The debt ceiling - political football

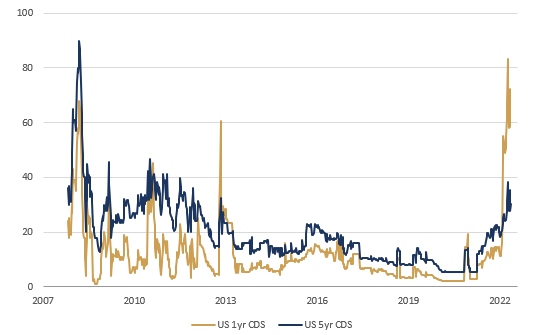

We’ve refrained from talking about the debt ceiling up until now – we’ve seen this show before and history suggests it’s mostly a non-event (the US credit rating downgrade in 2011 is perhaps the one exception). We suspect the situation is no different today, although a big surge in the cost of insuring against a US government default on short-dated debt suggests there is some apprehension:

US Credit Default Swaps (basis points)

Despite the theatrics on Capitol Hill, the US won’t default, nor do we think that creditworthiness will be called into question. Congress has raised (or suspended) the US debt ceiling over 90 times since its inception in 1917. Back then it was a constitutional check on wartime spending, but today this clunky legislative device is a political bargaining chip with little capacity to constrain the US’ growing debt pile – the debt ceiling has never been lowered.

The debt ceiling is currently at $31.4tn and the total stock of outstanding US government debt reached this level back in January (in gross terms). Since then, unable to issue any new debt, the US Treasury has been depleting its cash balance - the so-called Treasury General Account briefly fell below $100bn, down from over $400bn at the start of the year. Income tax receipts have partially replenished that cash balance (April is a crucial month in this regard), and alongside extraordinary measures, the working assumption is that the Treasury has enough money to prolong spending until early July. But absent a resolution to the political impasse, Independence Day could be a rather sombre affair.

The political deadlock centres around what the Kevin McCarthy, the Republican Speaker of the House, sees as profligate spending by the Biden Administration. During Biden’s 25-month tenure in the Oval Office, the debt burden has increased by $3.7tn. Admittedly some of this reflects legacy COVID spending introduced by his predecessor, but the implementation of the American Rescue Plan and the Inflation Reduction Act – which will vest over a number of years – contributed handsomely to the budget deficit (and overall debt). The deficit has been deteriorating for the past nine months, moving from 3% of GDP in mid-2022 to 7% today.

McCarthy is proposing to raise the debt ceiling by $1.5tn (or until March 2024 - whichever arrives first) in exchange for restraint on discretionary spending and the unwinding of some of Biden’s recent initiatives. A vote on the ‘Limit, Save Grow Act’ will likely take place in the House this week, although the jury is still out on whether a very fragmented GOP (Republican) caucus can coalesce around a common economic and fiscal goal. But given the intractable Democrats – eager for an unconditional increase in the debt ceiling - a partisan compromise does not seem forthcoming.

In our minds, there is no doubt that that the US will avoid the nuclear option – defaulting on its debt. Such an act of economic self-harm would cause untold damage. In the unlikely scenario the Treasury did run out of cash, existing debt obligations would be prioritised over domestic spending. But given the high political stakes – with the election cycle moving into focus early next year – it seems inconceivable that one side one won’t blink first. In the meantime, this could be another source of short-term volatility for the Treasury market and those thinly traded credit default swaps.

Ready to begin your journey with us?

Past performance is not a guide to future performance and nothing in this blog constitutes advice. Although the information and data herein are obtained from sources believed to be reliable, no representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by Rothschild & Co Wealth Management UK Limited as to or in relation to the fairness, accuracy or completeness of this document or the information forming the basis of this document or for any reliance placed on this document by any person whatsoever. In particular, no representation or warranty is given as to the achievement or reasonableness of any future projections, targets, estimates or forecasts contained in this document. Furthermore, all opinions and data used in this document are subject to change without prior notice.