Wealth Management: Instant Insights – Artificial Intelligence

Investment Insights and Investment & Portfolio Advisory, Wealth Management

Idea in brief: Investing in AI |

||

|

Narrow vs Strong AI Two types of AI permeate the global economy today: narrow and strong. Virtually all current AI is narrow AI, where AI is used to carry out a specific programmed function. |

AI filters across businesses Machine learning, cognitive systems, robotics and smart machines all claim to use AI. As a result, AI will push demand for jobs away from repetitive tasks. |

Three sectors to watch eCommerce, technology and healthcare companies are sectors where the impact of AI is visible and tangible. |

AI's coming of age

The birth of artificial intelligence (AI) can be traced to an eight-week workshop held by mathematicians and scientists at Dartmouth College in 1956. Fast forward and the advent of big data, faster computers and better public and private sector funding led to an explosion of AI-enhanced products and services in the early 2000s.

Today, two types of AI permeate the global economy. Narrow AI is used to execute specific tasks such as voice and facial recognition or virtual assistance platforms such as Apple's Siri or Amazon's Alexa. Meanwhile, strong AI is used in machines that apply deep learning to find solutions to unfamiliar tasks without human intervention. From driverless cars to the early identification of eye illnesses, strong AI allows computers to learn and improve on their performance through the processing of big data.

Both narrow and strong AI are having a lasting impact on our economies and the companies we invest in.

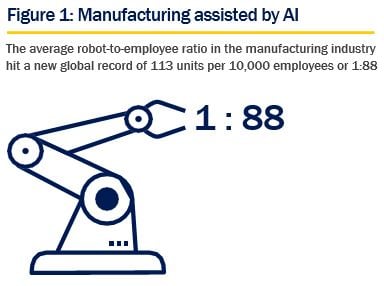

Source: International Federation of Robotics 27.01.2021

AI matters for investors

Learning, reasoning and self-correction lies at the heart of strong AI and is being used to improve manufacturing processes (Figure 1), advance scientific research and transform customer services through the use of big data. This enhancement of products, processes and decisions is already having an impact on companies' financials today.

The effects of AI are therefore being felt at a pan-regional and cross-sectoral level. By way of two examples, AI is being used in agriculture to optimise seed planting, fertilisation and irrigation, while in finance it is being used to automate trading, identify credit risk and bolster fraud detection services.

Yet AI remains in its infancy and its true impact through quantum computing is still relatively unknown.

Using and developing AI

For investors looking at the impact of AI today, three sectors stand out: eCommerce, technology and healthcare.

In eCommerce, Amazon's voice-recognition appliance - Alexa - is applying machine learning to identify patterns in stored data so as to improve the precision of its answers.

In the technology sector, AI is being used to enhance a number of key business components, including the use of image recognition. Examples of this include intelligent thermal imaging cameras in the context of Covid-19 screening at airports, cloud storage services and obstacle recognition technology used by automatic breaking systems in cars.

Turning to healthcare, medtech devices are deploying AI in order to improve monitoring and diagnostics. An example of this is the detection of infections on the lungs via CT scans. Meanwhile, AI has been used to accelerate drug development and clinical research at reduced costs.

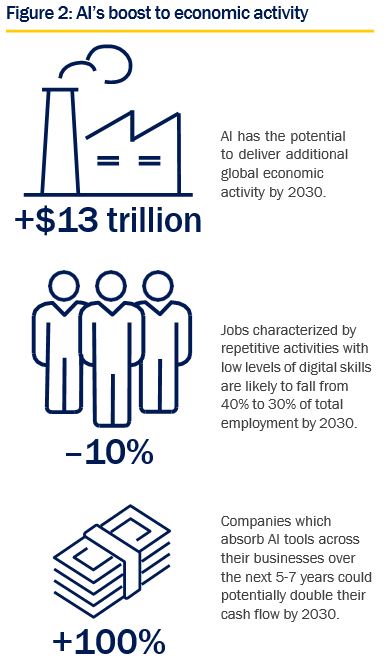

Source: McKinsey Global Institute September 2018 Discussion Paper

Adoption of AI in business

The business functions in which organizations adopt AI are largely service operations, product or service development and marketing & sales. This includes the use of AI for forecasting consumer demand as well as automating warehouse and contact-center processes.

The COVID-19 effect

The pandemic has seen a rapid shift to digital channels for consumers and businesses alike. Businesses have worked with their analytics teams to review demand patterns, supply chains and enable automation in factories and other industry settings where workers may need to operate social distancing. With more data from digital channels available, algorithms for product recommendations are driving a more tailored customer experience whilst facilitating the shift to an automated digital customer service.

The future of AI

With obvious and present benefits to eCommerce, technology and healthcare sectors (Figure 2), the advent of AI has encouraged companies to invest heavily in AI-based platforms. Examples of this are Google’s DeepMind or cloud computing services such as Microsoft’s Azure, IBM’s Watson or Baidu’s Apollo.

How to invest in artificial intelligence

AI's full effect on the business world is still little understood. Its impact on manufacturing to customer profiling is nonetheless having a profound impact on the way in which eCommerce, technology and healthcare companies offer goods and services today.

With our Investment & Portfolio Advisory team at Rothschild & Co Wealth Management, we can advise on the most appropriate ways of gaining access to this rapidly evolving and long-term investment theme.