible “bubbles”. Namely: the US technology sector, and the small group of related big stocks that has led the way up; and the Chinese market indices (figure 2).

Technology is closely linked to the ongoing “style” debate. If we divide the stock market into two blocs, “growth” and “value” – with higher valuations allegedly reflecting better long-term “growth” prospects – we’d usually find most technology stocks in the former. It has been outperforming the value bloc for more than a decade.

Extra momentum seems to have been added of late as smaller retail investors, channelled by newly-popular trading platforms such as Robinhood, have boarded the bandwagon.

Originally attached to fiascos in the 17th and 18th centuries (Dutch tulips and the South Sea respectively), “bubble” seems nowadays a label for any asset whose price has risen sharply and unexpectedly.

We think it makes sense only where prices have risen dramatically, and way ahead of “fundamentals” such as earnings or dividends; and where investors risk losing most, if not all, of their money.

It is not always a clear call. For example, most government bonds today are very expensive, but will likely be repaid at par. Amazon, and the technology-heavy NASDAQ index, both surged and slumped in 2000, only to eventually rebound to new highs. Many emerging currencies that have permanently collapsed did not surge beforehand.

But Japan’s stock market (and Tokyo real estate prices) in early 1990 were surely in a bubble. Many other technology, media and telecom stocks, along with the short-lived tech-focused Neuer Markt index in Germany, were in a bubble in 2000; so was silver in 1980.

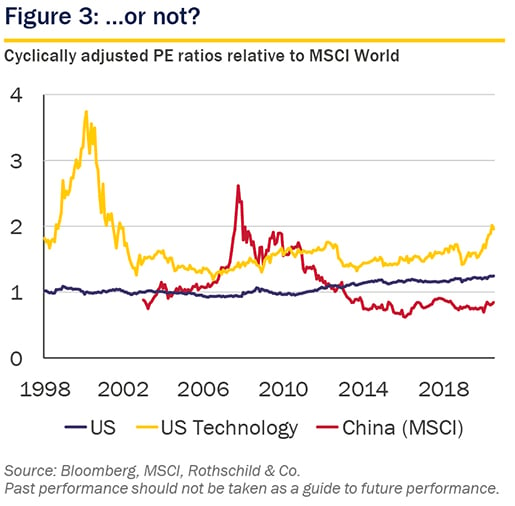

The recent gains in US technology, and in that small but high-profile group of stocks (figure 3), have been striking, but remarkably steady, and not (yet) exponential. China’s outperformance looks frothier, but is much more recent.

Figure 3 shows our estimates of cyclically adjusted valuations. They reveal the extent to which outperformance may be backed by substance (as opposed to froth). US technology’s valuation looks less frothy than its price, and remains materially lower than in 2000 (when it was closer to deserving the label).

For technology, and “growth” stocks more generally, their faster expected earnings growth places much of their worth a long way into the future. When perceived discount rates have been falling their valuations arguably ought to be higher than usual.

China’s market is more conventionally cyclical, but its valuation was low before the recent surge, and remains unremarkable. There too, we think the bubble charge is not yet proven.

No tree grows to the sky

Valuations are not the end of the story, however. The technology sector in particular faces growing headwinds. It is caught up in reviving trade tensions, whether because of perceived special tax treatments, or the security issues and retaliations raised by China’s Huawei. Its big names face growing scrutiny of their allegedly-dominant market positions and use of customers’ data.

Meanwhile, some of the sector’s recent gains reflect simply a redistribution of advertising revenue, away from conventional media to online platforms, rather than genuine innovation.

There is more to the technology sector than social media and search engines: “old” tech is still creative, there are new innovators, and also some unexpected names (such as the payment card companies). And much of the value-added by “technology” happens elsewhere. As noted, Amazon is these days classified as a retailer, and many other large companies use and create new technologies.

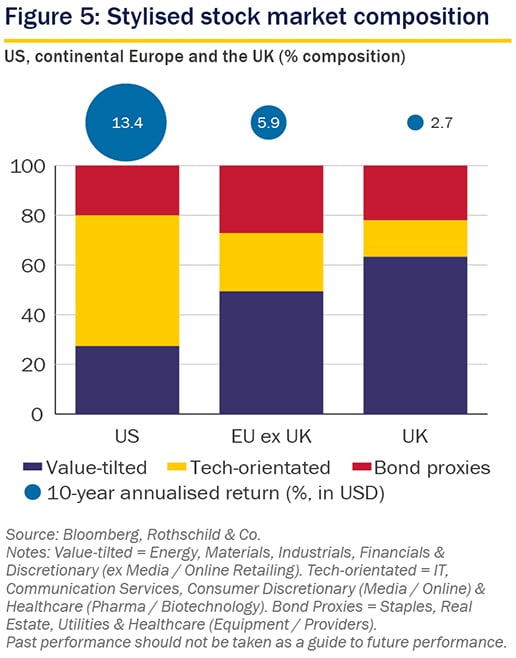

The sector’s appeal can fade without it being a bubble. When it does, that may be another reason for revisiting the regional call discussed above: the US tends to have more technology and long duration stocks in general than most other places – including Europe (figure 5).

In the meantime, to expect the US stock market to start to lag Europe’s when technology is still popular might be a tall order. Sectoral composition often trumps local economics.

There is of course one macro development that could catalyse an early change in both sectoral and regional leadership: a global rethink on interest rates.

Good luck with that.

Click here to continue: Market Perspective: Economy and markets: background

In this Market Perspective:

- Foreword

- Moving on? (current page)

- Economy and markets: background

- Important information

Download the full Market Perspective in PDF format (PDF 1.4 MB)