Wealth Management: Market Perspective – Even lower for even longer?

Kevin Gardiner, Global Investment Strategist, Wealth Management

We think an uncertain future still needs to be discounted… and eventually will be

“Gentlemen,” I said, “I've studied the maps,

And if what I'm thinking is right

There's another new world at the top of the world

For whoever can break through the ice”

Josh Ritter, Another New World

Last year's 'summer of love' in the global bond market, and the U-turn in US monetary policy, once again underlined the gap between interest rate reality and expectation.

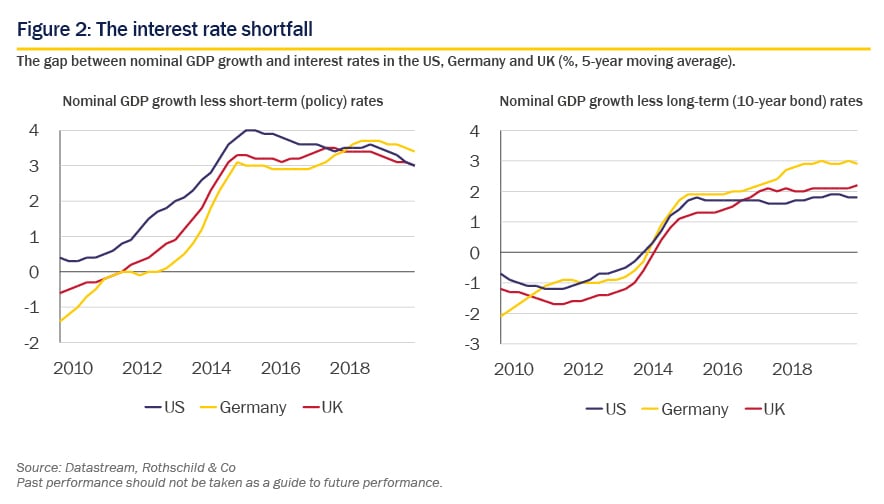

In fact, interest rates have now been unusually low for a decade. The gap between nominal GDP growth - an approximation of 'normal', perhaps - and interest rates has been trending at firmly positive levels in recent years.

Click the image to enlarge

We don't mind admitting we've been surprised. We're in good company. More importantly, it has not stopped us from seeing value in stocks - the main source of inflation-beating returns in most balanced portfolios.

We wrote about this topic in September, but make no apologies for revisiting it so soon. Conscious of being such stale bears of bonds, we are trying to keep a more open mind. Might today's rates after all be sustainable? If so, what might they mean for client portfolios?

Another new world? Roundtable discussion

Are we missing something? As part of our due diligence, a recent roundtable here included two external and firmly independent guests - an eminent economics professor with monetary policy experience and an asset allocator from a big sell-side bank. But there was little talk of another new world.

The current situation admittedly looked pretty stable. Today's rates and yields may not last forever, but there is no obvious sign of an imminent regime change. The phrase 'local equilibrium' featured.

A shortage of 'safe' assets relative to demand was mooted - a result of the prudential political climate. Debt issued by the most highly rated governments has been rising, but has fallen short of global demand. Some of the underlying drivers may have been in place even before the Global Financial Crisis.

For example, much recent economic growth this century has come from emerging countries, whose own bonds are not (yet) perceived to be 'safe', which has added to net demand for developed country bonds. Since 2008, of course, the squeeze has been augmented by central bank buying through quantitative easing (QE).

There was scepticism - and not just from us - about 'secular stagnation'. Output growth may be under-recorded (perhaps by 0.5 percentage points per annum), most likely because of the more 'virtual' modern economy. It was suggested that patent applications show no obvious sign of a structural slowdown.

In discussing potential destabilising shocks, there seemed to be more deflationary ones - in which case, the most likely policy response to any renewed slump would have to be fiscal, not monetary. Government reluctance to use today's low yields to boost infrastructure spending is a bit puzzling.

It was suggested - again, not just by us - that there may be fewer 'bubbles' out there than pundits suggest. Bonds may not be a wealth-preserving investment at today's prices, but likely losses to maturity do not deserve that label.

Turning to stocks, it was noted that some markets are currently positively inexpensive, including the UK, Germany and Spain. The US market is more obviously pricey, but not prohibitively so.

We also discussed the impact of low yields and greater life expectancy on defined benefit pension schemes; the varying distribution of risk appetite across geographies (rather than cohorts - 'new' money is no more risk-taking than 'old'); and a suggestion that philanthropic investing is spreading.

Previously, we've suggested several possible reasons for today's interest rates regime:

- secular or cyclical disappointment on growth

- 'supply-driven' growth (as opposed to the demand-driven, Keynesian establishment sort), which can coexist with falling consumer prices (deflation)

- lowered 'time preference' (if society takes the welfare of future generations more seriously, and/or if today is somehow seen as more uncertain than tomorrow), and/or 'production possibility frontier' (if corporate profitability were trending lower)

- the flow-based 'distortion' discussed here.

The last of these is the one we've largely opted for to date. That seemed to be our guests' view too - but none of us saw that picture changing anytime soon.

Suprasecularly speaking...

Another form of outside advice we may need to heed is the academic literature. There has been an intriguing new addition to the debate.

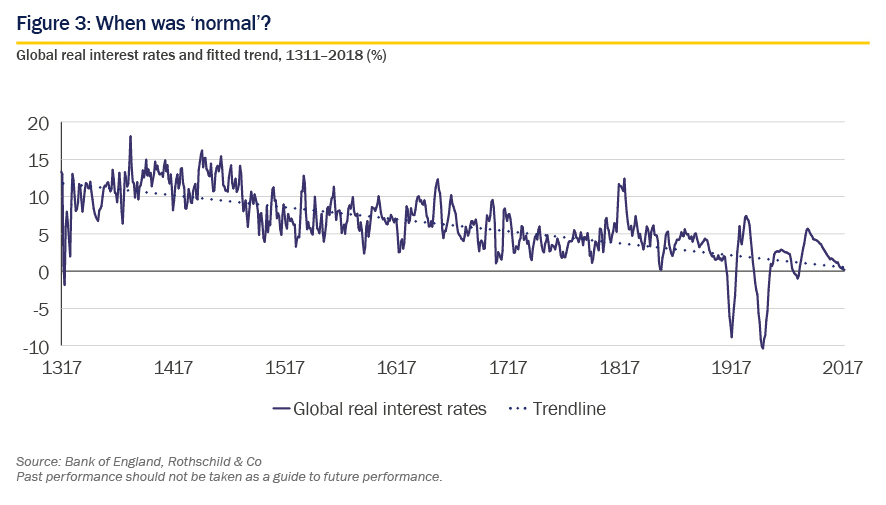

A Bank of England working paper by Paul Schmelzing - Eight centuries of global real interest rates, R-G, and the 'suprasecular' decline, 1311-2018 - presents, for the first time, a continuous, weighted series of global real interest rates from the 14th century. It is a daunting feat of scholarship, and getting widespread attention. And here's the thing. The data seem to suggest that 'normal' doesn't exist - and never did.

Over the full period, Schmelzing's global real rate averages 4.6% (on top of inflation of 1.6% per annum). But even the most cursory look at his charts shows that the series is not stationary: it slopes downwards (as does the volatility of both real rates and inflation).

Starting at around 13% in the early 14th century, Schmelzing's identified trendline slopes down to almost zero now, at an average annual decline of 1.6 basis points (0.016 percentage points per annum).

Click the image to enlarge

Most of today's real rates of course are negative, sitting just below that trendline (he works in terms of seven-year moving averages). But if we extrapolate the line into the future, it suggests that negative real interest rates will become the norm, not the exception, within many of our younger clients' and colleagues' working lives.

On this view, today's interest rates may not be that unusual, but merely the shape of things to come. We just got there early, maybe because of QE, expectations (mistaken or not) of secular stagnation, imminent deflation or whatever (the paper doesn't talk much about the underlying reasons for the trend).

Schmelzing distinguishes between 'safe' real interest rates and the overall average. It is the latter where the trend decline is most visible, suggesting that spreads for riskier loans are largely responsible (not that people noticed or thought about such things at the time).

He also suggests that a declining trend in real interest rates reflects declining returns to capital generally - and that this refutes Thomas Piketty's influential Capital in the Twenty- First Century (2014). The 'R-G' in the title of Schmelzing's paper refers to Piketty's assertion that investment returns exceed growth rates, dooming us to higher inequality.

But this is where we say so long and thanks for all the fish.

Schmelzing's compilation skills, and his sheer erudition, are remarkable. But medieval borrowing costs may not be relevant to today's.

We have known for some time that real interest rates in the distant past may have been a lot higher. Sydney Homer's A History of Interest Rates (1902) reported Sumerian (3000 BC) real rates on grain at one-third (that is, 331/3%). But classical - and medieval - capital markets were rather different to today's (as are retrospective inflation indices).

As noted, Schmelzing does not speculate much on causality. But it is quite possible that the long-term decline in real interest rates - like the secular decline in stock market yields since stock indices were produced in the 19th century - is simply reflecting a massive change in liquidity and creditworthiness.

Credit is no longer the preserve of kings or individual merchants, but reflects the borrowing and lending decisions of millions of households and intermediaries, all better informed, and creditworthy, than the brightest scholars in the old world.

Nor are we convinced that the decline in real interest rates is necessarily reflective of 'the' return on capital generally (we doubt such a thing exists).

History has a lot to teach us qualitatively, but can be the source of much spurious precision. And while we pride ourselves on taking a long-term view, 700 years is not really practical - an entire lifetime can be spent below (or above) the trendline.

The most relevant interest rates for today's investment decisions are surely those of the last half century or so. During this period, the downtrend is less pronounced.

That said, as the roundtable discussion underlined, we're getting less, not more, confident about the prospects of rates rebounding any time soon. And we didn't buy Piketty's thesis anyway.

Investment conclusion?

If we're right, and interest rates are still likely eventually to rebound alongside ongoing economic growth, then there are probably better long-term returns to be had from other assets - most likely, stocks.

If we're wrong, and rates again defy expectations to stay even lower for even longer, then clearly bonds will do better than we expect. But what about stocks, and business generally?

It all depends of course on why those rates stay low. If growth is going to disappoint - say we're wrong about secular stagnation, and it's real - then stock returns, and the business climate, may disappoint too. Defensiveness would be the name of the game.

But if yields stay low because of a supply-driven regime change, or lowered time preference, say, then stocks may still have the edge. If we use today's interest rates to discount stocks' long-term cashflows, the big equity indices look cheap, not dear - especially, even after their tremendous run to date, those in the longest-duration regions and sectors, namely the US and technology.

Click here to continue: Market Perspective: Economy and markets: background

In this Market Perspective:

- Foreword

- Unfinished business

- Even lower for even longer? (current page)

- Economy and markets: background

- Important information

Download the full Market Perspective in PDF format (PDF 3.9 MB)