Supply chain update

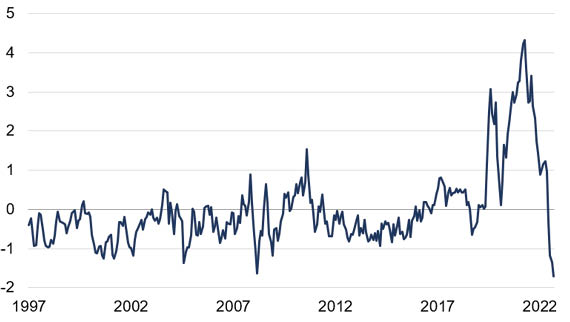

Supply chain stresses have continued to abate in recent months. In fact, the New York Fed's Global Supply Chain Pressure Index – which combines transportation cost data and supply-related PMI sub-indices – has fallen to its lowest level on record, reflecting a freeing-up of capacity (Chart 1).

Chart 1: Global Supply Chain Pressure Index (standard deviations from average value)

Source: Rothschild & Co, Bloomberg, Federal Reserve Bank of New York

Source: Rothschild & Co, Bloomberg, Federal Reserve Bank of New York

As we have noted before, the shift in consumer demand from goods to services – following the easing of COVID-related restrictions – will have likely contributed to supply chain normalisation. But the reopening of China – the central node in the global manufacturing network – has also provided a major boost to the supply-side of the world economy. Disruptions appear to be easing elsewhere, too. The New York Fed's analysis noted significant reductions in backlogs in the UK and falling delivery times in the semiconductor-intensive Taiwan (disruptions in the euro area were the largest source of upward pressure in May).

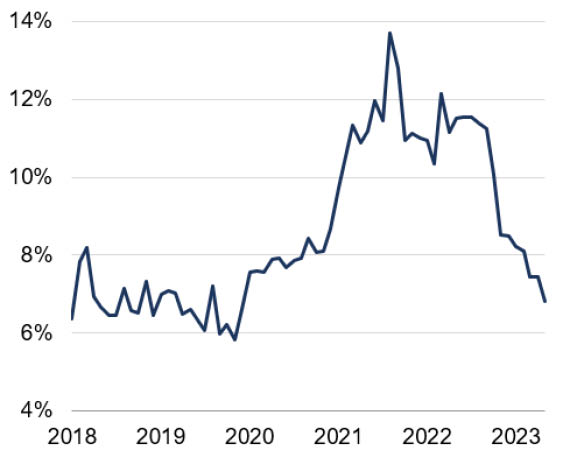

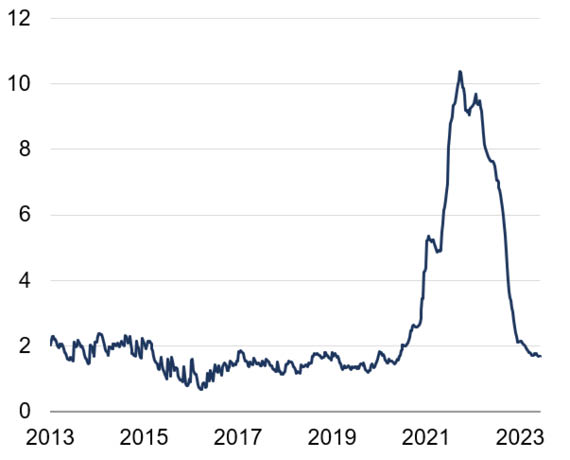

In addition, more "raw" metrics are suggesting healthier supply chains. The cost of chartering a shipping container has returned to pre-pandemic territory and is now over 80% below its late-2021 high (Chart 2). Moreover, containership traffic appears to have eased: the proportion of goods at sea that are stuck on stationary ships has returned to 2018-19 levels (Chart 3).

Chart 2: Spot container freight rates (USD per 40 foot, thousands)

Source: Rothschild & Co, Bloomberg, Drewry Research

Source: Rothschild & Co, Bloomberg, Drewry Research

Chart 3: Freight on stationary ships (as a % of goods shipped at sea)

Source: Rothschild & Co, Kiel Institute

Source: Rothschild & Co, Kiel Institute

The outlook for goods-related CPI inflation has clearly improved. Coupled with falling production costs for manufacturers – producer price inflation rates have moved substantially lower – “goods” CPI inflation should continue to subside in the US and Europe.

Ready to begin your journey with us?

Past performance is not a guide to future performance and nothing in this blog constitutes advice. Although the information and data herein are obtained from sources believed to be reliable, no representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by Rothschild & Co Wealth Management UK Limited as to or in relation to the fairness, accuracy or completeness of this document or the information forming the basis of this document or for any reliance placed on this document by any person whatsoever. In particular, no representation or warranty is given as to the achievement or reasonableness of any future projections, targets, estimates or forecasts contained in this document. Furthermore, all opinions and data used in this document are subject to change without prior notice.