Digital frontiers: Cybersecurity

|

Key takeaways

|

An opportunity for investors

The essence of cybercrimes has evolved alongside technological progress. Cybercriminals continuously develop and refine their tactics, leveraging the increasing connectivity and dependence on digitalization in society and across sectors like communications, healthcare, energy, transportation, finance, and public services. This exposes critical infrastructure to vulnerabilities that cybercriminals exploit, making cybersecurity a pressing concern for both businesses and governments.

As technology advances and society becomes more dependent on digitalization, cyber incidents including ransomware attacks, data breaches, and IT disruptions, have claimed the top position as the number one global risk in the 2024 Allianz Risk Barometer, marking the first time this has occurred. In the past year alone, ransomware attacks soared by over 70%, with hackers developing malware at unprecedented rates. In response, governments are pushing for heightened cybersecurity investments and stricter regulations, demanding quicker incident reporting and more robust attack detection methods. This evolving environment presents opportunities for investors, as companies and governments alike prioritize cybersecurity expenditures to mitigate these escalating risks and safeguard digital ecosystems.

Situation today

Every day, fresh ransomware assaults make headlines. The average nine-month timeframe to detect security incidents underscores the critical need for swift action to prevent or mitigate damages.

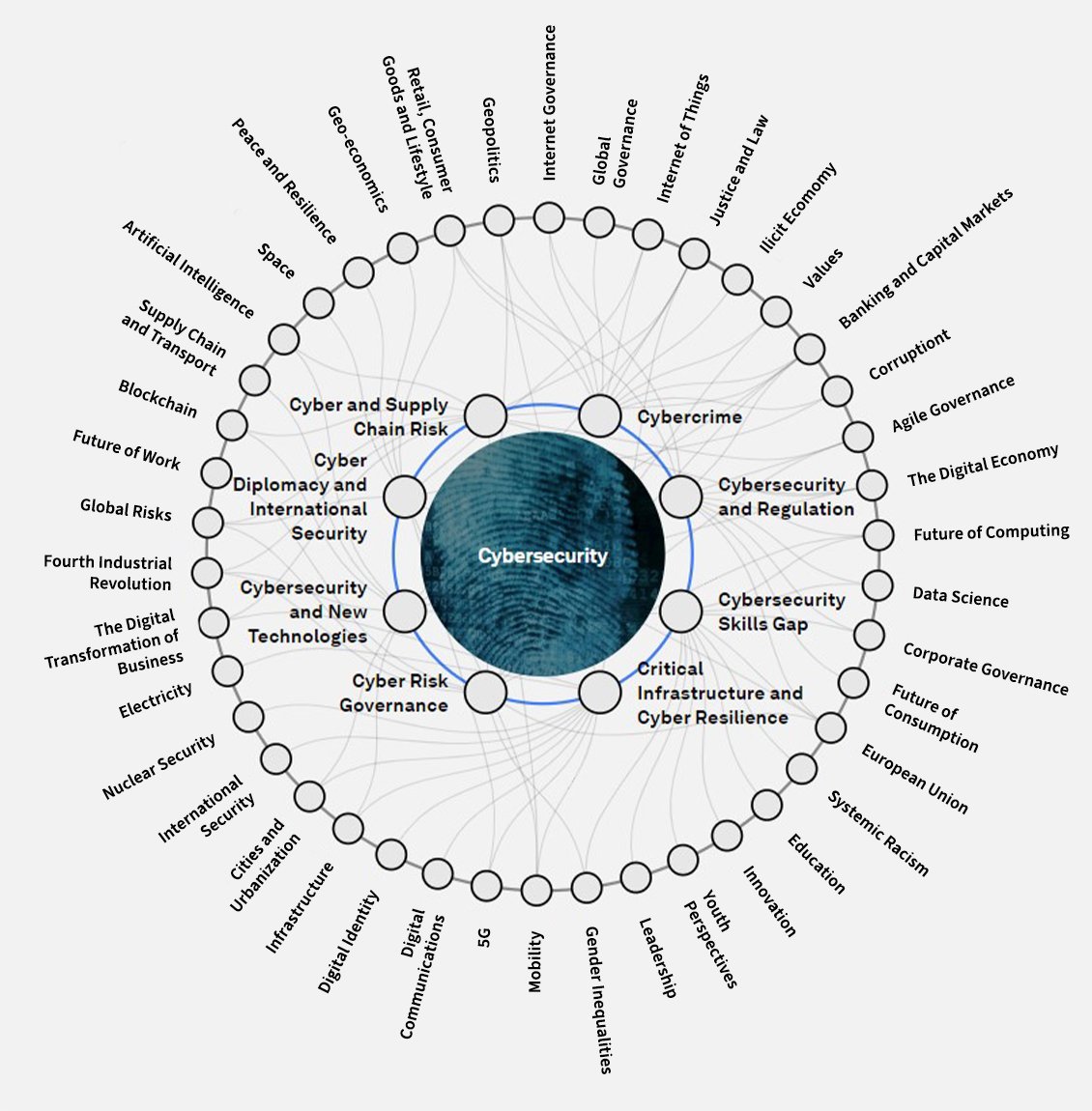

At the same time, geopolitical instability and advanced technologies like artificial intelligence, deepfakes, and sophisticated phishing pose serious threats to democratic elections, using these tools as weapons (Chart). While the idea of information warfare isn't new, the spread of information sources and rapid tech progress make defending against these threats tough. Looking ahead to the rest of the year and beyond, these risks will grow. With elections in over 45 countries, affecting more than 50% of the world's Gross Domestic Product (GDP), safeguarding fair elections becomes crucial. As a result, the cybersecurity industry has boomed, surpassing overall global economic growth fourfold and even eclipsing advancements in the technology sector. [2]

Chart: Cybersecurity ecosystem and extent of vulnerabilities

Sources: World Economic Forum, 2024.

Situation tomorrow

Attacks targeting critical infrastructure are poised to advance in sophistication, potentially extending to control centers, defence and satellite commands, and other highly sensitive government facilities.[3] With the progression of AI, ransomware groups are expected to increasingly exploit AI-developed malware codes and chatbots, challenging the effectiveness of traditional cybersecurity measures in detecting and preventing such attacks. Moreover, AI and machine learning models programmed for malicious purposes can utilize generative AI to automate hacking and spread disinformation and propaganda. From an Environmental, Social, and Governance (ESG) standpoint, cybersecurity emerges as a significant ESG concern and the foremost immediate risk to the sustainability of financial institutions.[4] Establishing secure systems will be imperative for ESG reporting to meet new regulatory requirements. Concurrently, ESG investments are projected to soar to between USD 14 trillion to USD 19 trillion by 2025, underscoring the increasing importance of cybersecurity within this framework.[5]

Growth potential

The cybersecurity market is set for further expansion.

|

Some numbers

|

Sources: IMB. Cost of Data Breach Report 2023, 25.10.2023.

Another contributing factor to the growth in the sector is the significant shortage in the global cybersecurity workforce, which currently exceeds four million individuals, resulting in a demand-supply gap. It's projected that by 2025, human error or a lack of skilled professionals will contribute to over half of significant cyber incidents. The challenge of recruiting qualified cybersecurity engineers hinders incident prediction and prevention, potentially leading to increased losses. Therefore, there is a pressing need to invest in measures to mitigate these risks.

|

Addressing the challenge of cybersecurity will require substantial investments and capital expenditures. The Investment and Portfolio Advisory team at Rothschild & Co Wealth Management has dedicated time and resources to analysing this market and is ready to advise you on investing in this long-term trend. For further information on how to invest in this sector please contact your client adviser. |

[1] Gartner. Global Security and Risk Management Spending to Grow 14% in 2024, 28.09.23.

[2] WEF. Global Security Outlook 2024: Insight Report, January 2024.

[3] ThreatLabz. State of Ransomware, December 2023, p.14.

[4] Fortinet. Point of view: Major trends in European retail banking for 2024, p.1.

[5] Bloomberg. ESG assets may hit $53 trillion by 2025, a third of global AUM, 23.02.2021.