Stock markets rise to fresh highs in February

Investment Communications Team, Investment Strategy Team, Wealth Management

Investment Communications Team, Investment Strategy Team, Wealth Management

Summary

Global equities surged by 4.3% in February (USD terms), while government bonds were down again by 0.5% (USD, hedged terms). Key themes included:

- Stock indices rise to new highs despite bond yields moving higher;

- Economic resilience and disinflation continue;

- Geopolitical landscape remains uneasy in Middle East and Ukraine.

Markets: Fresh highs for stocks

Markets: Fresh highs for stocks

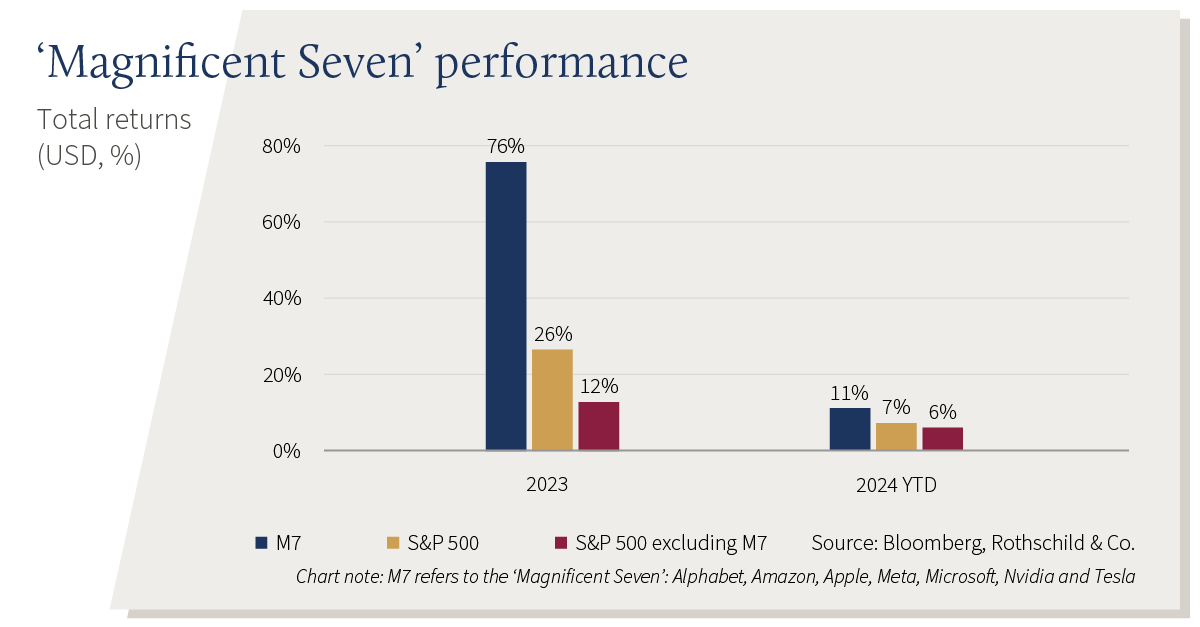

Stock indices rose to record levels across the globe, including the S&P 500, Euro Stoxx 600 and Nikkei 225. Regional and sector returns broadened in February, though ‘growth’ stocks continued to lead the market higher. Meanwhile, the performance of the ‘Magnificent Seven’ (M7) appeared fragmented: Nvidia’s 60% surge in 2024 contrasts starkly with Tesla, down a fifth. The US earnings season was better than anticipated: the Q4 earnings growth rate was 4%, taking the annual figure to a modest 0.9%. In fixed income, US (4.3%), UK (4.2%) and German (2.5%) 10-year government bond yields rose to year-to-date highs. Oil prices remained rangebound, though the European wholesale natural gas benchmark fell to its lowest level in nearly three years. Remarkably, bitcoin surged and was close to record highs – it surpassed $60,000.

Economy: A resilient growth-inflation mix

The US hard data appeared to soften at the turn of the year, as both retail sales and industrial production declined in January. Even so, the initial first-quarter GDP estimates were still tracking at a healthy pace. The timelier survey data were also subdued: the closely-watched ISM Manufacturing PMI declined to 47.8 in February. Labour market tightness persisted – the unemployment rate held steady at 3.7% – but headline inflation continued to cool, to 3.1% in January. In Europe, the UK entered a technical recession at the end of last year, but promisingly, core retail sales rebounded by 3.2% in January. The Composite PMIs also improved in February: the eurozone series moved higher (though remained below the neutral 50-mark), and the UK series expanded at an even faster pace. Euro area headline (2.6%) and core inflation (3.1%) declined in February. UK headline and core inflation were unchanged at 4% and 5.1% in January, respectively – but another reduction in Ofgem’s energy price cap (from April) points to ongoing disinflation ahead. The Swiss economy expanded by 0.3% in the final quarter, taking economic growth to 0.7% for the year as a whole. Inflation also remained muted, as the headline rate declined to 1.3%. Elsewhere, Japan entered a technical recession. China’s NBS PMIs were unremarkable, as manufacturing contracted modestly again in February (services looked more upbeat). Its headline inflation rate also fell further into deflation territory in January, to -0.8% (y/y).

Policy: No rush to cut interest rates

Several FOMC committee members reiterated the ‘higher for longer’ rhetoric. Money markets moderated 2024 rate cut expectations, more than halving the number of cuts anticipated in some places since the start of the year. Three cuts were priced-in for the Federal Reserve, Swiss National Bank and Bank of England, and four for the European Central Bank. US regional banking stress briefly reemerged – and quickly dissipated – following an unexpectedly weak quarterly report from New York Community Bancorp. In China, the five-year loan prime rate – a mortgage-linked lending rate – was cut by 25bps to 3.95%, in an attempt to alleviate the ongoing property sector issues. Beijing also introduced further supportive stock market measures. In the Middle East, Red Sea disruptions persisted, though global shipping rates declined modestly in February. On the fiscal policy front, the EU agreed to a €50 billion package for Ukraine, but US support remained gridlocked in Congress. Meanwhile, a spending bill was belatedly agreed, temporarily averting a US government shutdown. Ahead of Super Tuesday, Trump continued to build on his significant lead over Haley in the Republican primaries.

Performance figures (as of 29/02/2024 in local currency)

| Equity (MSCI indices $) | 1M % | YTD % |

|---|---|---|

| Global | 4.3% | 4.9% |

| US | 5.3% | 6.9% |

| Eurozone | 2.9% | 3.4% |

| UK | 0.0% | -1.3% |

| Switzerland | -2.2% | -2.5% |

| Japan | 3.0% | 7.8% |

| Pacific ex Japan | 0.5% | -3.0% |

| EM Asia | 5.9% | 0.3% |

| EM ex Asia | 1.0% | -1.6% |

| Fixed income | Yield | 1 M % | YTD % |

|---|---|---|---|

| Global Govt (hdg $) | 3.19% | -0.5% | -0.8% |

| Global IG (hdg $) | 5.01% | -1.1% | -1.1% |

| Global HY (hdg $) | 8.31% | 0.9% | 1.0% |

| US 10Y | 4.25% | -2.1% | -2.2% |

| German 10Y | 2.41% | -2.0% | -2.6% |

| UK 10Y | 4.12% | -1.8% | -3.5% |

| Switzerland 10Y | 0.80% | 0.0% | -0.7% |

| Currencies (NEERs) | 1M % | YTD % |

|---|---|---|

| US Dollar | 0.7% | 2.2% |

| Euro | 0.5% | 0.1% |

| Pound Sterling | 0.0% | 1.6% |

| Swiss Franc | -2.1% | -2.7% |

Table note: NEERs under ‘currencies’ are the JP Morgan trade-weighted nominal effective exchange rates

| Commodities ($) | Level | 1M % | YTD % |

|---|---|---|---|

| Gold | 2,044 | 0.2% | -0.9% |

| Brent Crude oil | 84 | 2.3% | 8.5% |

| Natural gas (€) | 25 | -17.8% | -23.1% |

Source: Bloomberg, Rothschild & Co.