Wealth Management: Instant Insights – Investing in the planet (en anglais uniquement)

William Therlin and Amaya Gutiérrez, Wealth Management

Idea in brief: the environment |

||

Gaining momentumThe public and corporate debate around climate change has gathered pace with a growing need for environmental action. |

A goal in mindLimiting global average temperature increases to 1.5°C above preindustrial levels is expected to significantly reduce the risks of negative consequences from global warming. |

Options available to investorsAs climate-related financial disclosure improves, opportunities arise for investors wanting to make a positive impact on the environment. |

Our story begins in 1971. That year, Methodist ministers Luthor Tyson and Jack Corbett founded the fund Pax World, one of the first sustainable mutual funds aimed at combining financial objectives with social and environmental ones. Meanwhile, Norway began oil production in the North Sea, proceeds from which would spawn the world's largest sovereign wealth fund. In the subsequent five decades, concern for the environment would unleash a movement which has brought environmental issues from the periphery to the centre stage of finance (see our article on Combining business with humanity).

A wind of change

In 2020, the world's largest asset manager pledged to double its offering of environmental, social, and governance (ESG) exchange-traded funds to 150 by 2021, with the financial industry set to follow. At an environmental level, Norway's $1 trillion sovereign wealth fund has committed to gradually remove oil exploration companies from its investment universe.

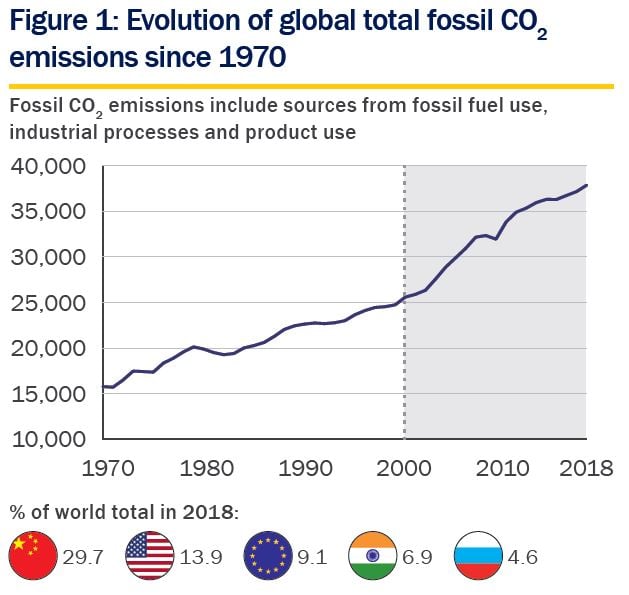

At the core of the environmental movement lies a growing awareness of the economic and human cost posed by climate change. Global fossil fuel CO2 emissions have continued to increase (see Figure 1). In 2019, 30,000 devastating fire outbreaks in the Amazon threatened an already endangered biodiversity, while bush fires in Australia are expected to have emitted as much carbon dioxide as the global aviation fleet did in 2018. And the environmental debate has continued under lockdown during the Covid-19 pandemic (see 'Sobering statistics').

EDGAR, Fossil CO2 and GHG emissions of all world countries, 2019 report, Rothschild & Co

While it is complex to calculate the cost of climate change, there are many direct consequences of human-induced global warming. Limiting global warming to 1.5°C higher than pre-industrial levels is expected to reduce some of the risks associated with temperature increases beyond this threshold.

Up to 420 million fewer people could be exposed to frequent, exceptional heatwaves, and the probability of extreme drought is expected to fall substantially. The risk of increases in heavy rainfall would be reduced globally, and tropical cyclones are projected to decrease in frequency.

Sobering statisticsIn China, around 1.1. million deaths every year are caused by air pollution. Emissions fell dramatically when the country went into lockdown in January and February 2020. Estimates suggest this fall saved 20 times more lives than have been lost to Covid-19. Source: Calculations by Marshall Burke of Stanford University, Department of Earth System Science. |

Corporate action

22nd April 2020 marked the 50th annual Earth Day and its call for environmental reform. Many recent initiatives showcase a growing awareness and responsibility towards the challenges associated with climate change. Among these, many businesses are radically overhauling their environmental policies.

Illustrating such corporate initiatives, online retail giant Amazon committed in 2019 to be net carbon neutral by 2040 and to meet the Paris Climate Agreement 10 years ahead of schedule. Less than a year after this, Amazon founder and CEO Jeff Bezos pledged to donate $10 billion of his personal wealth to combat climate change.1 Another tech powerhouse, Microsoft, set the bar higher by announcing its aim to be carbon negative by 2030.

1Amazon, “Amazon Co-founds The Climate Pledge, Setting Goal to Meet the Paris Agreement 10 Years Early”, 19th September 2019

Doing well by doing good

An investor can approach environmental investing by applying the tools, screening and selection process used for ESG investing. Being a shareholder in a publicly listed company is tied to certain rights which enable investors to respond to climate challenges through their portfolio holdings.

A common approach for managers is to apply exclusionary ESG criteria. Here, certain sectors, activities or products are defined and consequently excluded from portfolios.

Another common approach is to invest in businesses ranked as best-in-class. Using a sectoral screening process, those companies with the highest ESG ratings are identified. Such a positive selection process is usually done with an ESG research house facilitating the scoring, which allows for cross-sectoral comparisons to be made.

Investors can also use ESG integration techniques to consider both the negative and positive ESG aspects of a company within the security selection process. Here, environmental, social and governance factors are included in the financial analysis of a company.

Another possibility for investors is to partake in corporate engagement. Shareholders can influence a company to improve its ESG metrics, either via management boards or through proxy voting2 (see our article Shareholder engagement and activism).

2Authorization in which one person (the shareholder) can delegate another person to vote on his/her behalf

Lastly, thematic investing is another option to address environmental challenges while generating financial returns. Usually offered by specialist fund managers, these strategies invest in companies set to benefit from initiatives that support the environment, such as decarbonisation schemes. These fund managers often engage with portfolio companies in order to bring about positive change.

With a more pressing need for action to preserve the environment, it is reassuring that the options available to investors in the field of environmental investing have come a long way since 1971.

How to invest with the environment in mindAt Rothschild & Co Wealth Management, we believe we can contribute positively to environmental challenges by making our clients more aware of investment opportunities available to them. With our Investment & Portfolio Advisory team at Rothschild & Co Wealth Management, we can advise on the most appropriate ways of gaining access to these investments, keeping the environment centre stage. |

Download Instant Insights: Investing in the planet (PDF 184 KB)