Global supply chains

Geopolitical risk has risen, consumer demand remains firm, and the 're-shoring' debate has not disappeared. So, what are the latest developments in global supply chains?

Healthy conditions prevail

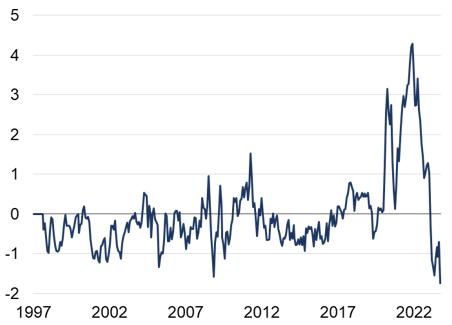

Supply chain conditions have actually remained healthy over the past few months. The New York Fed's Global Supply Chain Pressure Index – which combines supply-related PMI sub-indices and transportation cost data – fell to a fresh low in October, reflecting a substantial freeing up of capacity (Figure 1).

Figure 1: Global Supply Chain Pressure Index

Standard deviations from long-run average

Source: Rothschild &Co, Bloomberg, Federal Reserve Bank of New York

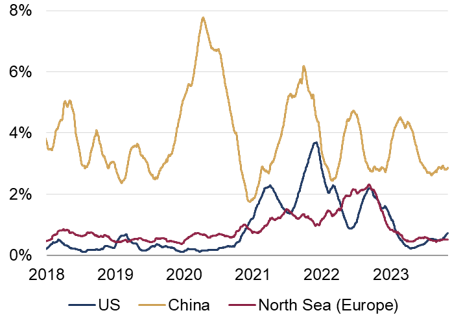

Other supply chain metrics also suggest that healthy conditions have prevailed. For example, container ship congestion has eased considerably at the major ports in the US, Europe and, most importantly, China (Figure 2). Subsequently, goods-related inflation has continued to fall in the developed world.

Figure 2: Containership traffic at major ports

Waiting ships relative to global capacity (%)

Source: Rothschild & Co, Kiel Trade Indicator

Note: US refers to ports in South Carolina, Georgia and Southern California. China refers to ports in Hong Kong, Guangdong, Shanghai and Zhejiang

Clearly, the tragic events in the Middle East are having little impact on global supply chains so far, though further escalation cannot be ruled out.

Re-shuffling, not re-shoring

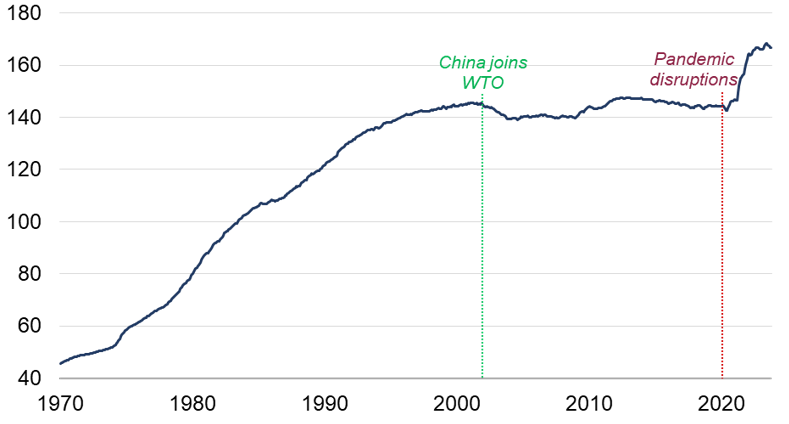

China's rapid ascent as a major player in the global trade network, along with the integration of other EM Asia economies, led to a structural change in goods-related inflation: the US goods Consumer Price Index (CPI) was flat for almost 20 years following China's accession to the WTO in December 2001 (Figure 3).

Figure 3: US goods CPI

Seasonally-adjusted index (1982-84=100)

Source: Rothschild & Co, Bloomberg, US Bureau of Labor Statistics

Note: US goods CPI accounts for roughly 20% of the entire CPI basket

That said, the supply chain 're-shoring' debate has been in focus in the post-pandemic world, after a combination of (temporary) supply shortages and increased geopolitical rivalry between the US and China. Bringing production closer to home would lead to a revival in goods-related inflation: factories would need to be re-located, labour would be more expensive, and manufacturing processes would not be as competitive.

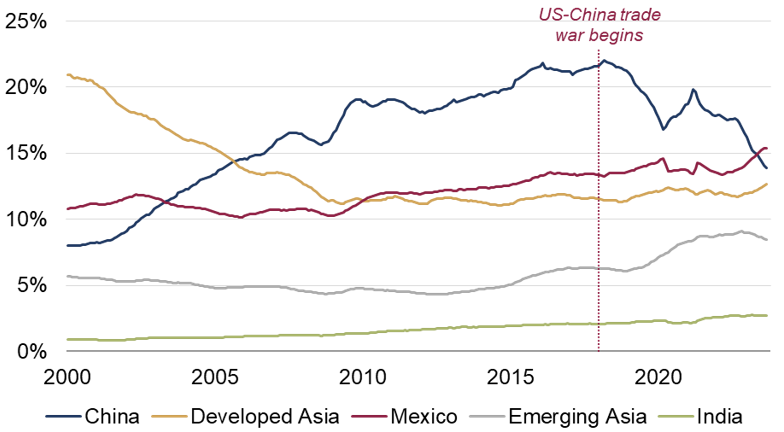

Admittedly, the US' goods import share from China has fallen since Trump commenced his trade wars with Beijing at the start of 2018 (Figure 4), but there is still little evidence of wider 're-shoring'. Instead, it looks as if supply chains may have been 're-shuffled', with the US importing a greater share of goods from other Asian countries and Mexico. China is the biggest supplier of course, because some of its share has been taken up elsewhere – perhaps via indirect China-US trade linkages. For example, this might occur if intermediate goods are exported from China to other Asia Pacific countries for assembly, then re-exported to the US. Some studies also suggest that US firms may have been misreporting their imports from China to avoid higher tariffs (see here).

Figure 4: US goods imports by region

Proportion of total imports in USD terms (%), 12-month moving averages

Source: Rothschild & Co, Datastream, US Census Bureau, author's calculations

Note: Developed Asia refers to Taiwan, South Korea, Singapore and Japan EM Asia refers to Thailand, Indonesia, Vietnam, Philippines, Malaysia and Burma. Data have been seasonally adjusted by Datastream.

A recent study from the Bank for International Settlements also concluded that the greater regional integration of supply chains – particularly in Asia – has not reversed (see here).

Conclusion

Supply chain conditions have continued to look healthy in recent months, and aside from US-China trade, non-commodity trade may not yet have deviated from its market-led direction in a significant manner. And even where imports from China are concerned, the Biden administration and Treasury Secretary Yellen have stressed several times that the US is trying to 'de-risk' – not 'de-couple' – from China, and only in critical areas, such as semiconductors and EV batteries.

Ready to begin your journey with us?

Speak to a Client Adviser in the UK or Switzerland

Past performance is not a guide to future performance and nothing in this article constitutes advice. Although the information and data herein are obtained from sources believed to be reliable, no representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by Rothschild & Co Wealth Management UK Limited as to or in relation to the fairness, accuracy or completeness of this document or the information forming the basis of this document or for any reliance placed on this document by any person whatsoever. In particular, no representation or warranty is given as to the achievement or reasonableness of any future projections, targets, estimates or forecasts contained in this document. Furthermore, all opinions and data used in this document are subject to change without prior notice.