Mosaique Insights: Issue 11

The only constant in life is change.

The first few months of 2023 were remarkable, and raise many questions about the future of the financial markets and the economy at large.

It is against this backdrop that we bring you the latest edition of Mosaique Insights in which we elaborate on how we navigated this first quarter of 2023 with contributions from our investment strategists, portfolio managers and fixed income teams and explain how we are positioning ourselves in this environment.

We also take the opportunity to look at recent market trends, namely artificial intelligence, and highlight most recent developments in the space - expect to hear more on this topic in the coming months. Furthermore, we shed light on the asset class of private markets and provide you with some insights into our philanthropic group approach called R&Co4Generations.

We hope you enjoy this edition of Mosaique Insights!

Laurent Gagnebin

CEO, Rothschild & Co Bank AG

Dr. Carlos Mejia

Dr. Carlos Mejia

CIO, Rothschild & Co Bank AG

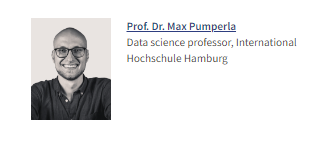

The following text is an excerpt from an interview we conducted with Prof. Max Pumperla.

Should you wish to receive the full publication, please contact your client adviser or send our Marketing team a message.

Artificial intelligence: The race to the future

Artificial intelligence (AI) has revolutionized the way we live, work, and communicate. From voice assistants to self-driving cars, AI is everywhere. But what is the future of AI, and how will it change our lives?

To answer these questions and more, we sat down with Prof. Dr. Max Pumperla, a data science professor at International Hochschule in Hamburg, and software engineer at Anyscale in San Francisco. He is also the lead author of “Learning Ray”, a book about the fundamentals of large-scale machine learning, and a contributor to the Ray project, on which models such as ChatGPT have been trained.

Q1. The world has been very excited about the new chatbot ChatGPT, with much talking about a breakthrough in the development of artificial intelligence and new possibilities for putting it to use. Did a new digital revolution begin in December 2022?

GPT-3, the base model underlying ChatGPT, will be three years old in June already. The fundamental building block in all such systems, the so-called transformer, has been in use since 2017. In other words, this breakthrough has been long in the making, but it’s certainly worth calling it one. I think it’s a big deal. While models like ChatGPT, or the newly released GPT-4, still have many flaws, even their most pessimistic critics can’t deny one thing: they’re extremely useful. Personally, I use these AI systems every day for coding, writing prose, text summarization and other tasks. It’s already inconceivable to me to go back to the old times, when I didn’t have such assistance. This is ultimately what technical revolutions always feel like. That same feeling will likely settle in for a larger consumer base, as the products around this technology mature enough. Even if we dropped all AI developments today, I think that the current state of technology would be enough to revolutionize most digital businesses substantially. Recent announcements such as Microsoft’s 365 Copilot give you a glimpse of what’s about to come.

Q2. What does AI change and how does it change the way we do business?

To paraphrase Amara’s law (American scientist and futurist), we often overstate the impact of technology in the short term and underestimate it in the long run. This is likely the case with the current wave of AI, too. Having said that, it’s not only ChatGPT that should be in the spotlight. We’ve made considerable progress in translating speech to text, generating speech, images or even videos, and many other tasks. For instance, taking a picture of your fridge, asking a voice assistant to tell you which recipes could be cooked from the ingredients you have, and then getting detailed, interactive cooking instructions – that’s not science fiction anymore. Also, the threshold for entering markets will decrease. For instance, with ChatGPT you don’t need to be a programmer to code relatively complex apps. I half-jokingly claim that I was an ok programmer before, but with GPT-based tools I’m an army of one. In day-to-day business, expect these AI systems to help you ideate and write good first drafts of all sorts of reports, transcribe and summarize meetings, give you complete suggestions for email replies, help you do analytics in your Excel sheets or create data visualizations. In other words, a lot of the grunt work will be automated, and we’re free to focus on more strategic topics. For me, it’s already a game changer to be freed from so many menial tasks, and I don’t think anyone will miss setting up a PowerPoint presentation. Beyond that, it’s difficult to judge the long-term impact at this point. 2023 is going to be an interesting year.